- Federal Reserve initiates a rate cut cycle extending to 2027.

- Economic weaknesses prompt monetary easing actions.

- Possible impacts on cryptocurrency investments as risk appetite grows.

François Rimeu from Crédit Mutuel Asset Management forecasts a potential rate cut cycle by the Federal Reserve, beginning this week and extending into 2027, responding to economic weaknesses.

Lower rates could stimulate crypto investment, boosting assets like Bitcoin and Ethereum, correlating positively with historical easing cycles.

Fed’s Multi-Year Rate Cuts and Crypto Implications

The Federal Reserve, with its upcoming rate decision, marks a notable adjustment in monetary policy. François Rimeu, strategist at Crédit Mutuel Asset Management, highlighted the prospects of a multi-year rate cut cycle influenced by ongoing economic weakness. The central bank is anticipated to reduce rates by 25 basis points this week, reaching a projected year-end rate of 3.1% by 2027.

The potential reduction in interest rates could instigate a rise in risk-taking behavior among investors, especially within the cryptocurrency space. Analysis from the London Stock Exchange Group reveals expectations of nearly six rate cuts by next year in U.S. money markets. Bitcoin (BTC) and Ethereum (ETH) may see increased investment interest, given their positive historical correlation with such monetary easing.

Arthur Hayes, Co-founder of BitMEX, stated via social media, “Fed rate cuts mark the return of risk-on, bullish for BTC and ETH.”

Community discussions suggest an uptick in activity and interest in DeFi strategies as the rate cuts potentially fuel liquidity inflow into the crypto markets.

Historical Rate Cuts and Rising Bitcoin Valuations

Did you know? In past scenarios like the March 2020 pandemic response, Federal Reserve’s rate cuts coincided with substantial gains in Bitcoin and Ethereum, highlighting the influence of monetary policy shifts on cryptocurrency markets.

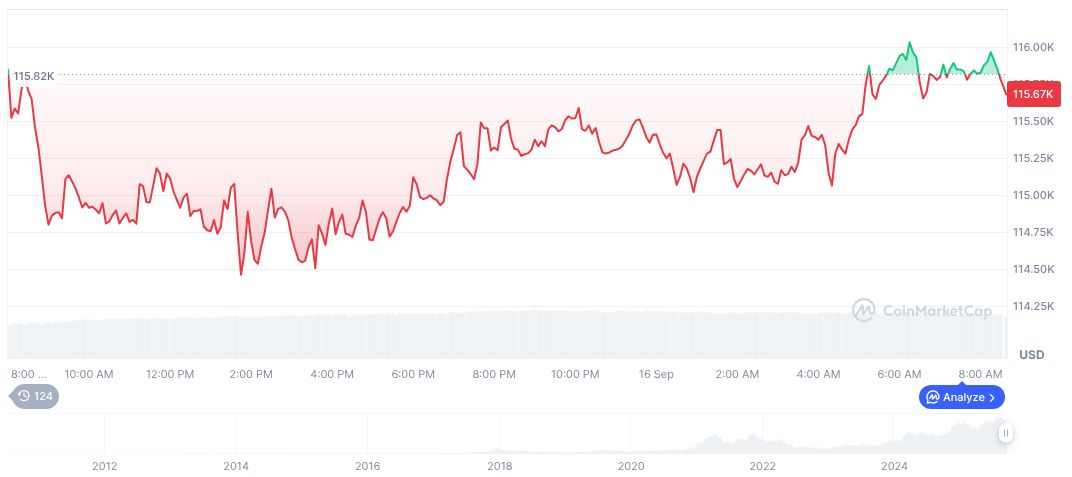

Bitcoin, with a current price of $115,651.16, holds a market cap of approximately 2.30 trillion dollars, as noted by CoinMarketCap. Its 24-hour trading volume is listed at approximately 48.49 billion dollars, with recent movements reflecting a 10.11% increase over the prior 90 days.

Coincu research team suggests that these monetary adjustments may bolster the cryptocurrency sector by widening investment inflows, shaping both financial strategies and technological advancements. Data show a notable correlation between rate cuts and increments in crypto valuations, indicating substantial investor interest and market growth potential.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/federal-reserve-rate-cut-cycle/