- Binance launches Ethena USDe spot trading paired with USDC, USDT.

- Eligible users receive rewards by September’s end.

- USDe growth influences ETH, BTC market dynamics.

Binance is set to launch Ethena USDe on September 9, 2025, accompanied by trading pairs USDe/USDC and USDe/USDT, enhancing trading capabilities.

USDe’s launch positions it as a top stablecoin, with 31% supply growth, backed by major institutional interest and competitive yield incentives for holders.

Ethena USDe Enters Binance with USDC and USDT Pairs

Binance’s decision to launch Ethena’s USDe on September 9, 2025, includes spot trading pairs with USDC and USDT. The exchange also opens the deposit channel, enhancing liquidity for Ethena. The decision is based on USDe’s growth, currently the third-largest stablecoin.

Significant market changes are anticipated with this move. Eligible users holding at least 0.01 USDe will receive yield rewards. This offers an opportunity for yield farming and may attract more users to Ethena’s ecosystem. Market signals show potential increases in USDe value.

Market participants reacted positively. While Binance CEO did not publicly comment, StablecoinX invested $530 million, indicating institutional confidence. The focus remains on how USDe’s trading affects BTC and ETH, which back most of Ethena’s supply.

“Our $530M PIPE investment underlines our confidence in Ethena’s delta-neutral stablecoin architecture and the long-term growth of the ecosystem.” – StablecoinX Representative, Major Investor

USDe’s $10 Billion Surge: Regulatory and Market Insights

Did you know? USDe’s rapid ascent to $10 billion supply set a new industry record, achieved in under 10 months, outpacing USDT and USDC significantly.

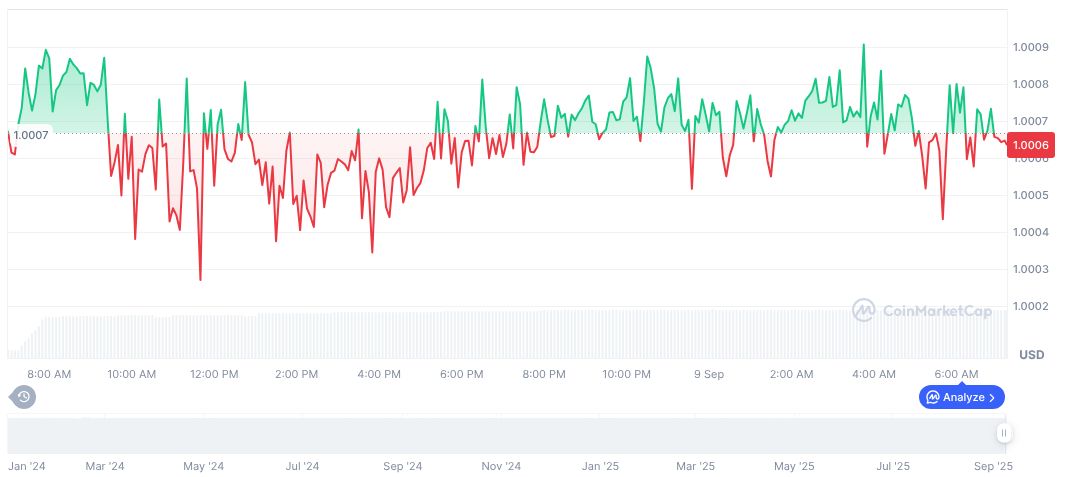

CoinMarketCap data shows Ethena USDe at a stable $1.00 price, with a market cap nearing $12.91 billion as of September 9, 2025. Its 24-hour trading volume reflects $459.82 million, evidencing high transaction activity. Price movements over 90 days show a consistent rise of 1.66%.

Coincu researchers highlight potential regulatory and technological impacts from USDe’s listing. DeFi and stablecoin regulation might increase scrutiny. Technological advances in delta-hedging boost Ethena’s operational reliability, enhancing its market position.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/binance-ethena-usde-september-launch/