- Bitcoin price today trades near $115,930, testing resistance at $116K–$118K ahead of the Fed rate cut.

- Analysts warn of a potential dip toward $104K or even $92K before a larger rebound later in the cycle.

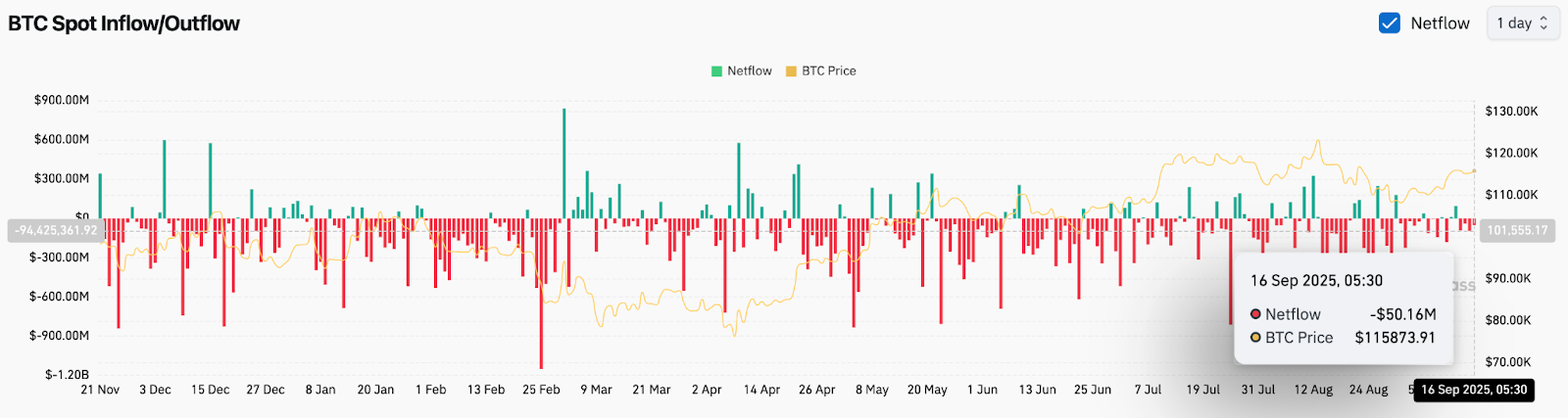

- On-chain data shows $50M in outflows, signaling caution as futures open interest remains subdued.

Bitcoin price today is trading near $115,930, holding steady after a strong rebound from the $111,000 zone. The market now faces a pivotal test, with resistance clustering between $116,000 and $118,000 while traders brace for the Federal Reserve’s rate cut decision in two days.

Bitcoin Price Holds Fib Support But Meets Resistance

On the daily chart, Bitcoin has retraced toward the 0.618 Fibonacci level at $115,429, defending this area repeatedly over the past week. The 20-day EMA at $113,645 and the 50-day EMA at $113,478 have turned into short-term supports, giving buyers a clear line of defense.

Related: Shiba Inu (SHIB) Price Prediction For September 16

Overhead, the 0.786 Fib extension at $120,054 marks the next critical resistance, aligned with the upper boundary of the ascending channel. A clean break above this level could set up a push toward $123,600. Failure to clear $116,000–$118,000, however, risks triggering a deeper pullback.

Fed Cut Looms As Analysts Warn Of Pullback

Market sentiment is sharply focused on the Fed’s expected rate cut this week. Analysts from JPMorgan and other institutions have suggested a possible “sell-the-news” reaction before any sustained recovery.

Prominent strategist Ted Pillows outlined two scenarios: a dip toward $104,000 before reversal, or a sharper decline toward $92,000 where a CME gap remains unfilled. Both scenarios imply downside pressure in the near term before a larger rebound toward new all-time highs later in the cycle.

On-Chain Flows Show Outflows Ahead Of Decision

On-chain data supports a cautious stance. Spot exchange netflows show a $50 million outflow on September 16, extending a pattern of capital leaving exchanges throughout September. While outflows are typically bullish over the long term, the reduced exchange liquidity also heightens volatility risk around key events like the Fed’s policy decision.

Related: Pi Coin (PI) Price Prediction For September 16

Open interest in futures has flattened since early September, suggesting that traders are reluctant to take large directional bets ahead of the macro catalyst. Unless inflows return decisively, Bitcoin may struggle to extend its rally beyond $118,000.

Technical Outlook For Bitcoin Price

Immediate support sits at $113,500, reinforced by the 20- and 50-day EMAs. A breakdown below this level would expose $111,100, followed by the 200-day EMA at $105,349. Failure there could accelerate losses toward the $104,000 and $92,000 scenarios mapped by analysts.

On the upside, Bitcoin needs a clean break above $116,000 to maintain bullish momentum. Targets remain at $118,000, $120,000, and eventually $123,600 if buyers sustain control.

Outlook: Will Bitcoin Go Up?

Bitcoin’s next move hinges on how the market digests the Fed’s rate cut. The technical structure shows resilience, with supports holding and momentum slowly improving. Yet the looming macro event and cautious on-chain flows argue for potential volatility before a clearer breakout emerges.

Related: Linea (LINEA) Price Prediction 2025, 2026, 2027, 2028–2030

As long as Bitcoin price today holds above $113,500, the medium-term bias remains constructive. However, traders should be prepared for a possible dip toward $111,000–$104,000 before any sustained push toward $120,000 and beyond.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source: https://coinedition.com/bitcoin-btc-price-prediction-for-september-17-2025/