- The SEC’s new process allows major exchanges to list ETPs faster.

- This increases the institutional accessibility of digital assets.

- Bitcoin ETPs are expected to see significant market activity.

The U.S. SEC approved faster listing processes for exchange-traded products at CBOE, Nasdaq, and NYSE, enhancing access to digital assets like Bitcoin.

This decision could boost institutional interest and market liquidity, given the streamlined access to cryptocurrency-related financial products.

Accelerated ETP Listings Expand Investor Access

The SEC’s action allows the Chicago Board Options Exchange, Nasdaq, and the New York Stock Exchange to rapidly introduce ETPs based on spot commodities. The change shifts regulatory responsibilities towards exchanges, relying on approved universal listing standards to maintain compliance.

With the new approval, digital asset products such as Bitcoin-linked ETPs can be introduced to the market more efficiently. This is expected to bolster institutional participation, as fewer regulatory steps are involved before these products become available to investors.

Among the market responses, SEC Commissioner Caroline A. Crenshaw noted, “In other words, the Commission is passing the buck on reviewing these proposals and making the required investor protection findings, in favor of fast tracking these new and arguably unproven products to market.”

SEC Strategy Builds on Bitcoin Market Momentum

Did you know? The SEC’s accelerated ETP listing process builds upon previous market shifts initiated by Bitcoin futures and spot Bitcoin ETFs, which historically led to major inflows and increased market liquidity.

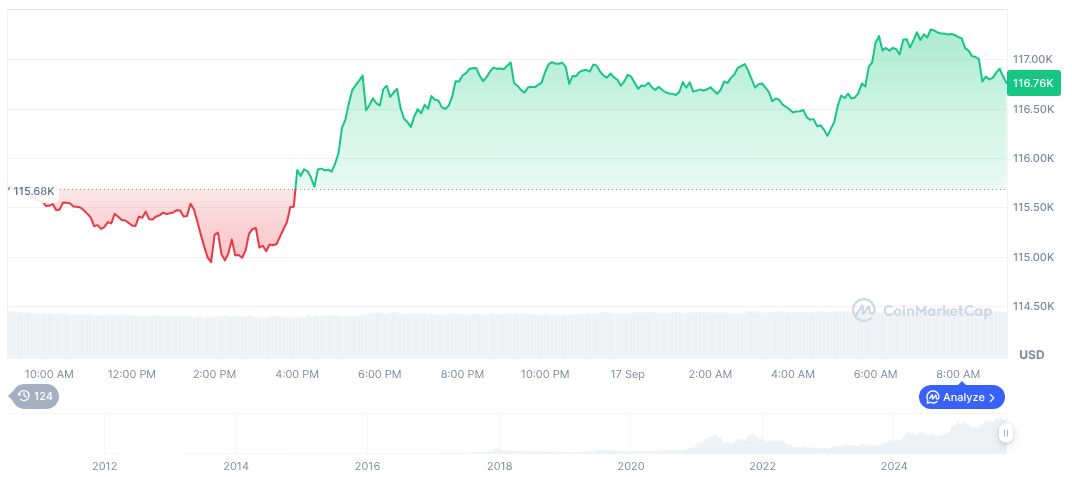

Bitcoin’s current market data, provided by CoinMarketCap, includes a trading price of $116,404.20 with a market cap of $2.32 trillion, and recent 90-day price changes demonstrate an 11.22% increase. The cryptocurrency currently holds a 56.88% market dominance.

Experts from the Coincu research team suggest this regulatory shift could trigger a broader acceptance of digital asset products, sparking increased liquidity and market participation, which aligns with historical trends seen in traditional commodities. Furthermore, the comments on the CBOE BZX Exchange rule change acknowledge that while streamlined procedures are beneficial, digital asset ETPs are “nascent and untested.”

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |