Key Takeaways

AAVE whale scooped up 50,000 tokens worth $15.07 million as whales dominate the futures market. The token could break out from recent consolidation to $336 if whale demand persists.

After facing rejection at $331 five days ago, Aave [AAVE] has struggled to maintain an upward momentum. In fact, at the time of writing, AAVE was trading at $303, after moderate gains of 1.08% in just 24 hours.

Amid this market cooldown, investors, especially whales, have taken the opportunity to accumulate and take strategic positions.

Whale scoop up 50K AAVE

After taking a break from the spot market over the past weeks, a whale returned and jumped into the market to accumulate AAVE.

According to Onchain Lens, a newly created whale wallet purchased $50k AAVE worth approximately $15.07 million.

Source: On-chain Lens

When a whale enters the market, it typically reflects strong conviction and is often interpreted as a bullish signal.

This sentiment was reinforced by exchange data: according to CoinGlass, AAVE registered a negative Spot Netflow for four consecutive days, indicating sustained accumulation pressure from investors.

Source: CoinGlass

At press time, Netflow was -$613k, indicating higher outflows, a clear sign of aggressive accumulation.

Whales dominate Futures market

Interestingly, this whale acquisition is not an isolated case. In fact, Futures Average Order Size data from CryptoQuant showed whales have dominated AAVE Futures over the past week.

Source: CryptoQuant

As such, the altcoin recorded Big Whale Orders for seven consecutive days. This indicates that whales entering the market are mostly participating in the futures market.

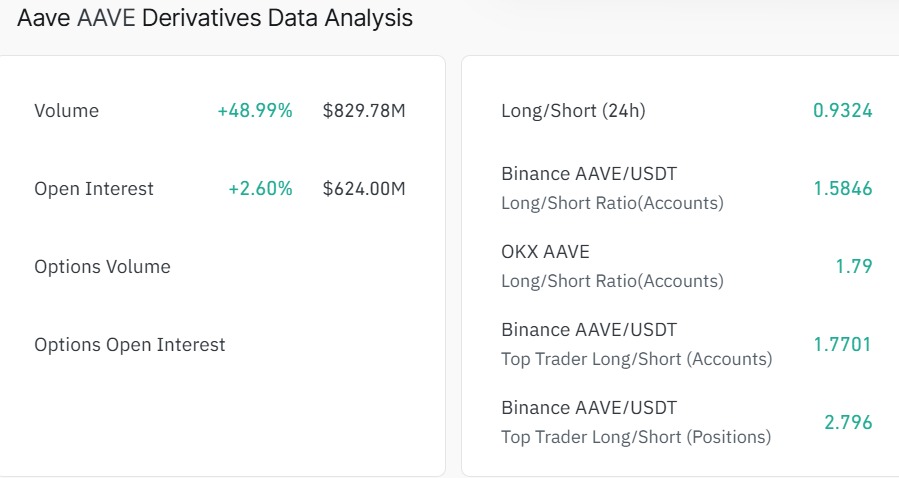

On top of that, the altcoin’s Derivatives Market surged 48.9% to $829.78 million, while Open Interest(OI) rose 2.6% to $624 million, at press time.

Source: CryptoQuant

Typically, when OI and volume rise, it signals increased capital inflow and participation in the futures.

However, AAVE’s Long Short Ratio has remained below 1, and hovered around 0.94, with shorts accounting for 51% of total Futures accounts.

Source: CoinGlass

With shorts dominating, it seems these whales are mostly bearish and are betting on prices to drop again.

Can whale demand boost AAVE for a breakout?

According to AMBCrypto’s analysis, AAVE has shown stability as buyers, especially whales, stepped in to accumulate and take futures positions.

As a result, at the time of writing, the altcoin’s Stochastic RSI made a bullish crossover, reaching 21. This indicated strengthening buyer’s momentum.

Source: TradingView

Typically, when this metric makes a crossover to the upside, it signals potential trend continuation. However, to validate this upside move, AAVE’s Relative Strength Index (RSI) must also complete an upside crossover.

In doing so, it will confirm buyers’ rising dominance, setting the ground for a breakout towards $336. However, if this upside move fails, AAVE will slightly retrace to $296 support.

Source: https://ambcrypto.com/aave-can-15m-whale-activity-push-it-toward-336-price-level/