- Stephen Miran’s nomination advances in Senate, potential Fed impact.

- 13-11 vote reflects party-line division.

- Possible policy changes may influence BTC, ETH markets.

Stephen Miran’s nomination to the Federal Reserve Board advanced by a 13-11 vote in the U.S. Senate Banking Committee on September 10, amid looming financial market implications.

Miran’s pending confirmation could influence U.S. monetary policy, with potential impacts on financial and cryptocurrency markets ahead of the Federal Reserve’s crucial September meeting.

Senate Advances Miran’s Federal Reserve Bid Amid Party Split

The U.S. Senate Banking Committee approved Stephen Miran’s nomination to the Federal Reserve Board on September 10. This 13-11 vote occurred along party lines, juxtaposing the committee’s previous considerations. Miran is the current Chair of the Council of Economic Advisers.

Miran’s potential addition to the Federal Reserve Board has significance due to the upcoming Federal Open Market Committee meeting. The chance of rate adjustments during this session poses important currency and macroeconomic implications. Market players are vigilantly observing these potential policy shifts.

Cynthia Lummis, U.S. Senator, commented on the logistical hurdles for swift confirmation. “Whether Miran can be confirmed in time before the Federal Reserve’s interest rate meeting on September 16-17 will be very challenging.” The process could affect Miran’s participation in crucial Federal Reserve discussions. Market reactions remain intertwined with expectations of monetary policy pivot. Stakeholders await further Senate developments.

Cryptocurrency Markets Eye Federal Decisions as Bitcoin Surges

Did you know? Previous rapid Senate confirmations took only four days, raising expectations for Miran’s potential impact on upcoming discussions.

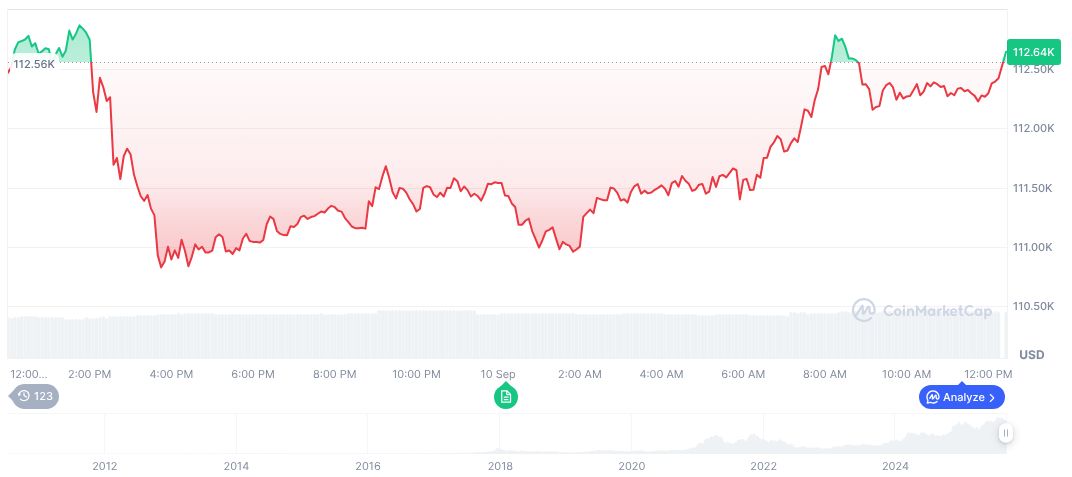

Bitcoin (BTC) currently trades at $114,042.27 with a market cap of formatNumber(2271603695262, 2). Recent movements show a 6.09% increase over 90 days, according to CoinMarketCap. In 24-hour trading, BTC volume rose 26.30%, amidst heightened market anticipation for Federal Reserve actions.

Insights from the Coincu research team suggest potential shifts in Financial, regulatory, and technological landscapes. The team anticipates rate adjustments could elevate major cryptocurrencies, especially under dovish monetary policy expectations. Ongoing Fed dynamics could significantly shape the crypto economic environment.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/miran-nomination-fed-approval/