- Fed focuses on labor market risks during rate decision meeting.

- No immediate drastic crypto market volatility reported.

- Implications for USD, ETH, and BTC noted by experts.

Federal Reserve Chairman Jerome Powell highlighted the labor market risks in today’s FOMC meeting, influencing decisions on interest rates that impact global markets, including cryptocurrency assets.

Powell’s focus on labor market risks suggests potential monetary policy shifts, affecting the USD and potentially the crypto markets, though no immediate volatility is expected.

Labor Market Shifts Prompt Fed’s Policy Reassessment

Federal Reserve Chairman Jerome Powell and the FOMC emphasized the risks in the US labor market during the rate-setting meeting. Recent economic indicators suggested labor conditions were “leaning to the downside,” prompting a re-evaluation of previous projections. Powell’s cautious remarks signal a potential shift from the Fed’s prior stance on solid labor market conditions.

“The downside risks for the labor market are leaning to the downside,” highlighting a shift in the Fed’s outlook from “solid” labor conditions to a more cautious stance on employment.

Immediate implications for global financial markets involve potential adjustments in foreign exchange and interest rates. Despite heightened economic uncertainty, institutional traders have not reported an immediate impact on cryptocurrency markets. Primary sources, including the CME FedWatch tool, continue to project a stable probability for minor rate cuts.

Investor reactions remain mixed among market analysts, who anticipate modest effects on digital currencies like Bitcoin (BTC) and Ethereum (ETH). Stephen Miran, an FOMC member, is known to advocate for larger cuts, yet expectations for drastic changes are subdued.

Crypto Market Stability Amid Fed’s Economic Maneuvers

Did you know? In prior FOMC meetings, US dollar depreciations were common following rate cuts, typically resulting in brief bullish trends within the crypto market. Experts generally observe short-term effects unless stabilized by sustained rate reductions and enhanced liquidity.

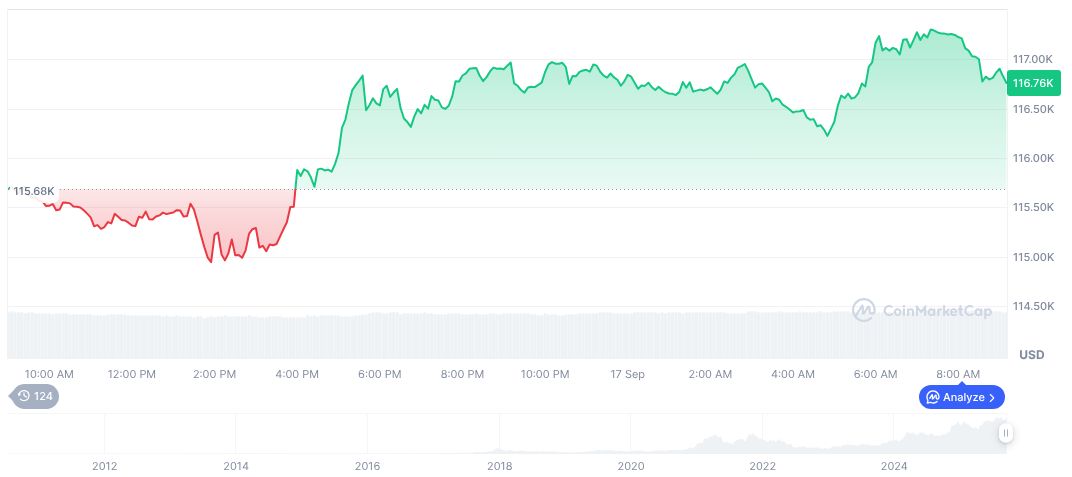

Bitcoin (BTC) currently trades at $115,742.71, with a market cap of $2.31 trillion, dominating 57.20% of the market. Over the past 24 hours, BTC’s price dipped by 0.65%, while the 7-day trend indicates a 2.16% rise. With a circulating supply of 19,922,281, its market condition remains strong. Data sourced from CoinMarketCap highlights the cryptocurrency’s resilience amidst global economic fluctuations.

The Coincu research team highlights the complex interplay between Powell’s labor market focus and long-term cryptocurrency trends. Historically, dovish Fed policies have often provided temporary bullish sentiment for digital assets. However, deeper regulatory and economic factors continue to shape the broader landscape.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/analysis/fed-labor-market-rate-decision/