- Christopher Waller joins Federal Reserve Board, influencing monetary policy.

- His role impacts financial markets and crypto movements.

- Dovish policy stance suggests potential rate cuts impacting asset markets.

Christopher Waller was sworn in as a member of the Federal Reserve’s Board of Governors on September 16, joining the Federal Open Market Committee.

Waller’s appointment could influence upcoming U.S. monetary policy, impacting financial markets including cryptocurrency sectors sensitive to Federal Reserve rate decisions.

Waller Joins Fed: Implications for U.S. Economy and Crypto

Christopher Waller’s appointment marks his transition from St. Louis Fed’s Director of Research to a strategic position on the Federal Reserve Board. Known for his expertise in monetary theory, he will influence the FOMC’s voting dynamics, potentially advocating for a more dovish economic stance in upcoming meetings.

This transition comes as the Federal Reserve is signaling possible interest rate adjustments. Waller’s presence may prompt a shift towards looser monetary policies, particularly in light of his previously mentioned preference for a 25 basis point rate cut, signaling a change in direction. Waller’s insights on monetary policy are detailed in a recent interview where he expressed, “Our goal is 2% inflation, price stability… The new framework goes back to where we were in 2012. We’re trying to make sure… this is a robust framework.” – Hoover Institution

Market reactions have been measured, with observers focusing on Waller’s potential impact on future monetary decisions. Highlighting policy nuances, his past sentiments emphasize price stability and employment goals, indicating a careful approach to impending monetary challenges.

Bitcoin’s Market Position as Fed Signals Policy Shifts

Did you know? Waller’s appointment continues a tradition of scholars transitioning to leadership roles in the Federal Reserve, suggesting a focus on research-backed monetary policy.

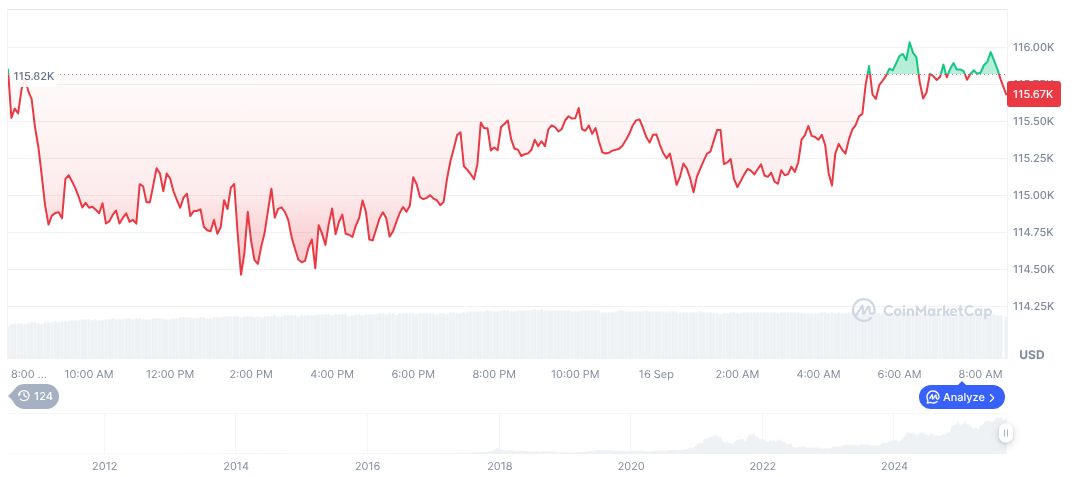

Bitcoin (BTC) maintains a price of $115,092.88, reflecting a recent 0.40% daily gain. With a 57.36% market dominance and a market cap of $2.29 trillion, BTC experienced a modest 9.81% increase over the past 90 days. Source: CoinMarketCap.

Insights from Coincu’s research team suggest that Waller’s stance could result in regulatory shifts and financial adjustments. Potential interest rate cuts may enhance liquidity in traditional markets, impacting cryptocurrency valuations indirectly.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/christopher-waller-federal-reserve-board/