- Whale accumulation of $229.91M ETH shows growing confidence in long-term holding.

- Key support at $3,960 and $3,360 may dictate Ethereum’s next price direction.

- Exchange outflows and rising network activity signal structural strength and adoption.

Ethereum is showing signs of structural strength despite recent price weakness. According to Arkham data, three whale addresses acquired nearly $229.91 million worth of ETH from FalconX and Bitgo. This large-scale accumulation comes as exchange balances decline sharply, suggesting long-term investors are preparing for the next market phase.

Key Support Zones Define Market Outlook

Ali Martinez noted that Ethereum’s realized price distribution highlights two crucial support levels. Around $3,960, approximately 676,000 ETH were last transacted, creating a strong near-term cushion.

Meanwhile, at $3,360, more than 1.7 million ETH were realized, forming a deeper support base. These levels will likely determine whether Ethereum sustains its bullish structure or risks further correction. Holding above $3,960 could encourage renewed momentum, while losing this level may push the price toward $3,360.

Shrinking Exchange Balances Signal Structural Shift

Cas Abbé highlighted that Ethereum’s exchange balance just turned negative for the first time on record. Billions of dollars in ETH are leaving centralized exchanges, reducing liquid supply.

Historically, this trend marks the beginning of structural market shifts. Selling pressure weakens as long-term holders tighten their grip on supply. Market tops usually emerge only after this pattern reverses, not at its start. Consequently, the current movement suggests Ethereum is being positioned for holding rather than distribution.

Related: Ethereum Could Become “High-Octane Money,” Says Former BlackRock Crypto Head

Network Activity Underpins Growth

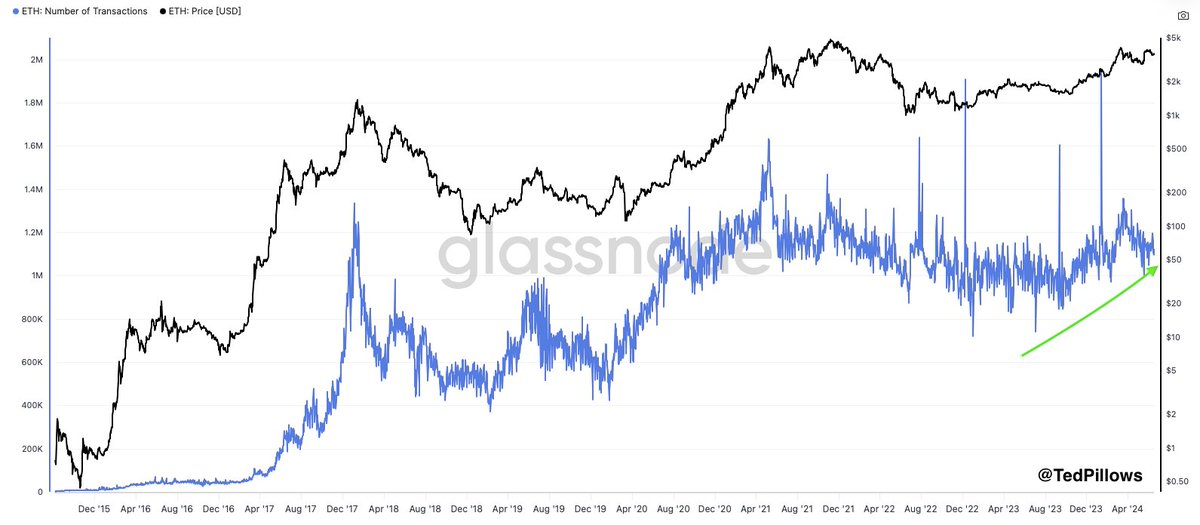

TedPillows emphasized that Ethereum’s transaction activity continues to trend upward despite volatile market conditions. Even after its 2021 peak above $4,800, the network maintained strong usage.

Activity remained stable through price corrections, underscoring consistent demand and adoption. Recently, transactions have stabilized and started climbing again, confirming that the Ethereum network continues to scale. This persistent growth indicates healthy fundamentals and provides a base for potential future expansion.

Market Outlook

Ethereum trades at $4,305.93, with a daily trading volume of $39 billion. The price has dipped 0.27% in the last 24 hours and declined 0.99% over the past week. With 120 million ETH in circulation, Ethereum’s market capitalization stands at $519 billion.

Related: ETH Price Analysis: Key Differences Between 2025 Cycle and the 2021 Top

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Source: https://coinedition.com/ethereum-whales-accumulate-230m-as-exchange-balances-turn-negative/