- Main event, leadership changes, market impact, financial shifts, or expert insights.

- Tether reenters U.S. market aiming for leadership.

- Significant implications for U.S. crypto market dynamics.

Tether is making a strategic return to the U.S. market, aiming to dominate the country’s stablecoin sector, as announced by company executives at a recent press briefing.

The move signals Tether’s intent to strengthen its market leadership, with potential impacts on liquidity and competition in the stablecoin market, amid evolving U.S. regulations.

Tether’s Return: Market Impacts and Strategic Goals

Tether’s decision to reenter the U.S. market highlights its desire to consolidate its position as a dominant player. Bo Hines, noted as the future CEO of Tether USA₮, exemplifies the company’s focus on compliance and adaptation to U.S. regulations.

Tether aims to increase the issuance of its USDT in the U.S., which can significantly impact the liquidity and trading volumes of major cryptocurrencies. The financial foundation, supported by U.S. Treasury bonds, is robust for these objectives.

Paolo Ardoino, CEO, Tether, “We have achieved significant growth and built trust in our brand, with our U.S. Treasury exposure reflecting our commitment to financial stability and regulatory compliance.”

Financial Dynamics and Regulatory Challenges Ahead

Did you know? Historically, Tether’s expansions into new markets often increased USDT’s global adoption, impacting cryptocurrencies like Ethereum and Bitcoin through enhanced liquidity.

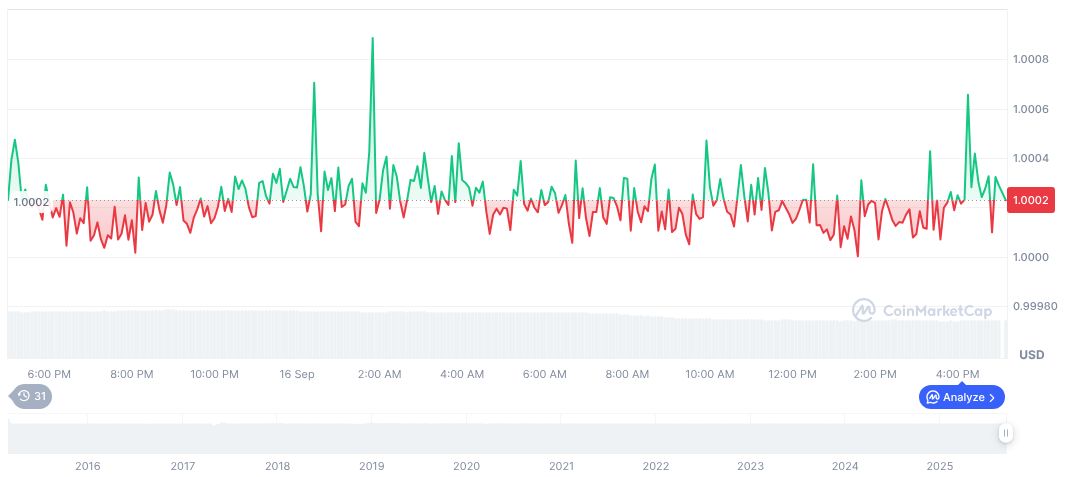

According to CoinMarketCap, Tether USDt (USDT) maintains a current price of $1.00, with a market cap of $170.87 billion and a 24-hour trading volume dropping 15.25% to $116.68 billion. The circulating supply stands at approximately 170.79 billion, with minor price fluctuations observed over recent months.

The Coincu research team suggests Tether’s U.S. expansion could lead to regulatory influences, affecting other stablecoins, potentially increasing demand for regulatory clarity and prompting further innovation in stablecoin technology.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/tether-us-stablecoin-market-return/