- Federal Reserve prepares for potential rate cut amid economic signals.

- Market stability hinges on upcoming CPI data release.

- Options traders brace for pivotal U.S. market session.

The Federal Reserve’s anticipated September rate cut is advancing, influenced by weak U.S. employment figures, as traders gear up for Thursday’s CPI release.

Market stability is expected despite potential volatility from inflation data, impacting risk assets like cryptocurrencies if figures exceed forecasts.

Fed Decisions and Economic Implications for Investors

Federal Reserve decisions have traders expecting a rate cut, following unemployment data suggesting subdued economic growth. Experts highlighted the precarious situation as the CPI data looms: “Any very positive or very negative data could change the market outlook,” stated Eric Teal, CIO at Comerica Wealth Management. Muted volatility expectations underscore market cautiousness, reflected by S&P 500 projections of a modest 0.7% swing post-CPI. However, traders warn of potential risks should inflation data exceed predictions, possibly leading to sharper market moves.

High inflation data could prompt market volatility, with widespread implications for U.S. economic strategy. Eric Teal noted that such data shifts could spark major strategy adjustments. Traders have fully digested potential Fed actions, and key players anticipate modest market changes unless significant inflation surprises arise.

Financial circles and industry insiders are watching closely. Several prominent figures have made cautious remarks. Dominic Pappalardo from Morningstar highlights the pervasive expectation of a rate cut. As Jerome Powell, Chair of the Federal Reserve, hinted in his speech on monetary policy, “An adjustment to the central bank’s policy stance ‘may be warranted’ given the shifting balance of risks with respect to the labor market.” As the situation unfolds, traders and analysts continue to monitor the developing events.

Crypto Market Dynamics Amidst Economic Change

Did you know? During past economic shifts, anticipation of Federal Reserve rate cuts has often led to increased options trading activity, reflecting heightened trader interest and analysis based on historical market trends.

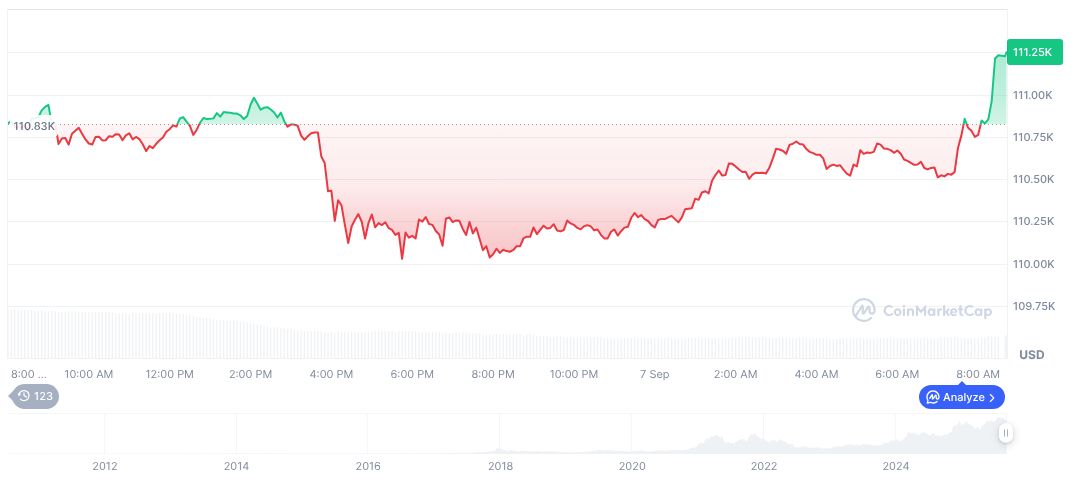

Bitcoin (BTC) currently stands at $111,307.92, with a market cap of $2.22 trillion and a trading volume showing a -29.17% change over 24 hours, according to CoinMarketCap. BTC’s market dominance is 57.88%, with price changes over 90 days marking a 3.70% increase.

Coincu analysts highlight the importance of the Fed’s decisions, suggesting that historically strong correlations exist between monetary policy changes and crypto market dynamics. Optimistic outcomes could favor crypto inflows, as lower rates benefit risk assets like BTC and ETH. As the landscape evolves, financial observers continue to assess the long-term impacts.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/fed-rate-cut-stock-market/