- Keyrock’s $27.8M acquisition of Turing Capital expands institutional services.

- Jorge Schnura leads new division.

- No immediate cryptocurrency market shifts observed.

Keyrock acquired Turing Capital on September 16 for $27.8 million, creating a new asset and wealth management division in Luxembourg, led by Turing’s CEO Jorge Schnura.

The acquisition enhances Keyrock’s institutional services, supporting diversification into digital assets, aligning with EU MiCA regulations, and expanding liquidity provision and on-chain management.

Keyrock Acquires Turing Capital, Expands Asset Management

Keyrock, a digital asset trading infrastructure provider, has acquired Luxembourg-based alternative investment manager Turing Capital for $27.8 million. The acquisition led to the formation of an Asset and Wealth Management division at Keyrock, which Jorge Schnura will lead as President.

Keyrock’s expansion aims to increase its offering for institutional clients, focusing on liquidity provision and investment strategies. This step is part of Keyrock’s broader expansion in the United States and preparation for compliance with the EU’s MiCA regulations.

Industry experts underscore the importance of this deal, given its potential to enhance institutional services in emerging crypto sectors. While market reactions are still unfolding, the acquisition lays the groundwork for comprehensive on-chain and systematic strategies for institutions. Kevin de Patoul, CEO of Keyrock, remarked:

This merger allows Keyrock to offer the first genuinely end-to-end, onchain asset management to our global institutional partners.

Bitcoin at $116K Amid Keyrock’s Strategic Moves

Did you know? Keyrock’s move aligns with broader trends in mergers between traditional asset managers and crypto-native firms, resembling Coinbase’s acquisition strategy to integrate on-chain fundraising.

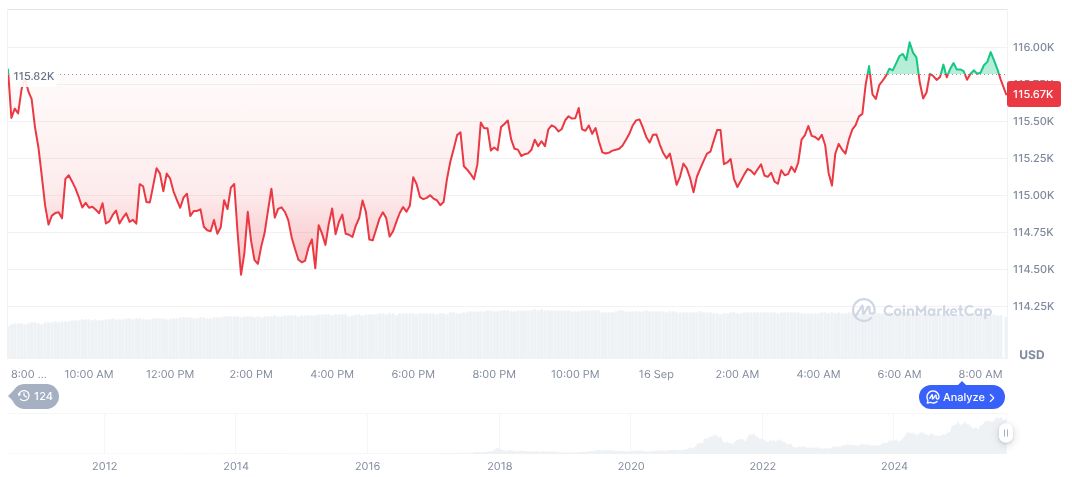

As of September 16, 2025, Bitcoin (BTC) trades at $116,935.63, recording a 1.39% increase over 24 hours. The market cap is valued at $2.33 trillion with a market dominance of 57.54%, according to CoinMarketCap. Recent price movements include a 4.87% rise over the past week.

Insights from the Coincu research team suggest potential enhancements in financial integration and risk management for institutions. Technological growth in on-chain asset strategies emerges as a priority, with considerable prospects for regulatory alignment following this acquisition.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/keyrock-acquires-turing-capital/