- Bullish receives a virtual currency license from NYDFS.

- The license aims to increase institutional market participation.

- Potential impact on significant cryptocurrencies like Bitcoin and Ethereum.

The New York Department of Financial Services has granted Bullish US Operations LLC a virtual currency license, enabling spot trading and custody services for institutional traders in New York.

This approval bolsters Bullish’s U.S. market expansion, potentially attracting institutional investors and enhancing liquidity in major cryptocurrencies like Bitcoin and Ethereum.

Historical Context and Market Insights in Crypto Industry

Did you know? In 2021, Coinbase received a similar regulatory nod, boosting institutional confidence and paving the way for elevated crypto exchange credibility worldwide.

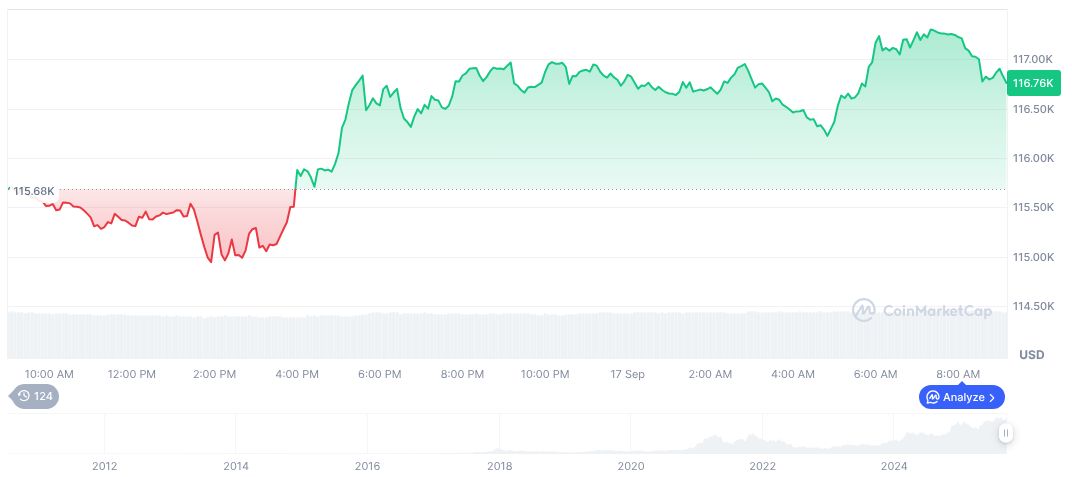

Bitcoin (BTC) is currently priced at $116,284.55, boasting a market cap of $2.32 trillion and a market dominance of 57.50%, as reported by CoinMarketCap. Over 24 hours, BTC has seen a 0.83% increase in price, with a 7-day change of 3.47%. The cryptocurrency’s circulation is set at 19,922,156 tokens, nearing its maximum supply of 21,000,000.

“The significance of the NYDFS license approval has been acknowledged in the context of enhancing Bullish’s regulatory compliance and market presence, particularly among institutional investors and major cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH).”

Market Data and Expert Insights

Did you know? In 2021, Coinbase received a similar regulatory nod, boosting institutional confidence and paving the way for elevated crypto exchange credibility worldwide.

Experts from Coincu suggest that Bullish’s regulatory approval could trigger increased institutional adoption of cryptocurrencies. Regulatory clarity is seen as a crucial enabler for market participation, influencing both financial strategies and technological adoption in digital asset trading.

Experts from Coincu suggest that Bullish’s regulatory approval could trigger increased institutional adoption of cryptocurrencies. Regulatory clarity is seen as a crucial enabler for market participation, influencing both financial strategies and technological adoption in digital asset trading.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/bullish-nydfs-license-expansion/