- The “40x Short Whale” increased its BTC short position by 135.11 coins.

- This brings its unrealized loss to approximately $2.585 million.

- The whale now holds the largest loss on Hyperliquid this month.

On September 12th, BlockBeats reported that the “40x Short Whale,” identified as wallet 0xa523, expanded its BTC short position by 135.11 coins, risking liquidation on Hyperliquid.

The whale’s high-risk maneuver, involving 40x leverage, now faces $43.4 million in losses this month, underscoring volatility in Bitcoin markets and potential liquidity challenges.

40x Leverage Brings $43.4M Loss for BTC Trader

The 40x Short Whale, identified by the wallet address 0xa523, added 135.11 BTC to its short position. This increased its nominal position to about $100.6 million. Using 40x leverage with an average entry price of around $112,300 and a liquidation price of nearly $115,200, the whale is under severe liquidation risk.

Within a month, the whale has faced significant losses, totaling $43.4 million. This loss surpasses those of recognized traders such as Aguila Trades and insider trader ‘qwatio’ on Hyperliquid. The whale’s situation in the market is precarious, with its position only 1.4% away from liquidation, intensifying market anxiety.

Market analysts are observing the situation closely due to the potential volatility it could trigger. As of now, major industry voices have remained silent, with no official statements or public reactions documented from key industry figures or institutions.

Bitcoin Volatility Increases Amid High-Leverage Trading Risks

Did you know? Despite the whale’s predicament, similar high-leverage trades have rarely reached such a scale, marking this event as one of the most significant in the recent BTC bear cycle.

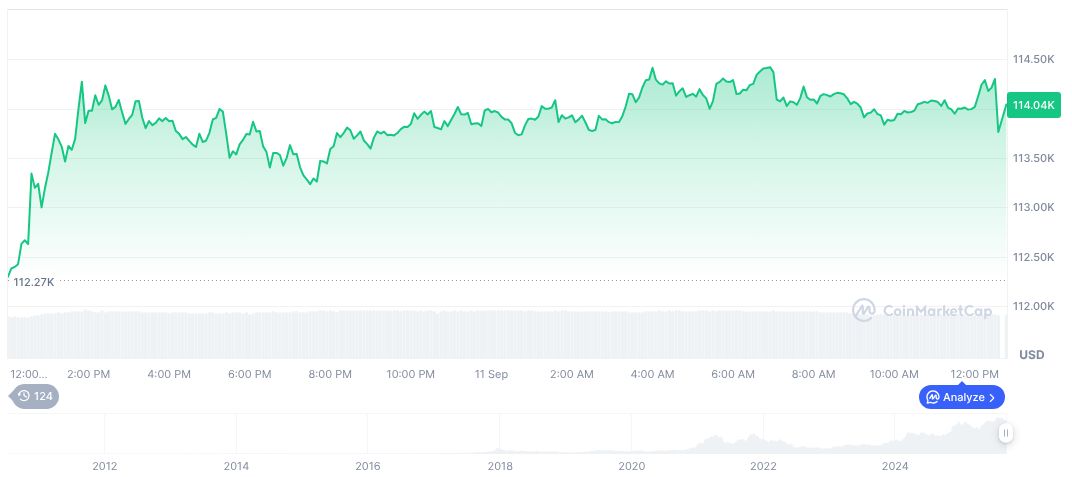

As of September 12, 2025, Bitcoin stands at $115,114.91, accumulating a market cap of approximately 2.29 trillion. Data from CoinMarketCap indicates a 1.07% increase in the last 24 hours. Despite recent gains, Bitcoin has undergone a 4.14% decline over 30 days, highlighting prevailing market volatility.

Expert analysis from Coincu suggests a potential increase in market volatility due to increased margin pressures. While regulatory responses remain unclear, the incident emphasizes the significant risks associated with high-leverage trading in the cryptocurrency market.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/analysis/btc-40x-short-whale-liquidation/