- Cardano trades near $0.886, regaining $0.85 support and testing resistance at $0.90–$0.95.

- Analysts highlight fractal patterns that could target $1.86 if the cycle repeats.

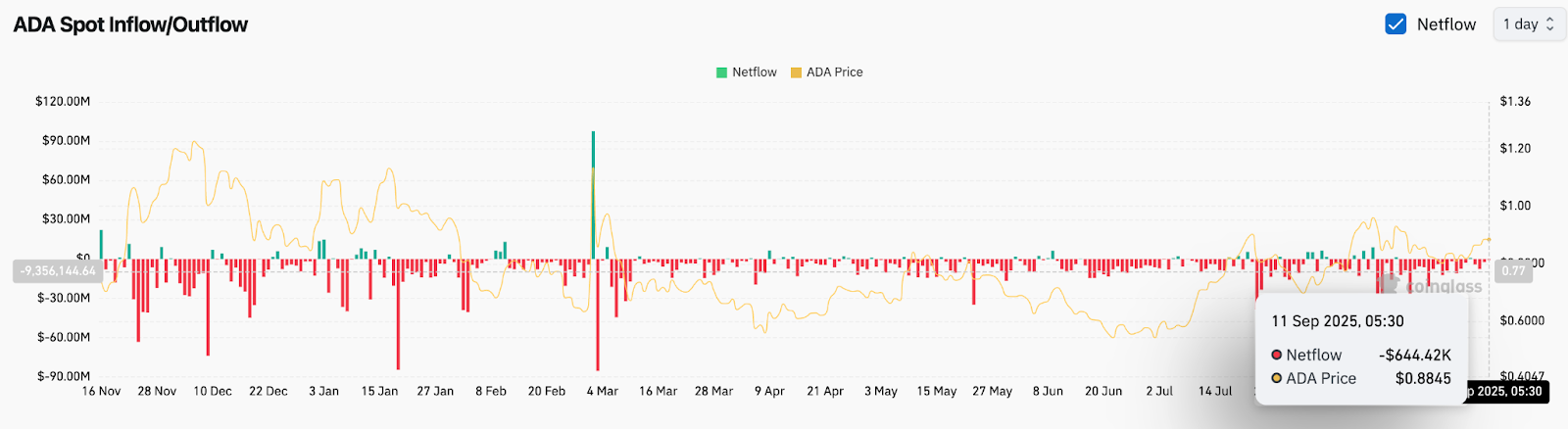

- Exchange flows show $644K in outflows, reflecting cautious accumulation amid mixed signals.

Cardano price today is trading around $0.886, holding above the $0.85 support zone while testing short-term resistance near $0.90. The move comes after ADA broke out of a descending channel, with buyers defending higher lows and regaining the 20-day EMA at $0.85. Momentum has turned constructive, but traders remain cautious amid mixed exchange flows.

Cardano Price Regains Key Support

On the daily chart, ADA has reclaimed the midline of its broader ascending channel after consolidating for two weeks. The $0.85 zone, which aligns with the 20-day EMA, has emerged as a strong pivot for buyers. A decisive break above $0.90 could invite momentum toward $0.95 and the psychological $1.00 mark.

Related: XRP (XRP) Price Prediction For September 12

The Parabolic SAR has flipped bullish, while short-term EMAs have started to slope upward, signaling an improving trend. The broader structure shows ADA still respecting its longer-term ascending channel, suggesting that downside risks remain contained above $0.80.

Analysts Highlight Cycle Fractal To $1.86

Market attention turned to a fractal comparison shared by Bitconsensus, which noted that previous ADA cycle bottoms triggered gains of +260% and +360%. If the pattern repeats, ADA could target $1.86 in the coming months, mirroring past rallies.

The projection builds on historical price structures where prolonged consolidations preceded steep breakouts. Analysts argue that ADA’s current setup resembles the 2023 and 2024 cycles, where consolidation phases eventually gave way to parabolic rallies. A sustained close above $1.00 would be the first technical confirmation that this fractal is in play.

On-Chain Flows Show Mixed Signals

Exchange flow data shows a net outflow of $644K on September 11, with ADA trading at $0.884. While the figure is modest, it continues a trend of weaker accumulation after August’s inflows. Historically, sustained outflows have aligned with upward price pressure, but the muted scale suggests traders are still hesitant.

Related: Shiba Inu (SHIB) Price Prediction For September 12

Open interest has stabilized after recent volatility, pointing to reduced leverage exposure. Analysts note that a surge in exchange outflows or futures positioning would be needed to confirm strong conviction for a breakout move.

Cycle Narrative Meets Technical Compression

Beyond short-term flows, the broader narrative continues to center on ADA’s cyclical behavior. The fractal-based outlook to $1.86 adds weight to the bullish camp, while technical compression within the channel keeps traders alert for a decisive break.

Bollinger Bands have tightened around $0.88, underscoring the potential for volatility expansion. If ADA clears $0.95, the upper band near $1.00 becomes the key test. A rejection, however, could send price back toward $0.85, with deeper risk into $0.80.

Technical Outlook For Cardano Price

Upside targets are clearly defined. A break above $0.95 could extend gains to $1.00 and $1.08, with $1.20 as a stretch target if momentum accelerates. On the downside, losing $0.85 would weaken structure, exposing $0.80 and the 200-day EMA near $0.75.

Related: Bitcoin (BTC) Price Prediction For September 12

The broader trend remains constructive as long as ADA holds within its ascending channel. Breaks above $1.00 could align with the fractal’s bullish case toward $1.30–$1.86 in the months ahead.

Outlook: Will Cardano Go Up?

Cardano’s short-term path hinges on whether bulls can build on the channel breakout and defend $0.85. With analysts highlighting fractal similarities and a potential repeat cycle to $1.86, the setup leans constructive, though caution remains around exchange flows.

As long as ADA holds above $0.85, the bias favors a retest of $1.00. Failure to clear resistance could prolong consolidation, but the cycle narrative and long-term channel keep bullish potential firmly on the table.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source: https://coinedition.com/cardano-ada-price-prediction-for-september-12-2025/