- U.S. inflation rebounded in August, fueling rate cut speculation.

- Expected Fed rate cut despite inflation concerns.

- Crypto markets show sensitivity to U.S. inflation changes.

Economists predict a modest rebound in U.S. consumer inflation for August 2025 due to higher gasoline prices and tariffs, possibly leading to a Federal Reserve rate cut next week.

Rising inflation may affect crypto asset valuations due to macroeconomic shifts, with BTC and ETH particularly sensitive to Federal Reserve rate policy signals.

August Inflation Rise and Federal Reserve Rate Speculation

U.S. inflation data for August is under scrutiny, with rising gasoline prices and import tariffs contributing to an expected increase. Analysts believe CPI growth of 0.3% from the previous month might lead to a Fed rate cut. Economists expect this inflation jump, informed by Christopher Hodge of Natixis saying:

Anticipated market shifts may see an impact on cryptocurrencies with historical sensitivity to U.S. economic data changes. Some firms predict that future rate cuts are uncertain despite initial projections this month, as noted by the Latest News Release on Consumer Price Index by BLS. Stephen Kates from Bankrate raised concerns:

“Core CPI has risen sequentially in each of the last two readings, and we expect the trend to continue for August data. The buildup of inventories by firms has helped to shield consumers from excessive price pressures, and the overall inflation readings the last several months were fairly benign. Those inventories have decreased, tariff revenues are up over 150% as compared to last fiscal year, and firms cannot bear the costs of tariffs indefinitely.”

“If upcoming inflation data continues to exceed expectations, the Fed’s focus may quickly shift back to controlling price increases.”

Bitcoin Price Movements Amidst Regulatory Considerations

Did you know? In July 2024, a similar inflation rise led President Trump to advocate for rate cuts, mirroring current circumstances.

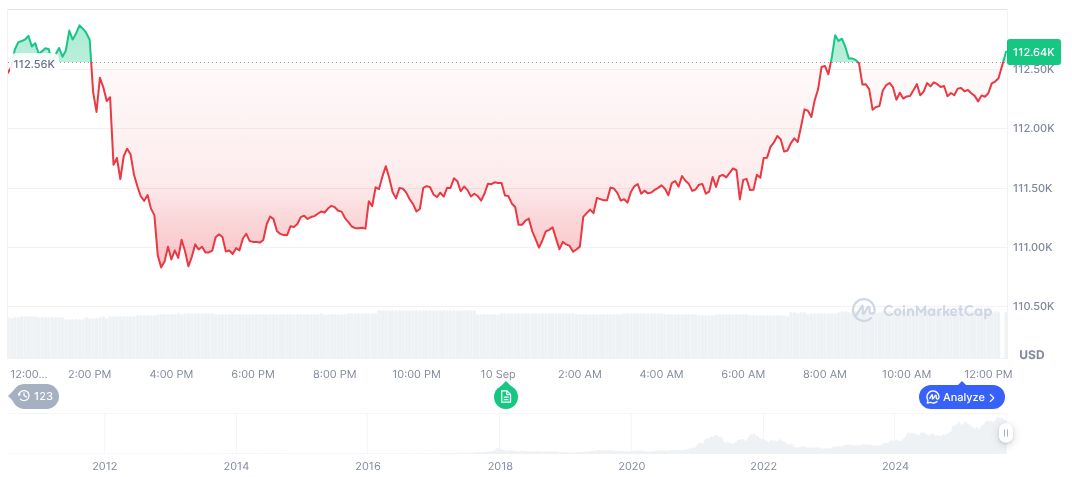

As of September 11, 2025, Bitcoin (BTC) is priced at $114,142.53, with a market cap of $2.27 trillion and a 24-hour trading volume of $53.37 billion, reflecting an 11.80% change. Over the past 30 days, BTC fell by 4.10%, despite an 8.75% increase over 90 days (CoinMarketCap).

The Coincu research team highlights possible regulatory outcomes due to persistent U.S. inflation changes, affecting the cryptocurrency landscape through market volatility and investor sentiment shifts. Crypto assets remain sensitive to macroeconomic developments, especially as future rate cuts become less predictable.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/august-inflation-fed-rate-cut/