- Federal Reserve rate policy decision influenced by CPI data release.

- BTC experiences volatility linked to inflation and Fed responses.

- Market players prepare for potential policy adjustments post-CPI.

The Bureau of Labor Statistics will release the August 2025 US CPI data today at 8:30 a.m. ET, crucial for Federal Reserve’s policy decisions.

This release could significantly influence crypto markets, with assets like BTC and ETH expected to react based on Federal Reserve’s subsequent policy signals.

August CPI Spurs Fed Rate Speculations

The US August CPI data reveals new inflation insights crucial for Federal Reserve policy. With the data coming on the heels of a surprise drop in producer prices and weak US job growth, markets priced in a potential rate cut from the Fed by next week. The CPI’s outcome is set to influence macro trends across traditional and digital financial ecosystems.

Anticipated rate adjustments from the Federal Reserve could lead to shifts in economic expectations, with cryptocurrencies like Bitcoin and Ethereum poised to respond to any signs of easing. Historically, higher-than-expected CPI readings have mobilized market volatility.

“Tariff revenues are up over 150% as compared to last fiscal year, and firms cannot bear the costs of tariffs indefinitely. The staggered implementation of tariffs should prevent a single month with spiking prices and instead, we can expect this to be another inflation reading that shows higher, but not alarmingly high, price increases.” — Christopher Hodge, Chief Economist, Natixis (source)

CPI Impact on Bitcoin Trading Volume and Trends

Did you know? Previous unexpected CPI increases have led central banks to delay rate cuts, causing tangible shifts in asset trading patterns and price stabilities.

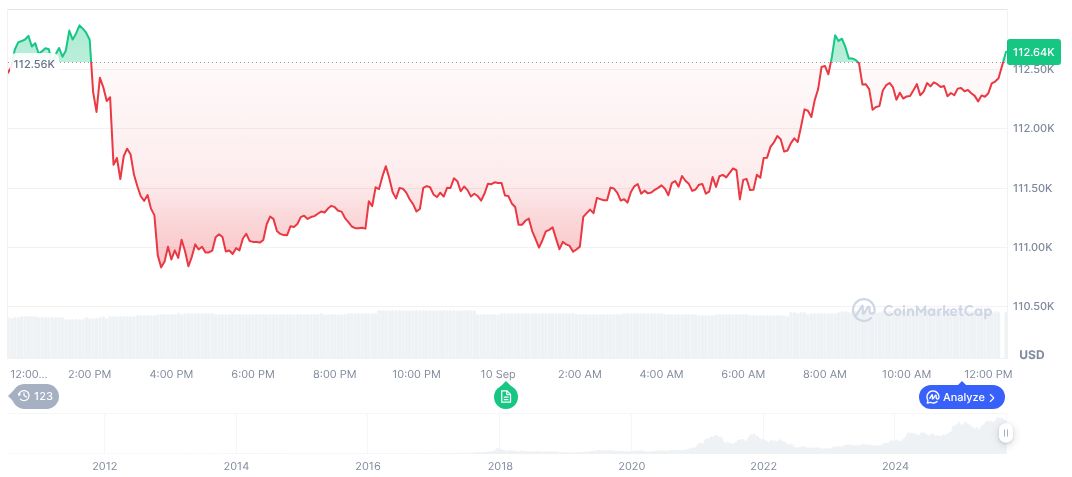

According to CoinMarketCap, Bitcoin (BTC) currently trades at $114,317.80, with a market cap of $2.28 trillion and circulating supply nearing its limit of 21 million coins. Over 24 hours, BTC’s trading volume spiked to $55.60 billion, while its price increased by 2.39%.

Insiders from the Coincu research team highlight potential shifts in derivatives markets, suggesting policy outcomes from the Federal Reserve may impact various financial sectors, driven by CPI data, potentially reshaping the economic landscape. This aligns with the observations in the crypto market funding drop observed in August 2025, which highlighted the sensitivity of financial markets to regulatory and policy changes.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/analysis/us-cpi-data-market-impact/