- The HKMA drafts new crypto asset classification in line with Basel’s 2026 rules.

- Crypto assets split into Groups 1a, 1b, 2a, and 2b.

- Impacts regulations for asset-backed and unbacked crypto holdings.

The Hong Kong Monetary Authority has released a consultation draft to clarify crypto asset guidelines, aligning with the Basel Committee’s standards, aiming for implementation in early 2026.

This classification framework affects future bank capital requirements for crypto holdings, potentially altering market dynamics and institutional participation in digital asset markets.

HKMA’s New Framework for Crypto Asset Classification

Classifications are pivotal, separating assets by stability and backing, with Groups 1a and 1b including traditional and stable tokenized assets, and Groups 2a and 2b holding more volatile, unbacked assets like Bitcoin and Ethereum. This framework will guide banks in determining their crypto asset holdings, requiring careful assessment of stability measures in place.

As noted by Arthur Hayes, Co-Founder, BitMEX, “Hong Kong’s approach to crypto regulation will influence how institutions view and handle these assets going forward.”

Bitcoin Market Performance Amid Regulatory Developments

Did you know? The Basel Committee’s guidelines, forming the basis of HKMA’s draft, mark one of the most comprehensive efforts in global crypto asset regulation, signifying substantial shifts in how banks globally may handle digital assets by 2026.

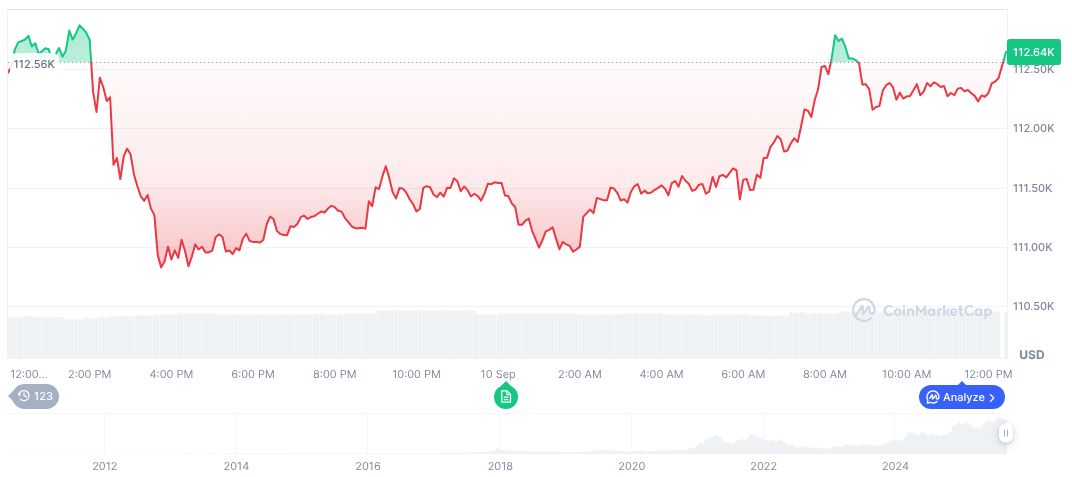

Bitcoin (BTC) holds a market value of $113,953.17 with a $2.27 trillion market cap, underlining its dominance at 57.33%. Over the past 90 days, Bitcoin’s price surged by 8.74%, despite a 3.63% slip within the last month. CoinMarketCap data shows a substantial 24-hour trading volume reaching $51.59 billion, emphasizing ongoing market activity.

The CoinCu research team suggests such regulatory frameworks could catalyze structured stability in the crypto market. Clear classifications like those proposed by HKMA may drive broader institutional involvement, potentially invigorating innovation within tokenized asset sectors.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/hong-kong-crypto-asset-classification-2026/