- JPMorgan strategist warns Fed rate cuts won’t revive growth.

- Market expected Fed rate cuts will reduce interest income.

- Previous rate cuts since 2008 failed to stimulate economy.

David Kelly, Chief Global Strategist at J.P. Morgan Asset Management, highlighted economic slowdown concerns during a CNBC interview on September 6, 2025, questioning the effectiveness of anticipated Fed rate cuts.

Kelly’s critique suggests rate cuts may undermine retirees’ income, questioning their utility in rejuvenating economic growth, while markets rallied on rate cut expectations.

JPMorgan’s Kelly: Rate Cuts Unlikely to Boost U.S. Growth

David Kelly expressed concerns over the economic downturn during an interview with CNBC. He described the U.S. economy as a tortoise nearly out of breath and questioned the effectiveness of anticipated Federal Reserve rate cuts. Kelly believes that these rate adjustments, although expected, will not address the core issues facing the economy.

The strategist pointed out that rate reductions might diminish retirees’ interest incomes, while creating expectations for more cuts. This environment may not encourage borrowing, a key mechanism usually hoped to spur economic growth. His analysis emphasizes past experiences where similar cuts failed to catalyze economic recovery.

“What’s going on is the economy is not in a recession yet, but it’s slowing, slowly. And it’s very consistent across all the data that just shows this economy – it was always a bit of a tortoise – is now a tortoise that’s pretty much out of breath.” – David Kelly, Chief Global Strategist, J.P. Morgan Asset Management

Market reactions quickly followed Kelly’s statements. On September 6, 2025, U.S. stock indices, including the S&P 500, increased as a result of growing expectations of rate cuts. Kelly’s cautionary comments resonated with concerns over the same solutions failing to offer long-term solutions for growth.

Bitcoin and Crypto Dynamics Amid U.S. Rate Changes

Did you know? Historical trends show that despite multiple rate cut cycles since the 2008 financial crisis, the anticipated economic stimuli did not substantially improve growth rates, casting doubt on their effectiveness in the current economic climate.

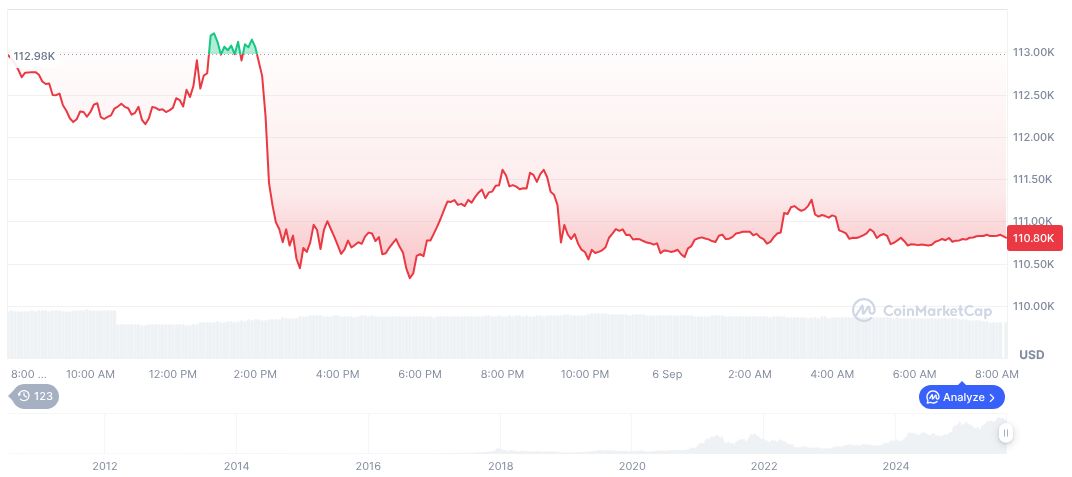

According to CoinMarketCap, Bitcoin’s latest statistics show a price of $110,805.10 and a market cap of $2.21 trillion as of September 6, 2025. Notably, a trading volume drop of -21.88% was observed. Bitcoin experienced a -1.83% price reduction over 24 hours, following an upward trend of 2.04% over the past week.

The Coincu research team indicated that crypto markets could see increased volatility with shifts in U.S. interest rates. Historical data suggest risk assets, such as Bitcoin and Ethereum, may experience capital inflows during periods of increased liquidity. Potential regulatory changes may also influence these outcomes.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/analysis/jpmorgan-strategist-rate-cuts-impact/