Key Takeaways

BNB held resilience with 26 million staked, $133 million launchpad funds, and steady chain fees. Yet profit-taking drove Spot Netflow higher, keeping $1,000 dependent on cooling inflows.

Since hitting $900 two weeks ago, Binance Coin [BNB] has struggled to maintain an upward momentum. Over this period, the altcoin traded within a thin margin and remained stuck between $880 and $830.

At press time, BNB traded at $856 after 24-hour gains of 1.14%.

Amid this slowdown, analysts debated the altcoin’s path. CryptoQuant’s DarkFost suggested a potential rally to $1,000, citing token burns and repurchases as key supports.

Four drivers of BNB resilience

According to Darkfost, BNB’s Spot Volume flashed overheating, which is a pause and consolidation signal. Even so, the market held without a sharp correction.

Source: CryptoQuant

As per the analyst, this market resilience arises from four major factors.

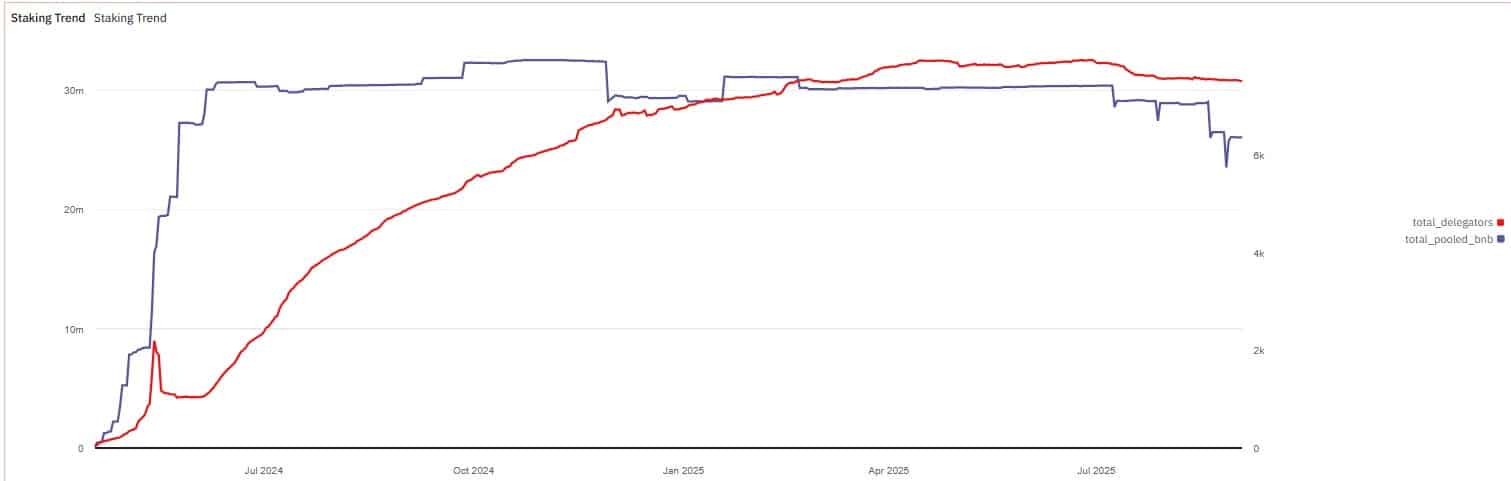

First, BNB Chain staking remained attractive. Total Pooled BNB climbed to 26 million, while Delegators recovered to 7,500, showing consistent staking demand.

Source: Dune

The second factor was that Binance Launchpads have become highly popular, with an increased amount of capital raised through them.

In fact, Binance Launchpads have raised $133 million as Chainbroker, reflecting demand for chain-backed tokens.

Source: Chainbroker

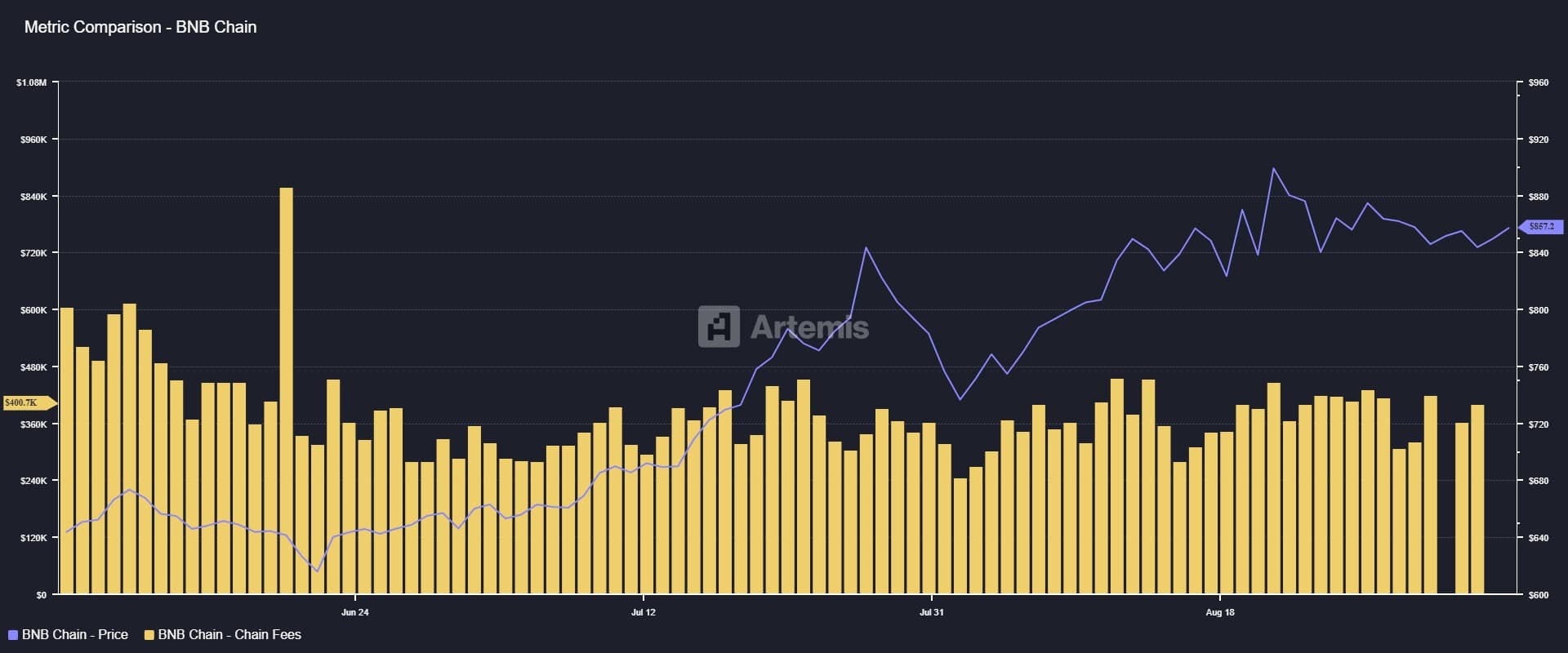

Another factor Darkfost observed is Chain Fees, as BNB has continually raised funds through staking fees.

Daily fees averaged $400,700 in recent months, according to Artemis.

Source: Artemis

Finally, Binance continued buybacks and burns, reinforcing confidence. These conditions set the stage for a potential rally to $1,000, DarkFost noted.

On-chain activity signals recovery

Importantly, BNB’s on-chain activity has also signaled increased usage and adoption.

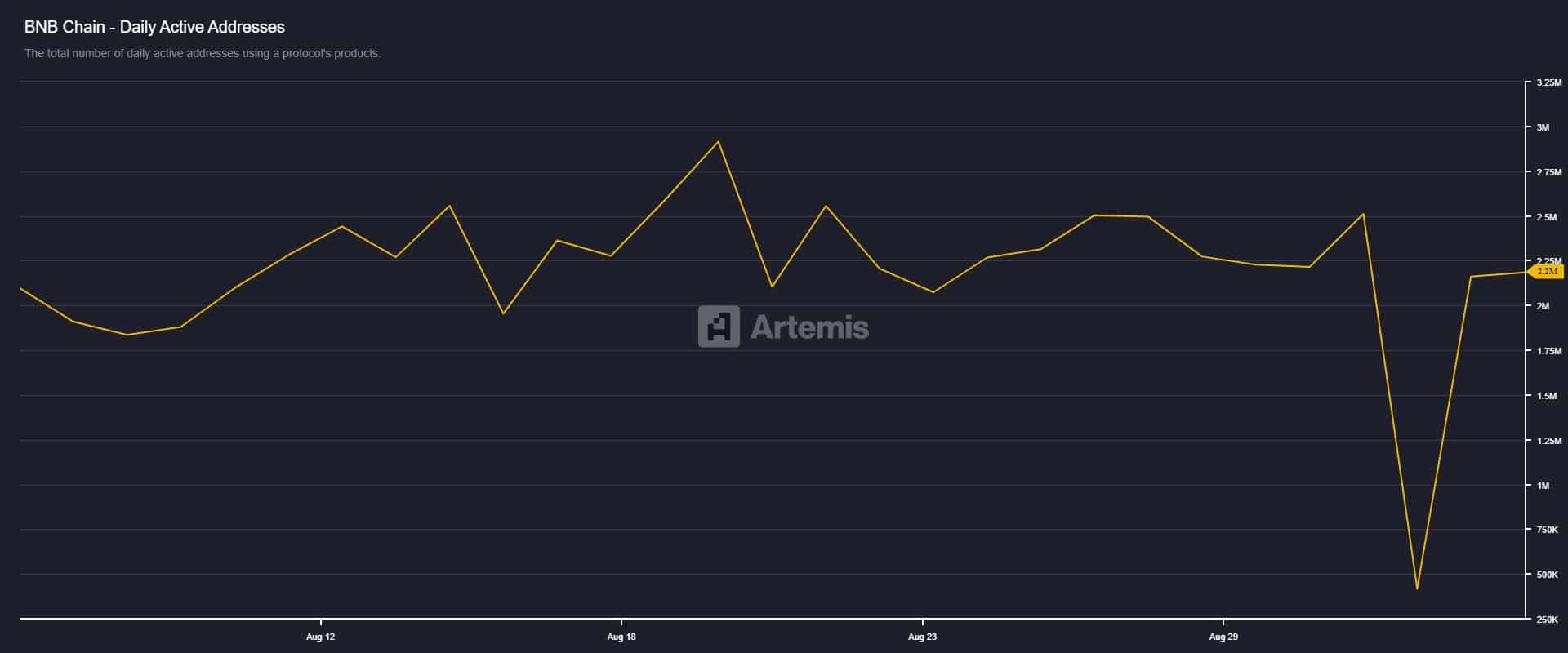

For instance, according to Artemis, BNB’s Daily Active Addresses recovered from a 417k decline recorded on the 2nd of September to 2.2 million at press time.

Source: Artemis

Such a spike in addresses signaled increased network usage and higher on-chain demand for the asset.

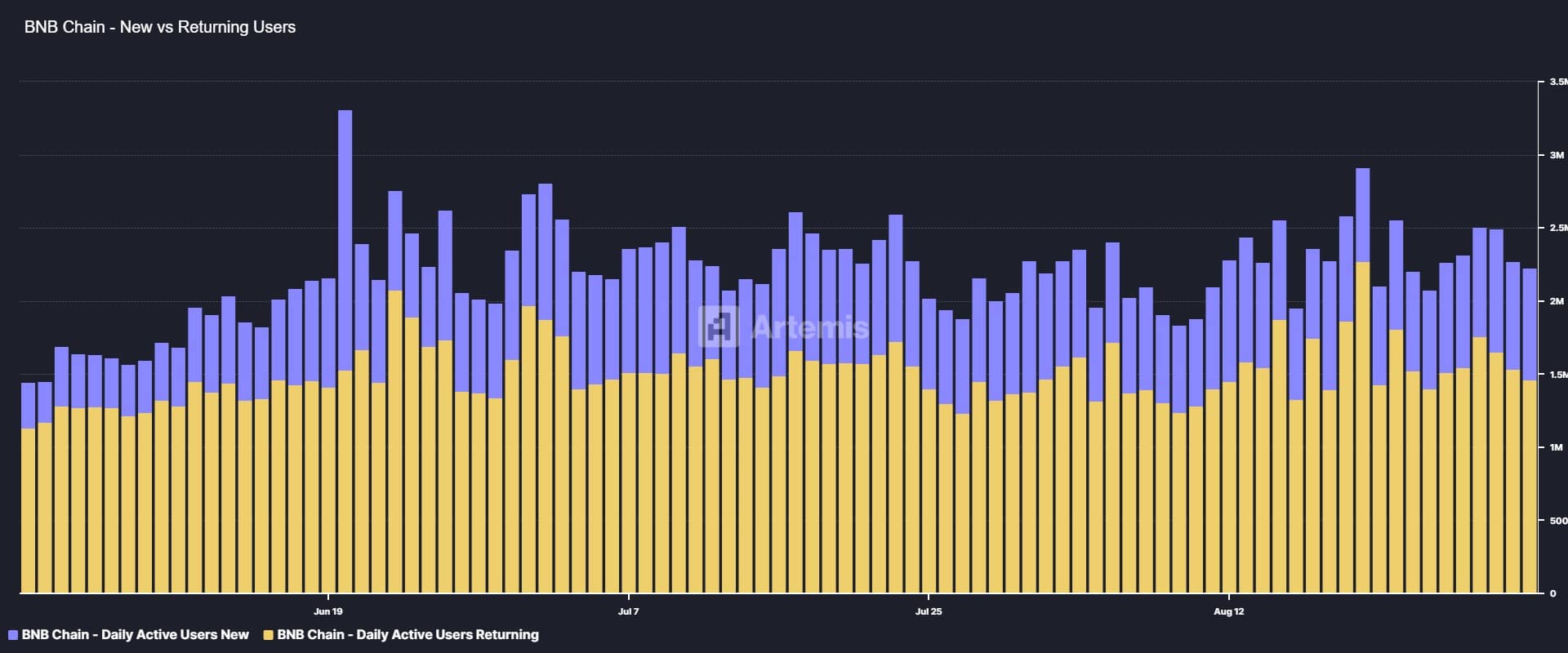

In fact, the number of New Users surged to 752k while Returning Users jumped to 1.4 million, at press time. This confirmed growing adoption and usage across the chain.

Source: Artemis

What’s holding BNB back?

Surprisingly, despite showing resilience, BNB remained in a consolidation phase as profit-taking pressure persisted.

According to CoinGlass data, BNB registered positive Spot Netflow on six of the past seven days, indicating steady accumulation and investor confidence.

Source: CoinGlass

At the time of writing, Spot Netflow reached $4.71 million, up from $2.02 million the prior day. Rising inflows hinted at selling pressure from profit-taking.

Is $1,000 within reach?

According to AMBCrypto’s analysis, Binance Coin has shown resilience in adoption and on-chain demand. Yet, consolidation persisted as selling pressure offset gains.

If profit-taking cooled, BNB could reclaim $880 resistance, opening the path toward $1,000.

However, if sellers remained active on each rally, consolidation would likely continue, with $840 acting as a key support.

Source: https://ambcrypto.com/binance-coin-why-these-drivers-could-fuel-bnbs-1k-rally/