- Next Technology to execute a 200-for-1 reverse stock split.

- Reduces shares from 566 million to 2.83 million.

- Shift largely driven by digital asset gains.

Next Technology Holding Inc. (NASDAQ: NXTT) announced a 200-for-1 reverse stock split effective September 16th, reducing shares from 566 million to 2.83 million, now trading with CUSIP 961884301.

This split aims to enhance stock market standing amid a 2,373% revenue surge driven by Bitcoin asset gains, affecting liquidity and potentially influencing Nasdaq requirements.

Next Technology’s Strategic 200-for-1 Stock Split Move

Next Technology Holding Inc. has announced a 200-for-1 reverse stock split, set to take effect on September 16. This adjustment reduces the outstanding shares significantly. The shares will trade on Nasdaq with a new CUSIP number, 961884301, while the authorized share capital and par value remain unchanged.

Effectiveness of the reverse split sees shareholder’s accounts automatically reflect these changes without the need for any action. The company has seen a substantial increase in Bitcoin holdings from 833 to 5,833, acquired through share issuance and cash payment. Current assets total nearly $633 million as of June 30.

Industry analysts are keenly watching the implications of this move, with no official public commentary from prominent figures like Arthur Hayes or Changpeng Zhao. The company’s significant shift towards digital assets, especially Bitcoin, marks an interesting trend in financial strategies.

Bitcoin Surges as Next Technology Boosts Asset Holdings

Did you know? A reverse stock split of 200-for-1 is a rare move typically aimed at meeting exchange listing requirements while stabilizing stock value.

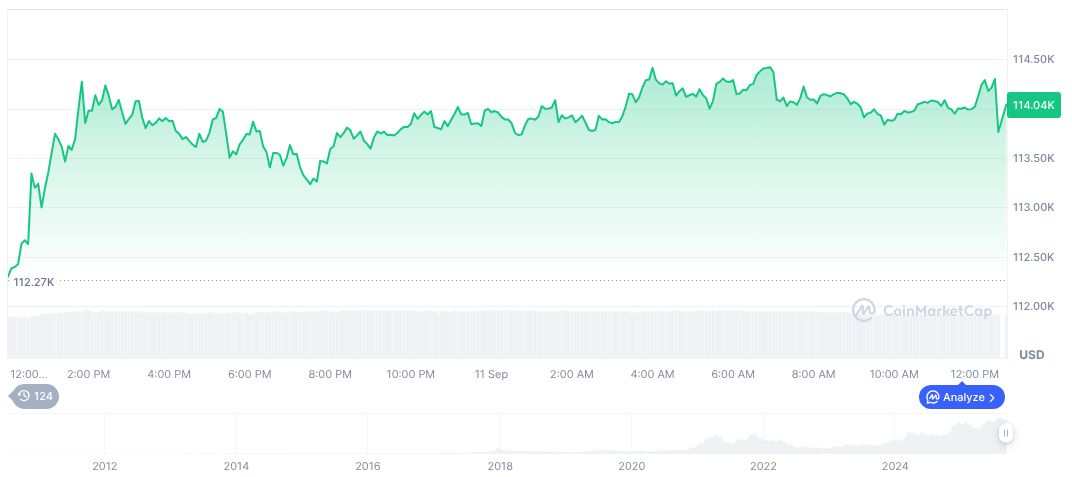

Bitcoin, under the symbol BTC, is trading at $115,263.39 with a market cap of approximately 2.30 trillion. The market dominance sits at 57.38%. CoinMarketCap data indicates a 0.90% rise in 24 hours and a noted increase of 9.38% over the past 90 days, reflecting ongoing investor interest.

Coincu research analysts note that the increasing reliance on Bitcoin for treasury management can influence company financials significantly. While regulatory landscapes evolve, the strong focus on digital assets could drive further strategic decisions in the industry.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/next-technology-reverse-stock-split/