- $352 million outflows were reported, with the US leading with $440 million.

- Bitcoin inflows totaled $524 million, while Ethereum saw $912 million outflows.

- Solana maintains strong inflows, attracting attention from DeFi and NFT sectors.

Digital asset investment products experienced a $352 million outflow last week, according to CoinShares’ data, with trading volume declining 27% despite strong year-to-date inflows totaling $35.2 billion.

This indicates divergent regional investment sentiment, particularly significant outflows in the U.S. contrasted by inflows in Germany and Hong Kong, with mixed asset performance affecting Ethereum and Bitcoin.

Bitcoin’s $524M Inflows Surpass Ethereum’s $912M Outflows

The latest CoinShares report highlights last week’s $352 million outflow in digital asset investment products, marking a 27% drop in trading volumes. Despite this, year-to-date inflows are robust at $35.2 billion. The United States saw the most significant outflows at $440 million, while Germany experienced $85.1 million in inflows.

Jean-Marie Mognetti, CEO, CoinShares, stated, “Digital asset investment products saw outflows totaling $352 million last week despite improving prospects for a Fed rate cut.”

Investors’ confidence in Bitcoin is apparent, with $524 million in inflows. Meanwhile, $912 million outflows from Ethereum might signal declining enthusiasm for ETH-based products. Solana continues an impressive inflow streak, attracting significant attention from the DeFi and NFT sectors.

Market analysts observe varied regional sentiments, with Germany and Hong Kong drawing more investments. Neither major exchange CEOs nor Ethereum co-founder Vitalik Buterin have publicly addressed these fund flow shifts on Twitter.

Market Data

Did you know? Solana has experienced 21 consecutive weeks of inflows, accumulating $1.16 billion year-to-date, reflecting a lasting confidence reminiscent of past bullish cycles in its sector.

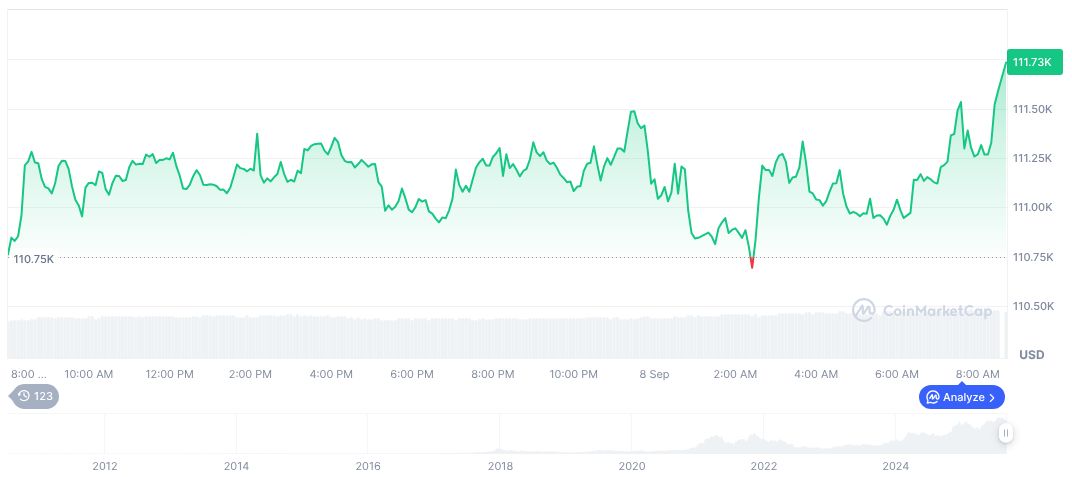

Bitcoin (BTC) currently trades at $112,275.01, with a market cap of $2.24 trillion and dominance at 57.67%. Recent trading volumes reached $31.93 billion. Over the past 24 hours, Bitcoin’s price increased by 1.05%, while experiencing a 2.81% rise over the past week, according to CoinMarketCap data.

The Coincu research team suggests potential regulatory feedback could impact further outflows or inflows, especially concerning U.S. institutional actions. Historical patterns indicate these inflows illustrate strong investor belief across specific cryptocurrencies, highlighting resilience despite broader market volatility.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/crypto-investment-product-outflow/