- Gemini’s rumored IPO at $28 per share remains unconfirmed.

- Market analysts urge caution in the absence of official statements.

- Potential parallels with the Coinbase IPO could suggest market volatility.

Gemini reportedly raised $425 million in its IPO by pricing 15.2 million shares at $28 each, though official confirmations remain absent from key regulatory and company sources.

Lack of official confirmation raises questions about the credibility and impact of Gemini’s purported IPO on the cryptocurrency market.

Key Developments, Impact, and Reactions

Speculations about Gemini’s IPO surfaced when an unverified report suggested that the exchange raised $425 million by issuing approximately 15.2 million shares at $28 each. The initial pricing was reportedly set between $24 and $26. However, key industry figures such as Cameron and Tyler Winklevoss have not yet commented on the matter.

Market analysts express caution, highlighting the need for official statements to ascertain the IPO’s potential effects. Despite secondary reporting, no concrete market shifts have been observed. Notably, financial experts urge restraint until verified information becomes available through official channels.

“Our commitment to compliance and transparency is unwavering as we aim to lead the digital asset space.” — Tyler Winklevoss, CEO, Gemini

Historical Parallels in Crypto Exchange Listings

Did you know? The Coinbase IPO in April 2021, NASDAQ: COIN, set a precedent as the first major U.S. crypto exchange listing, causing initial price fluctuations. Similar impacts are anticipated if Gemini confirms its IPO.

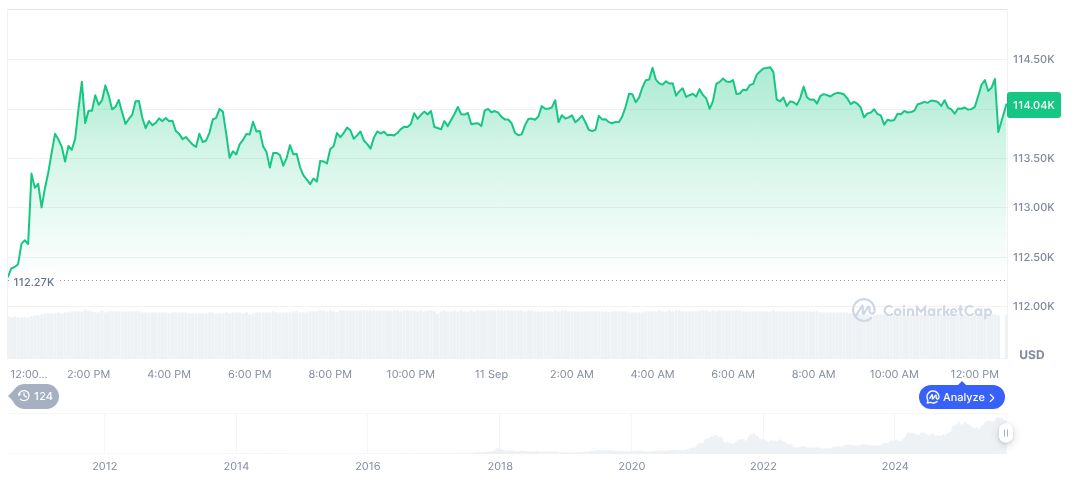

Bitcoin (BTC) is trading at $115,363.87, with a market cap of 2.30 trillion. Its 24-hour trading volume declined by 18.02%, while the price increased by 1.22%. BTC holds a market dominance of 57.52%. Attributes remain according to CoinMarketCap as of September 11, 2025.

Experts note the importance of official announcements in shaping investor decisions, particularly in the volatile crypto market. Historical trends of regulated exchange listings point to potential volatility, but confirmation of Gemini’s actions is essential for accurate projections.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/gemini-ipo-rumors-confirmation-absent/