Key Takeaways

World Liberty Financial [WLFI] gained by 11.64% to hit $0.2339 as Spot selling clashed with bullish Derivatives inflows and a governance-backed burn proposal.

World Liberty Financial [WLFI], over the last 24 hours, emerged as the market’s second-best performer after its price appreciated by double-digits to hit $0.2339.

Spot investors seemed to be moving against this bullish trend, selling into the market, while Derivatives investors continued to fuel the token with fresh liquidity amid ongoing governance proposals.

Here’s what AMBCrypto found could determine the token’s next direction.

Sell-offs or profit-taking? Which path are investors choosing?

Spot traders have acted as active sellers, according to CoinGlass data.

At the time of writing, this cohort registered its second daily inflows of WLFI into exchanges since the token’s public launch on centralized platforms.

During the same time, $5.1 million worth of WLFI were sold on the market – A sharp reversal from last week’s accumulation when $24 million worth of the token was purchased.

Source: Coinglass

There are two possible interpretations of this activity. Either the sell-off could reflect investors taking partial profits, or it could signal mounting selling pressure.

If it proves to be the latter, a full bearish shift in Spot trading would be confirmed by higher Exchange Inflows in the next session.

Inflows remain bullish

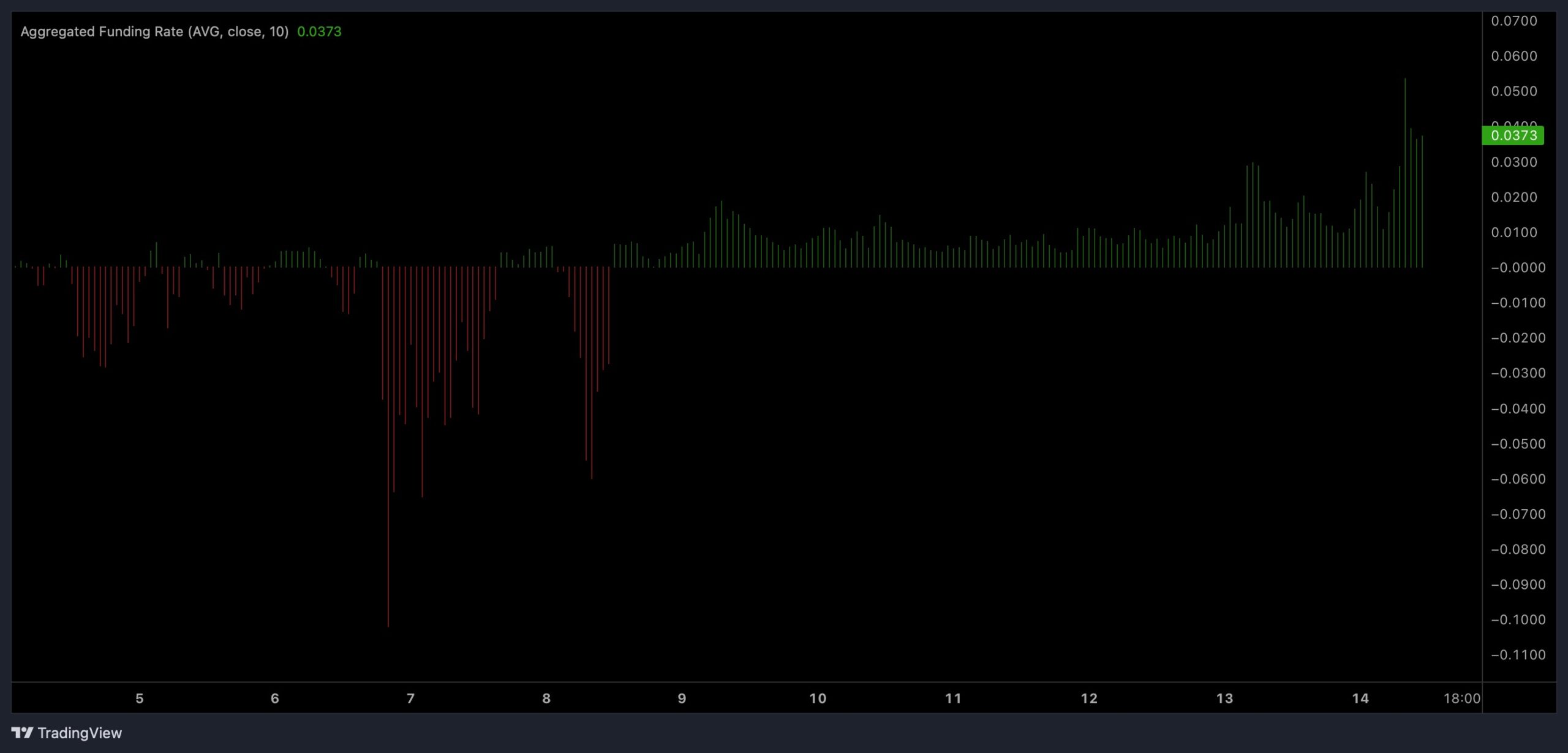

AMBCrypto further observed that the sell pressure in the Spot market did not spill into Derivatives, where inflows did increase over the last 24 hours.

According to Coinalyze, the Aggregated Funding Rate rose to 0.o373 during this period. This indicated that long traders have been paying funding fees to prevent wide price disparities – Typically a sign that buyers are dominating the market.

Source: Coinalyze

Additionally, the Open Interest lent some further insights too.

Coinglass data also revealed that the total market volume climbed to $1.04 billion, with $230 million added over the previous day alone. That shift set up a scenario where most of the new liquidity came from traders positioning for a price rally.

Liquidations and governance vote on WLFI

Finally, liquidation data hinted at a stronger probability of a WLFI rally, rather than a decline.

Given its ongoing market momentum, WLFI may be more likely to clear liquidation clusters positioned above the price level, clusters that have acted as demand targets.

Source: CoinGlass

The prevailing bullish sentiment makes it unlikely that traders will clear the lower clusters soon.

World Liberty Financial’s liquidity fee buyback-and-burn proposal further strengthens its bullish sentiment. In fact, the buyback-and-burn proposal for protocol-owned liquidity has so far earned 99.73% approval from over 5,600 voters.

If passed, the measure would permanently remove WLFI from circulation, strengthening scarcity dynamics. With four days left in the vote, the proposal’s success could boost demand and reinforce WLFI’s rally potential.