- Illiquid supply reached over 14.3 million BTC amid price swings.

- 72% of BTC is held by long-term investors.

- Market bullishness persists despite short-term price corrections.

In late August 2025, Bitcoin’s illiquid supply surpassed 14.3 million BTC, marking 72% of total supply, as noted by data analytics firm Glassnode.

This rising illiquid supply underlines strong accumulation despite price volatility, reflecting potential long-term bullish market sentiment for Bitcoin.

Bitcoin’s Illiquidity Hits 14.3 Million Amid Market Swings

Bitcoin’s illiquid supply reached a new milestone exceeding 14.3 million BTC, as reported by Coindesk. Glassnode’s data indicates that 72% of the total circulating supply is held by long-term investors, emphasizing a trend of increased cold storage preference. This pattern aligns with past behaviors where increased illiquidity set the stage for future price rallies.

The net illiquid supply grew by 20,000 BTC over 30 days, indicating long-term holders are not impacted by short-term price fluctuations, which saw a peak of $124,000 followed by a 15% decline. This sustained accumulation reflects confidence among holders despite price variations.

Notable industry figures have noted this trend. Arthur Hayes, co-founder of BitMEX, observed, “As more BTC leaves exchanges and enters cold wallets, we’re entering a liquidity vacuum. This always precedes explosive price moves.” Arthur Hayes also predicts a significant bitcoin bull run by 2028, aligning with the current illiquid trends.

Expert Insights Suggest Bullish Signals Despite Recent Volatility

Did you know? During previous major Bitcoin accumulation phases, such as in late 2020, the market observed price corrections followed by eventual rallies. The current situation, with 72% of supply illiquid, mirrors such instances, hinting at possible bullish outcomes.

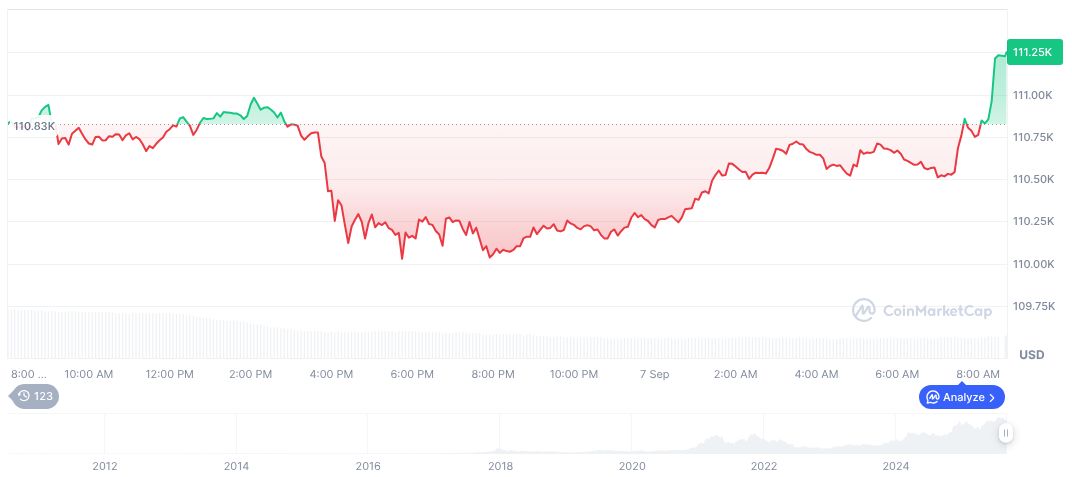

According to CoinMarketCap, Bitcoin (BTC) is presently priced at $111,182.11. Its market cap stands at $2.21 trillion, while the fully diluted cap is recorded at $2.33 trillion. Over the past 30 days, Bitcoin’s value has decreased by 4.87%, maintaining a circulating supply of 19,917,571 BTC as of September 7, 2025.

Financial experts from the Coincu research team highlight that growing illiquidity could potentially drive Bitcoin’s price higher if external demand strengthens. The data reflects a robust market foundation despite recent volatile shifts, suggesting anticipation for renewed bullish trajectories in Bitcoin’s future.

Bitcoin’s value proposition continues to strengthen as more holders opt for cold storage solutions.

— Michael Saylor, Founder, MicroStrategy

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/bitcoin/bitcoin-illiquid-supply-all-time-high/