- The SEC has delayed its decision on the Truth Social Bitcoin ETF.

- Market reactions remain cautious following the SEC’s announcement.

- The cryptocurrency sector awaits further regulatory clarity.

The U.S. SEC has delayed a decision on Truth Social’s Bitcoin ETF application, impacting market dynamics and investor interest as reported on September 17 by PANews.

This decision underscores regulatory scrutiny in crypto investments, potentially affecting Bitcoin and Ethereum demand, paralleling delays in similar crypto-based financial products.

SEC Defers Truth Social ETF Application Amid Ongoing Scrutiny

The SEC’s delay follows Truth Social’s latest pursuit to join the increasing number of crypto ETFs awaiting regulatory approval. This application is part of a broader drive by Trump Media & Technology Group to enter digital assets. According to Paul Atkins, SEC Chair, “The SEC needs more time to consider the proposed rule changes and related issues.” Known for cautious decision-making, the agency’s approach suggests ongoing assessments of market implications and investor interests.

Market watchers remain alert as expectations adjust to the SEC’s actions. While the commission frequently defers decisions on new financial instruments, the broader crypto community anticipates regulatory clarity. Although public reactions from major industry figures are scarce, the delay is seen within the context of regulatory caution reflected globally.

Did you know? The SEC’s pattern of delaying spot Bitcoin ETF decisions highlights regulatory caution similar to actions taken in 2022, reflecting persistent scrutiny amid climbing crypto market activities.

Bitcoin Stability Amid SEC Deliberations: Price and Market Outlook

Did you know? The SEC’s pattern of delaying spot Bitcoin ETF decisions highlights regulatory caution similar to actions taken in 2022, reflecting persistent scrutiny amid climbing crypto market activities.

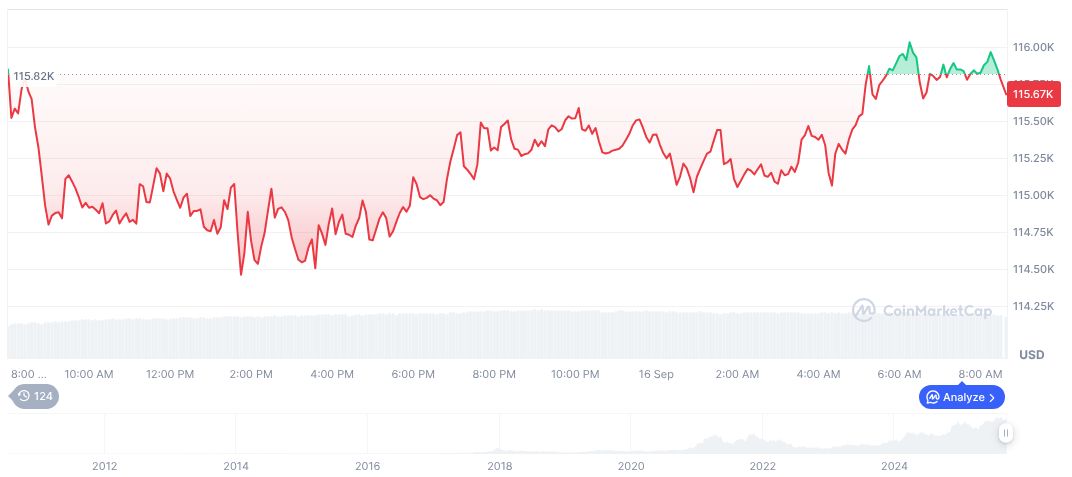

Bitcoin (BTC) prices remained roughly stable amid the SEC’s decision delay, trading at $116,824.19 with a market cap of $2.33 trillion, according to CoinMarketCap. The cryptocurrency reflects a dominance of 57.51% and a slight 1.28% price increase over 24 hours. Historical trends over the past 90 days show an 11.39% rise, with a 30-day slight dip of 0.54%. Trading volume hit $44.79 billion as interest adapts to regulatory outcomes. As of the latest update on September 17, Bitcoin’s circulating supply remains close to its maximum cap.

Coincu analysts predict further regulatory assessments before any ETF approval. Historical parallels show similar delays in past applications, suggesting potential outcomes may align with a gradual regulatory embrace of cryptocurrencies. For those interested in regulatory frameworks concerning such financial products, the SEC Rule Change – NYSE Arca – Filing 103554 provides additional context. Data-based studies underscore fiscal and procedural complexities of integrating ETFs into traditional markets.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/sec-delays-truth-social-etf/