Avalanche Foundation is seeking to raise $1 billion to establish cryptocurrency-focused treasury companies in the U.S. This move from AVAX follows a growing treasury strategy in the market.

Avalanche Eyes Major Treasury Push

According to the Financial Times, Avalanche is in advanced talks with investors to launch two U.S.-based vehicles designed to accumulate digital assets. One deal involves creating a new digital asset treasury company. The other crypto vehicle will include converting an existing firm into a treasury-focused entity. Together, the projects aim to secure around $1 billion in funding over the coming weeks.

‘Funds raised will be directed toward purchasing millions of AVAX tokens. These tokens will reportedly be sold at a discount by the Foundation. Insiders suggest the discounted sale is designed to accelerate institutional participation. This would strengthen the blockchain’s role in the growing crypto treasury model.

The initiative comes even as publicly traded crypto treasury firms have seen stock prices perform slowly. For example, the Solana treasury firm, SOL Strategies, began trading on Nasdaq yesterday. The stock saw little or no performance despite optimism.

However, the platform is betting on institutional demand. It draws comparisons to earlier Bitcoin treasury strategies that inspired billions in corporate allocations.

Hivemind Capital is reportedly leading the first of the two planned treasury deals. They have already secured a private investment of up to $500 million in an existing Nasdaq-listed company.

Dragonfly Capital sponsors the second deal. They also seek to raise $500 million through a special purpose acquisition vehicle, though it may not conclude until October.

Both vehicles are expected to buy AVAX tokens directly from the Foundation’s holdings. This would be around 420 million tokens currently circulating out of a maximum supply of 720 million.

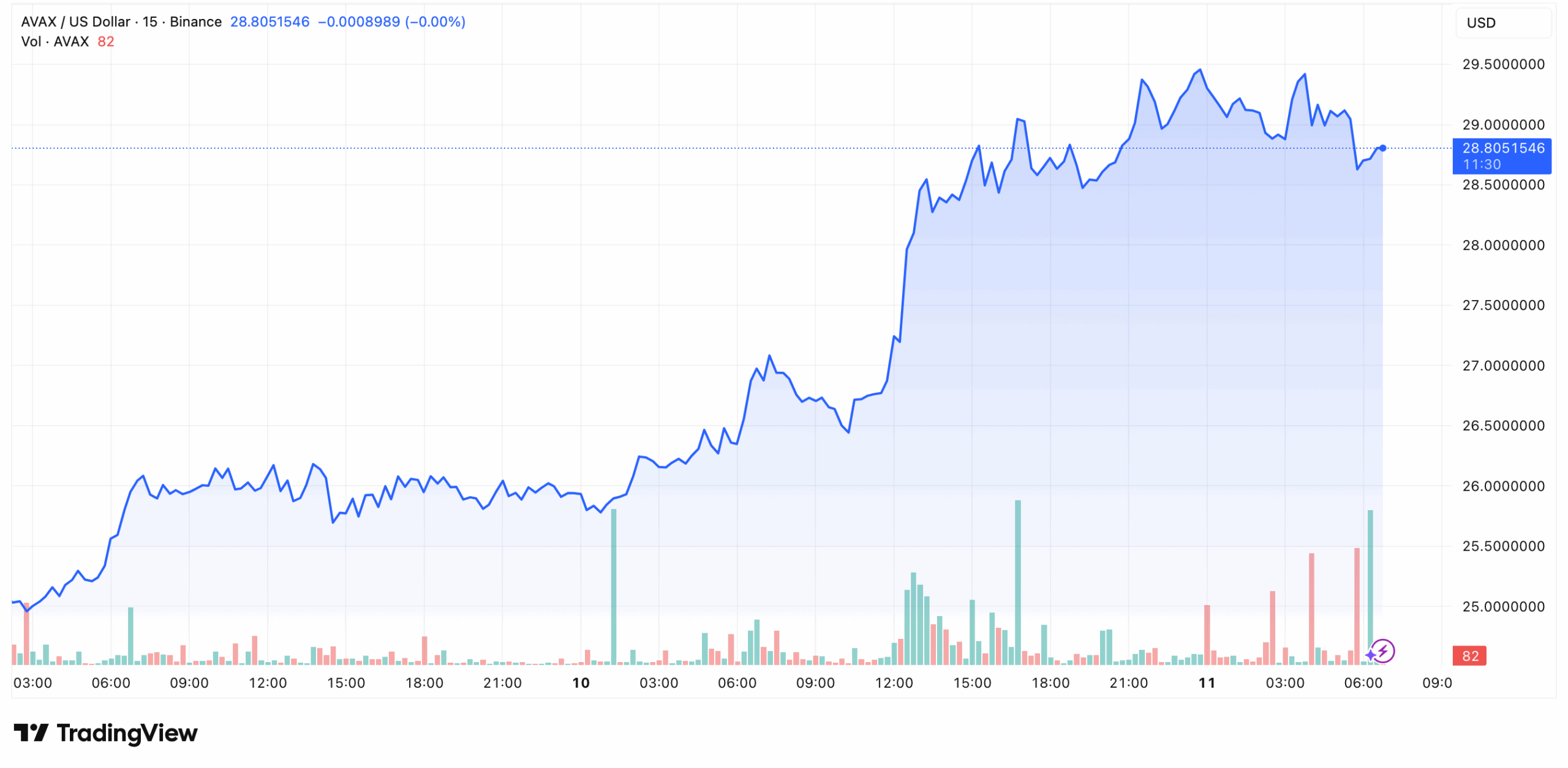

AVAX Price Responds to Institutional Interest

News of the plan helped lift AVAX’s price by more than 8% in the past 24 hours. Transaction volumes on the network also surged to nearly 12 million in a week. This rally was also supported by rising DeFi activity, memecoin trading, and adoption of Avalanche’s C-Chain.

Technically, a breakout above its current resistance level of $29.9 could pave the way toward targets near $31 and $34. This rally comes despite delays in ETF proposals. In July, the US SEC delayed Grayscale’s bid to list an Avalanche Trust on Nasdaq.

Similarly, VanEck’s Avalanche ETF application was also postponed. This added further uncertainty to near-term institutional adoption. However, the momentum behind its treasury plans indicates that the network is focused on long-term moves.

Notably, the platform has been gaining traction with major financial institutions. Firms including BlackRock, Apollo, and Wellington Asset Management have tested tokenized investment funds on their network.

Yet, AVAX is behind rivals like Ethereum and Solana in price gains this year. This makes the fundraising move pivotal to boosting long-term demand.

Investment disclaimer: The content reflects the author’s personal views and current market conditions. Please conduct your own research before investing in cryptocurrencies, as neither the author nor the publication is responsible for any financial losses.

Ad Disclosure: This site may feature sponsored content and affiliate links. All advertisements are clearly labeled, and ad partners have no influence over our editorial content.

Source: https://coingape.com/avalanche-seeks-1b-to-launch-treasury-focused-avax-firms-in-u-s/