- Bitcoin traders are anticipating potential volatility with a possible rate cut announcement.

- Historically, unexpected dovish shifts lead to heightened volatility in Bitcoin markets.

- Analysts predict a moderate market rise due to preemptive pricing of the expected rate cut.

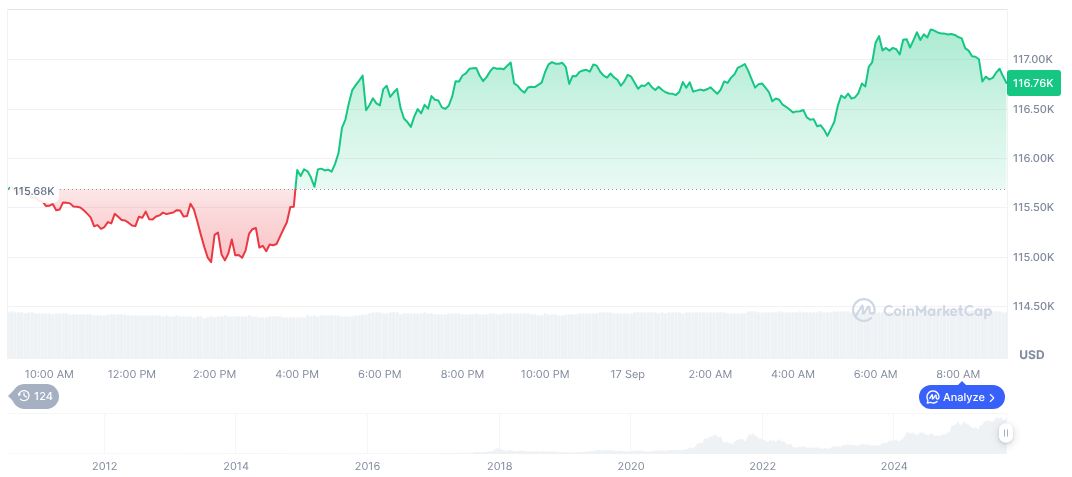

On September 17, Bitcoin traders examined historical Federal Reserve rate cuts as a 25 basis point rate cut is anticipated, potentially impacting market dynamics.

This expected rate cut could lead to moderate Bitcoin price increases driven by liquidity, without significant volatility, as past conditions have been priced in.

Anticipated Rate Cut: Bitcoin Market Braces for Impact

Wintermute, a leading crypto market maker, has analyzed historical rate cuts from 2019 to inform market predictions. Past cuts often led to significant volatility in Bitcoin markets when unexpected, but the gradual pricing in of this cut by the current robust market suggests otherwise.

Bitcoin performance has been steady, showing only a 2.6% increase over 14 days. This suggests a muted market reaction to the expected rate cut. Market sentiment remains calm, and analysts foresee a moderate rise, not sharp fluctuations.

Crypto macro emerges when Fed pivots. Dovish surprises = outsized BTC, ETH moves. But this cut was priced; expecting steady grind, not fireworks. — Raoul Pal, CEO, Real Vision, Twitter

Bitcoin Price Trends Amid Federal Reserve Strategies

Did you know? In periods of unexpected Federal Reserve dovishness, Bitcoin has often experienced heightened volatility. However, when rate cuts are anticipated, markets typically show moderate reactions due to preemptive pricing in.

According to CoinMarketCap, Bitcoin (BTC) currently trades at $116,828.01, holding a market cap of $2.33 trillion and dominance of 57.55%. Trading volumes, despite a slight -0.80% dip in 24 hours, remain robust at 46.45 billion, reflecting stable market engagement.

Insights from Coincu research suggest that Bitcoin’s stability despite potential rate cuts indicates experienced market pricing strategies. An understanding of historical trends shows moderate rises when rate cuts are expected. Analysts highlight that future financial outcomes may follow similar precedents, emphasizing liquidity impacts on digital assets.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/bitcoin-volatility-fed-rate-cut/