- SEC’s new agenda promotes crypto trading on regulated exchanges.

- Focus on safe harbor provisions.

- Reduced compliance burdens for crypto businesses.

The U.S. Securities and Exchange Commission (SEC) unveiled its regulatory plans for cryptocurrencies, including potential exemptions, aimed at enhancing market clarity and reducing compliance burdens.

This regulatory shift could increase institutional participation and market certainty, potentially boosting liquidity for major cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH).

SEC Proposes Crypto Trading on Regulated Exchanges

The SEC’s new agenda includes rule proposals aimed at crypto asset issuance. This involves clarifying regulations, providing safe harbors, and integrating crypto assets on national securities exchanges. Chairman Paul Atkins and Commissioner Hester Peirce are key figures in this initiative.

The deregulatory agenda could ease compliance burdens across Wall Street. Simplified broker-dealer rules are anticipated to offer financial firms greater latitude in managing crypto-related operations while reducing overall compliance costs.

The market has responded with cautious optimism. Reactions from financial sectors suggest potential for significant inflows into crypto as regulatory barriers lower. Hester Peirce stated, “We’re committed to fostering innovation through open dialogue with the community.”

Deregulatory Agenda Aims to Reduce Wall Street Compliance Burdens

Did you know? Commissioner Hester Peirce has long advocated for “safe harbors” to promote innovation in the crypto industry. This approach might soon become part of formalized regulatory policies, highlighting the growing acceptance of cryptocurrency within the regulatory framework.

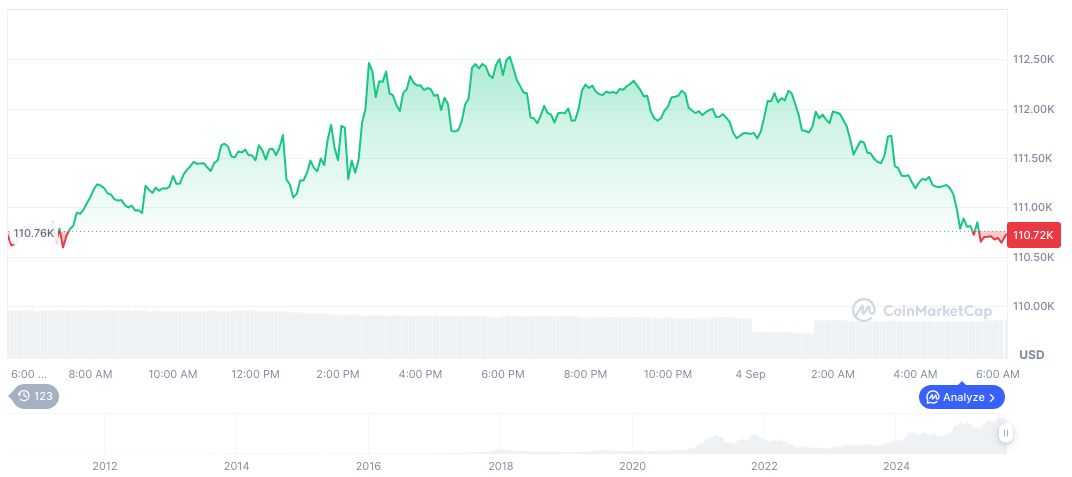

As of September 5, 2025, Bitcoin’s (BTC) market cap stands at $2.22 trillion, dominating 58.07% of the market, according to CoinMarketCap. Despite slight 24-hour and 7-day declines of -0.30% and -0.13% respectively, BTC saw a 6.46% surge over 90 days.

Insights from Coincu’s research team indicate significant possibilities for BTC and ETH. As crypto assets gain clarity under new SEC rules, institutional participation is poised to rise. While exact technological and financial impacts remain speculative, the deregulation push promises to streamline market entry and operation procedures for crypto businesses.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/sec-crypto-regulatory-agenda/