- Initial jobless claims have reached a four-year high.

- Speculations of Federal Reserve rate cuts have impacted cryptocurrency markets.

- Bitcoin and Ethereum have seen notable price surges in reaction.

The U.S. reports initial jobless claims spiking to a four-year high, prompting speculation over Federal Reserve rate cuts amidst stronger-than-expected August CPI growth and notable cryptocurrency market movements.

Anticipated rate cuts have fueled significant crypto market gains, influencing assets like BTC and ETH, showcasing the correlation between macroeconomic trends and digital currencies.

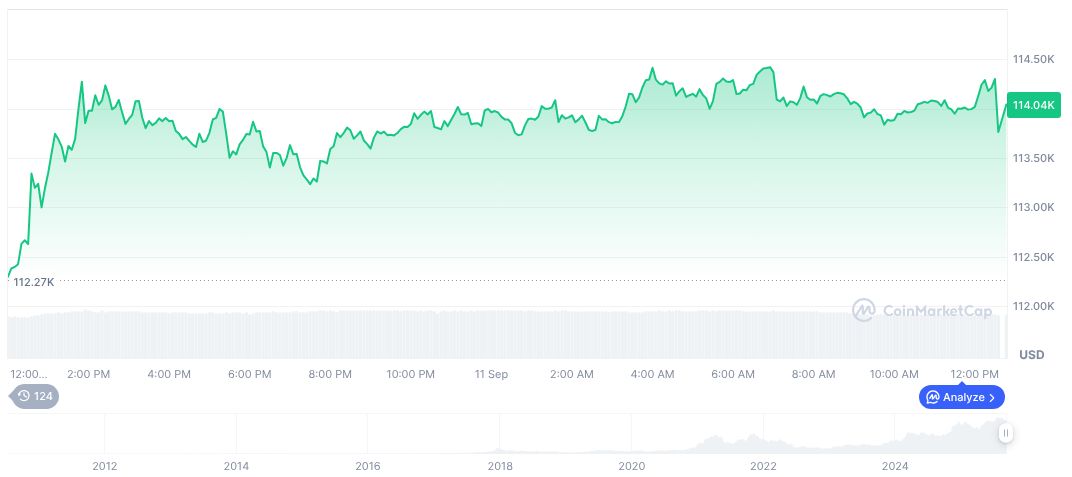

Fed Rate Cut Speculation Pushes BTC Past $114,000

The U.S. government’s recent data showed initial jobless claims peaking at nearly a four-year high, fueling expectations for further Federal Reserve interest rate reductions. This news spurred an immediate reaction in cryptocurrency markets, with Bitcoin (BTC) surging beyond $114,000. Ethereum (ETH) likewise saw gains, exceeding $4,400.

The anticipated changes in Federal Reserve policy have shifted market dynamics, with futures markets increasing bets on rate cuts in upcoming meetings. This expectation contributed to strong bullish pressure on various cryptocurrencies, leading to significant increases across the digital asset space.

Market observers noted substantial altcoin rallies parallel to BTC and ETH gains. Notably, BAKE jumped 333%, while SLF surged by 167%. Despite intense interest, there were

leaving speculation largely driven by market sentiment.

Altcoin Rallies and Market Sentiment Analysis

Did you know? BTC’s latest surge marked one of its highest levels since previous Fed policy shifts in 2023, which also spurred a notable cryptocurrency rally, highlighting its sensitivity to macroeconomic changes.

Bitcoin (BTC) experienced notable upswings today, reaching $114,021.23, with a 24-hour trading volume of $49.81 billion, according to CoinMarketCap. Its market dominance sits at 57.41%. BTC’s price is up 1.93% over 24 hours, but down about 3.98% from 30 days ago.

Coincu research suggests these market shifts could lead to heightened regulatory scrutiny as institutions reassess their crypto strategies. Analysts highlight that long-term impacts remain uncertain, though increased interest could spur technological innovation within the industry.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/fed-rate-cut-speculation-boosts-crypto/