- VanEck files for Hyperliquid ETF in US and ETP in Europe.

- HYPE token buybacks planned from ETF profits.

- Regulatory approval still required for product launch.

Investment firm VanEck has announced plans to file for a Hyperliquid spot staking ETF in the US and an ETP in Europe, pending regulatory approval.

These financial products may drive increased institutional interest in Hyperliquid, enhancing the blockchain’s market presence and potentially affecting HYPE token buybacks.

VanEck’s Strategic Move into Hyperliquid

VanEck’s announcement of the proposed Hyperliquid ETF and ETP marks a significant interest in expanding exposure into new blockchain opportunities. Hyperliquid ranked first in network revenue for four consecutive weeks, showcasing its growing institutional appeal. However, these products remain subject to regulatory approval processes.

Potential HYPE buybacks from ETF profits have grabbed attention, as emphasized by Kyle Dacruz, Director of Digital Assets Products at VanEck. The absence of major listings in the US for HYPE could limit immediate market movements. Despite the interest, reactions from key market leaders and influencers remain subdued.

“Hyperliquid has been a major focus for VanEck’s liquid fund this year.” — Matt Maximo, Senior Digital Assets Investment Analyst, VanEck

HYPE Token Performance Amidst Regulatory Await

Did you know? The Hyperliquid blockchain’s dominance in network revenue underlines its potential as the youngest blockchain to get ETF attention, similar to previous SOL launches. This draws significant interest from institutional investors.

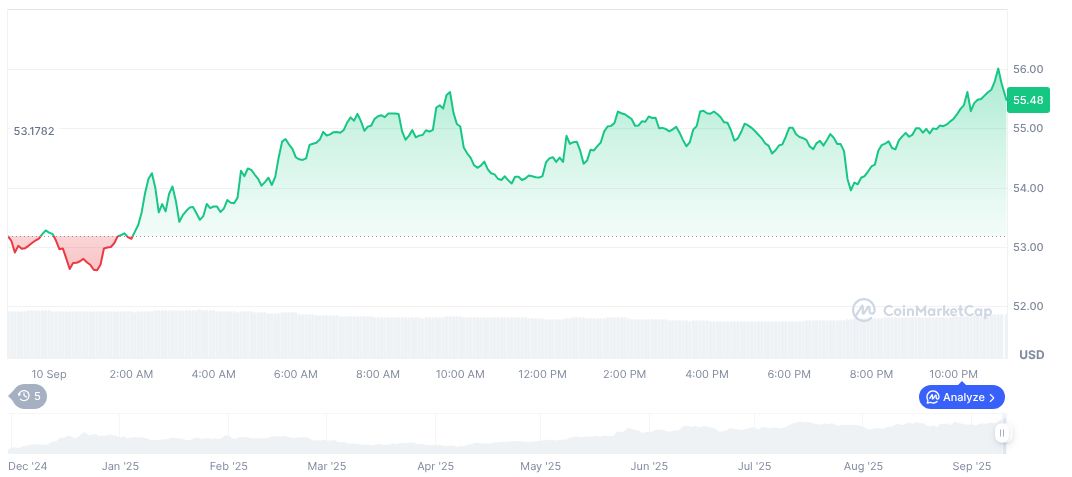

According to CoinMarketCap, the HYPE token currently trades at $55.76 with a market cap approaching 18,621,047,963. Recent gains include a 36.48% increase over 90 days. Though the 24-hour trading volume fell by 6.96%, price upticks over 5.07% within 24 hours indicate strong volatility.

Coincu’s research team highlights VanEck’s strategic move into emerging blockchains like Hyperliquid as potentially impactful in advancing financial products within global crypto markets. The aim to align with market needs while waiting for regulatory clearance portrays an optimistic outlook for enhanced ETF integration worldwide.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/vaneck-hyperliquid-etf-us-europe/