- Donald Trump’s interest rate comments impact crypto and stock markets.

- Trump reiterates benefits of decreased inflation and rising markets.

- Market volatility highlights reaction to potential policy shifts.

In an interview on September 12th referenced by BlockBeats News, Donald Trump emphasized the current strong stock market and reiterated his call for lower interest rates.

Trump’s stance on economic measures could influence market trends, impacting equities and crypto sectors amid concerns of broader monetary policy shifts and investor sentiment adjustments.

Trump’s Comments Stir Market Debate on Interest Rates

Donald Trump’s comments have renewed discussions about economic policy amidst fluctuating market conditions. His statement praised the current stock market and called for lowering interest rates to combat inflation. The focus on interest rates has raised concerns about the immediate effects on risk assets, including cryptocurrencies.

Analysts and investors have reacted swiftly. Discussions center around how Trump’s influence might shape Federal Reserve decisions, with experts like Benjamin Cowen emphasizing potential market reversals aligning with past trends.

Markets have shown volatility, with Trump’s comments influencing perceptions of economic stability. Traders have seen increased liquidity movements as investors adapt to the potential policy changes. Observers note that Bitcoin and Ethereum are notably affected by these sentiments.

Bitcoin Surges as Trump’s Stance Raises Volatility Concerns

Did you know? Just as September has historically been weak for crypto, Trump’s past calls for rate adjustments have previously aligned with market volatility, reflecting macroeconomic uncertainties.

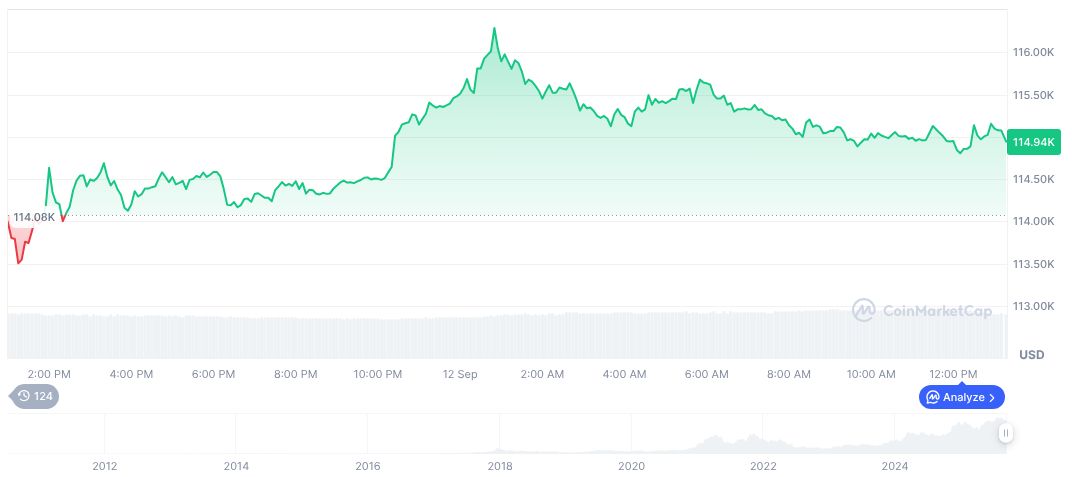

Bitcoin (BTC) recently saw a rise to $115,021.25 with a 1.34% increase over 24 hours, according to CoinMarketCap. The market cap stands at $2.29 trillion, with a dominant market share of 57.17%, highlighting its central role in crypto market reactions.

Coincu analysts suggest Trump’s stance may yield complex market dynamics, impacting liquidity flows and interest rate expectations. The historical trend shows that economic pronouncements often lead to market adjustments, firming investor caution amid geopolitical uncertainties.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/trump-interest-rate-influence-market/