The push to bring memecoins into the mainstream has just gained a lot of momentum, with REX Shares preparing to launch the first U.S.-listed Dogecoin (DOGE) exchange-traded fund (ETF).

If approved, the Dogecoin ETF would mark the first time the meme-inspired token receives formal recognition in the American market.

Despite extreme volatility, the crypto continues to capture investor attention, thanks in part to its association with Elon Musk, who’s helped amplify the token’s profile over the years.

Should a Dogecoin ETF launch, and Bloomberg’s Eric Balchunas believes it could happen as early as next week, it would not only cement the token’s cultural relevance further but also highlight the growing institutional appetite for digital assets beyond Bitcoin (BTC) and Ethereum (ETH).

Dogecoin price prediction

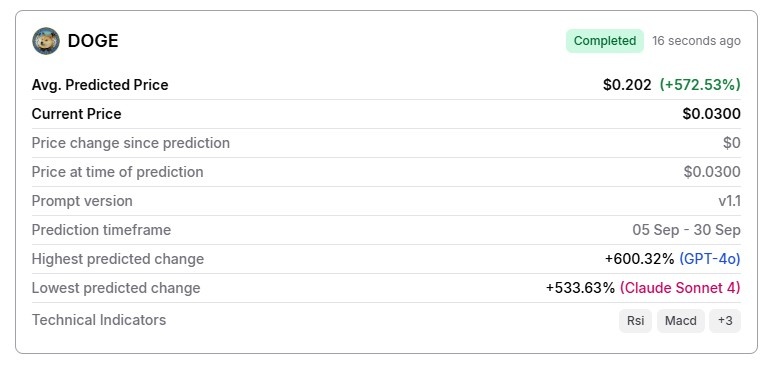

To set a DOGE price target for September 30, 2025, Finbold’s AI prediction agent used multiple LLMs to generate an average forecast for improved accuracy while incorporating momentum-based indicators into its context. You can experiment with the existing prompts or create your own. Try here now.

Based on the prediction generated by the artificial intelligence (AI) agent, the average DOGE price on September 30 will be $0.202, up no less than 572.53% from the September 5 price of $0.03.

All three language learning models (LLMs) used in the prediction were extremely bullish.

For instance, OpenAI’s flagship model, GPT, projected a price of $0.210, implying a 600.32% upside.

Similarly, Grok 3 predicted DOGE would hit $0.205 by the end of the month, rising 583.65% from the current price.

Anthropic’s Claude 4 Sonnet offered a slightly lower prediction, with a DOGE target price of $0.190, which still translates to an upside of 533.63%.

DOGE technical analysis

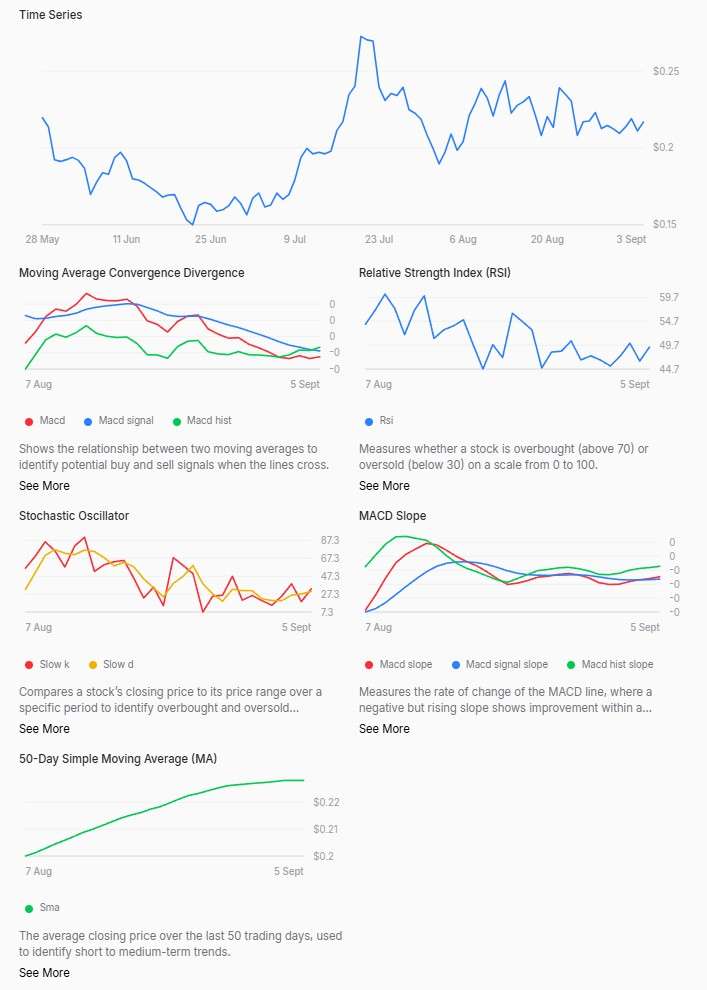

Looking at Dogecoin’s technicals, however, it appears that the projections are mostly hype-driven, as many indicators point to heavy bearish pressure even if a short-term boost is possible.

The moving average/convergence divergence (MACD) sits in negative territory, with the line below the signal line and the histogram slightly red. While this confirms lingering bearish momentum, the flat slopes show that selling pressure is at least not accelerating.

Further, the relative strength index (RSI) at 49 is near the neutral zone, reflecting an indecisive market leaning slightly to the downside.

Meanwhile, the stochastic oscillator is positioned just above oversold levels, with %K crossing above %D. This hints at a potential short-term rebound, although the signal remains weak.

Finally, the most concerning indicator is the 50-day moving average (MA), which sits at $0.23, far above the current price. The gap implies a prevailing downtrend, as Dogecoin trades well below its long-term trend.

Featured image via Shutterstock

Source: https://finbold.com/machine-learning-algorithm-sets-dogecoin-price-for-september-30-2025/