The crypto market often moves on big catalysts. Chainlink (LINK) may have found one of its strongest in the Chainlink Reserve. This on-chain reserve was launched on August 7, 2025 to support Chainlink’s network long-term growth. Instead of depending on hype, it steadily accumulates LINK using real revenue through two sources. These are on-chain decentralized finance (DeFi) usage, and enterprise giants like Mastercard and UBS. This is more than just a treasury setup, but a structural tailwind that could fuel LINK’s next bull run.

A Growing Chainlink Reserve: The Numbers Don’t Lie

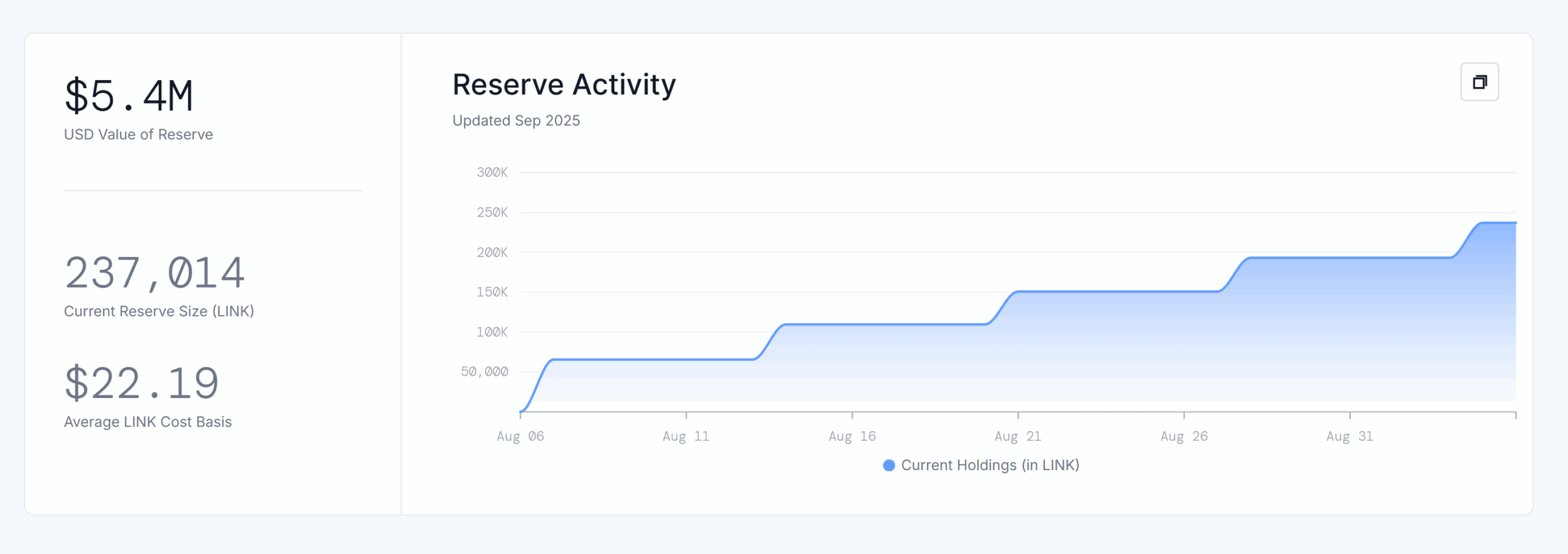

The growth of Chainlink is happening very fast and is noticeable. Currently, the reserve totals 237,014 LINK, with 43,937 LINK recently added, according to the reserve update. This shows, over $5.4 million worth of tokens have been removed from circulation in less than a month. By buying the tokens and locking them away, scarcity is created, and when demand grows, upward pressure is felt on prices.

How the Reserve Works

Every time Chainlink earns revenue, it is automatically converted to LINK and added to its reserve. This means that, in the spot market, the token’s buying pressure is directly created by every new enterprise deal or DeFi integration. In turn, this directly exerts buying pressure for LINK on the spot market.

For the first time, Chainlink’s network growth is directly connected to LINK’s value. Unlike when it relied solely on delivering secure data feeds and powering smart contracts.

Transparency Builds Trust

Chainlink reserve is appealing for its transparency. The public dashboard is open to anyone who can check the amount of LINK currently held and how it affects the circulating supply. With no planned withdrawals for years, it is clear that this is not short-term hype, but about long-term sustainability.

Why This Reserve Could Be a Game-Changer

When tokens are locked away for a long period of time, the Chainlink Reserve creates a steady demand and a lasting value, unlike speculative price pumps. As more institutions adopt Chainlink and DeFi activities increase, the reserve could also experience an increase in its buying activity. This could further tighten supply and support LINK’s price appreciation with Chainlink price prediction placing $88 figure, as analysts forecast a major rally.

The crypto market is noticing the impact of the reserve. Over the past month, Chainlink price has surged by 39%, although it is trading below its all-time high of $52.88 by around 60%. This gap could be filled by the steady accumulation of research, which could position LINK as one of the most promising and attractive opportunities in the market at the moment.

As the crypto market is recognized for being fueled by quick speculation, Chainlink reserves stand out as a catalyst driven by fundamentals. Should its moment continue, LINK could reclaim its all-time highs and push beyond them. The reserve could be the secret tailwind pushing the token to its next bull run.

Frequently Asked Questions (FAQs)

The reserve is an on-chain repository that accumulates LINK using protocol revenue from DeFi usage and enterprise clients.

It creates consistent buy pressure by converting revenue into LINK and locking it away, reducing circulating supply.

As of September 5, 2025, the Chainlink Reserve holds 237,014 LINK, valued at over $1 million.

Investment disclaimer: The content reflects the author’s personal views and current market conditions. Please conduct your own research before investing in cryptocurrencies, as neither the author nor the publication is responsible for any financial losses.

Ad Disclosure: This site may feature sponsored content and affiliate links. All advertisements are clearly labeled, and ad partners have no influence over our editorial content.