- DTCC lists Fidelity Solana and Canary ETFs, signaling launch readiness.

- SEC review delays might push market trading start.

- Market reacts positively despite regulatory uncertainties.

On September 12, 2025, DTCC listed the Fidelity Solana ETF, Canary Hedera ETF, and Canary XRP ETF, a procedural step towards potential ETF launches without regulatory approval.

These listings signal market interest but highlight ongoing regulatory challenges for digital asset ETFs, with no immediate trading or significant price effects until SEC decisions.

DTCC Spot ETF Listings Signal Institutional Readiness

DTCC has listed several crypto spot ETFs, including Fidelity Solana ETF and Canary Hedera ETF, as part of their standard pre-launch protocol. This inclusion on DTCC’s website acts as an initial indicator of market readiness.

The listing on DTCC does not imply SEC approval but highlights increased confidence among institutional market participants. Observers note the continued interest in spot ETFs, expecting future shifts in digital asset investments.

Market reactions to the DTCC listing have been generally positive, with no official commentary from major players. The announcement reinforced investor optimism, despite lacking formal approval from the SEC.

Crypto ETFs and Regulatory Challenges Outline Future Landscape

Did you know? The listing of Fidelity Solana and Canary ETFs marks a significant moment in crypto asset management and is part of ongoing evolution in integrating traditional financial systems with emerging crypto markets.

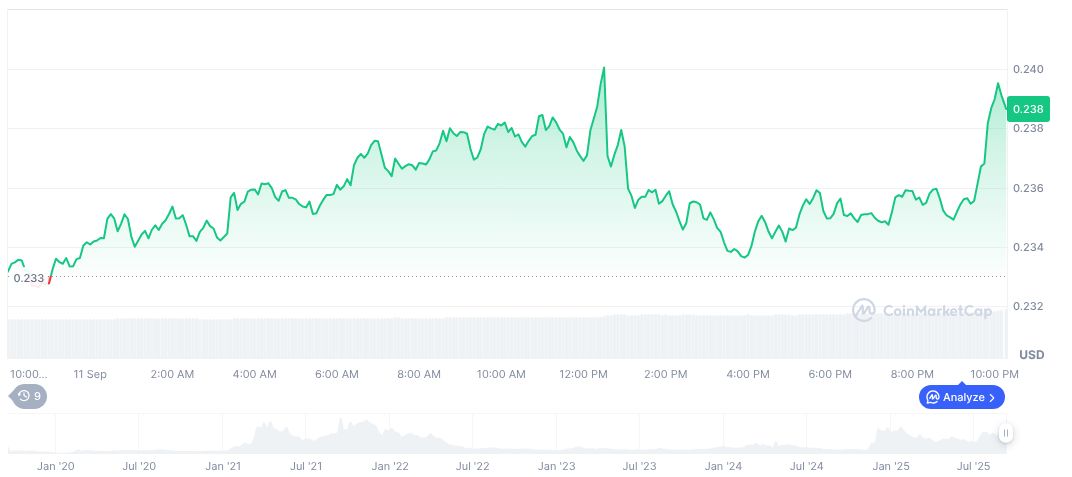

According to CoinMarketCap, Hedera (HBAR) trades for $0.24, with a market cap of $10.15 billion. Over 24 hours, trading volume rose by 22.63% to $267.41 million, while HBAR’s price gained 2.50%. Impressively, it has climbed 51.18% in 90 days.

The Coincu research team suggests that despite the positive sentiment, regulatory hurdles remain. Insights point to potential delays affecting broader market participation, but also recognize the growing alignment between digital asset markets and traditional trading frameworks, indicating a resilient long-term outlook. Steven McClurg, Chief Executive Officer of Canary Capital, noted, “As the most used network by transaction count, Hedera is a prime example of the type of enterprise technology that sits at the intersection of crypto and real-world scalability.”

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/dtcc-lists-crypto-spot-etfs/