- The Federal Reserve cuts rates by 25 basis points in response to labor market trends.

- Interest rate cut aims to balance employment and inflation concerns.

- Fed officials show a divided forecast for further policy adjustments in 2025.

The Federal Reserve announced a 25 basis point interest rate cut on September 17, 2025, highlighting concerns over job market weaknesses amid persistent inflationary pressures.

This policy shift suggests potential impact on cryptocurrency markets, with increased attractiveness of risk assets like Bitcoin and Ethereum as institutional investors face lower funding costs.

Fed Rate Cut Linked to Crypto Market Dynamics

Federal Reserve’s decision to lower the interest rate by 25 basis points is seen as a response to emerging labor market cracks. Jerome H. Powell, along with other FOMC members, contended that the risks to employment now outweigh ongoing inflation concerns. No further rate cuts were predicted by a majority of officials, although seven officials forecast no additional cuts this year.

Due to the rate cut, BTC and ETH may experience positive price impacts, as such cuts often lead to bullish sentiment in crypto markets. Lower interest rates typically increase the attractiveness of high-risk assets.

“Uncertainty about the economic outlook remains elevated. The Committee is attentive to the risks to both sides of its dual mandate and judges that downside risks to employment have risen.” — Jerome H. Powell, Chair, Federal Reserve

Bitcoin Price Surge and Institutional Interest

Did you know? In March 2020, a Fed rate cut triggered a notable crypto rally, highlighting the sector’s sensitivity to monetary shifts.

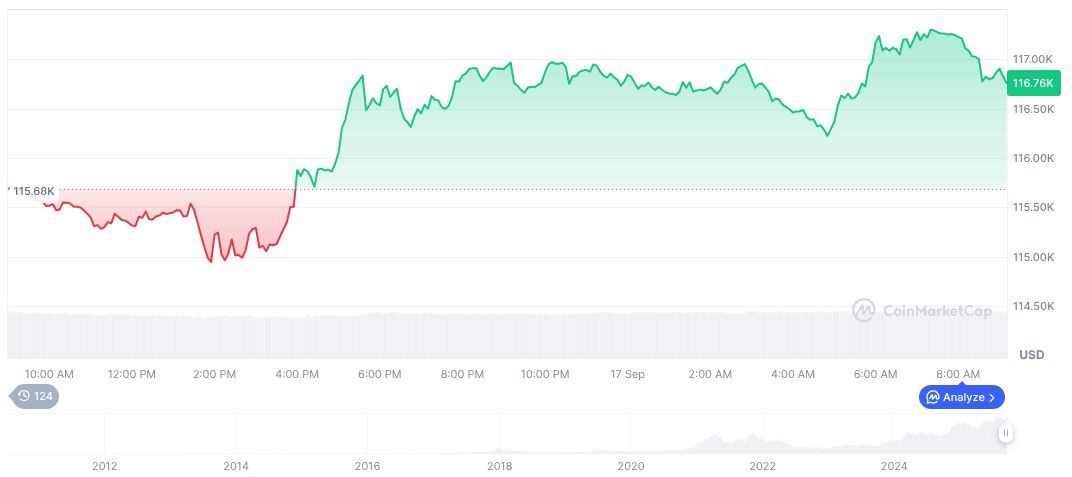

Bitcoin (BTC) stands at $116,829.43 with a market cap of $2.33 trillion and a dominance of 56.97%. With a circulating supply of 19,922,337 BTC, it experienced a 2.53% increase over seven days. Data from CoinMarketCap as of September 17, 2025, signals a dynamic market with a powerful trading volume of $60.13 billion.

Coincu’s research suggests potential upticks in institutional crypto allocations as low yields make alternatives appealing. Close attention to the tech landscape will likely shape responses, while historical data reinforces the positive correlation between rate cuts and risk asset performance. Fed decisions remain pivotal in shaping these dynamics.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/fed-rate-cut-employment-increase/