- John Williams of the New York Fed expects gradual rate cuts.

- Tariffs may increase inflation by 1.00% to 1.50%.

- Bitcoin and Ethereum likely impacted by policy expectations.

John Williams, President of the New York Federal Reserve, announced expected gradual rate declines and potential inflation increases due to tariffs, impacting economic forecasts.

These predictions impact interest rates, inflation, and unemployment, influencing market expectations for risk assets, including cryptocurrencies like BTC and ETH.

Fed’s Rate Outlook and Inflationary Concerns

John Williams, President of the New York Fed, emphasized the gradual decline in interest rates conditional on economic performance. He predicted an additional 1.00% to 1.50% rise in inflation due to tariffs but noted this effect has not yet influenced long-term expectations significantly.

The potential rise in unemployment to approximately 4.5% next year and an inflation forecast of 3% to 3.25% by 2025 are expected to have considerable implications on risk sentiment and asset allocations, notably within traditional and cryptocurrency markets.

Financial markets show heightened anticipation of a rate cut cycle, with CME’s FedWatch data indicating a probability range of 84.6% to 87.3%. The expectation has historically favored risk assets, influencing cryptocurrencies such as Bitcoin and Ethereum.

Cryptocurrency Markets and Monetary Policy Effects

Did you know? Previous Federal Reserve rate cut cycles often correspond with increased capital flows into high-risk assets, benefitting cryptocurrencies in periods of monetary easing.

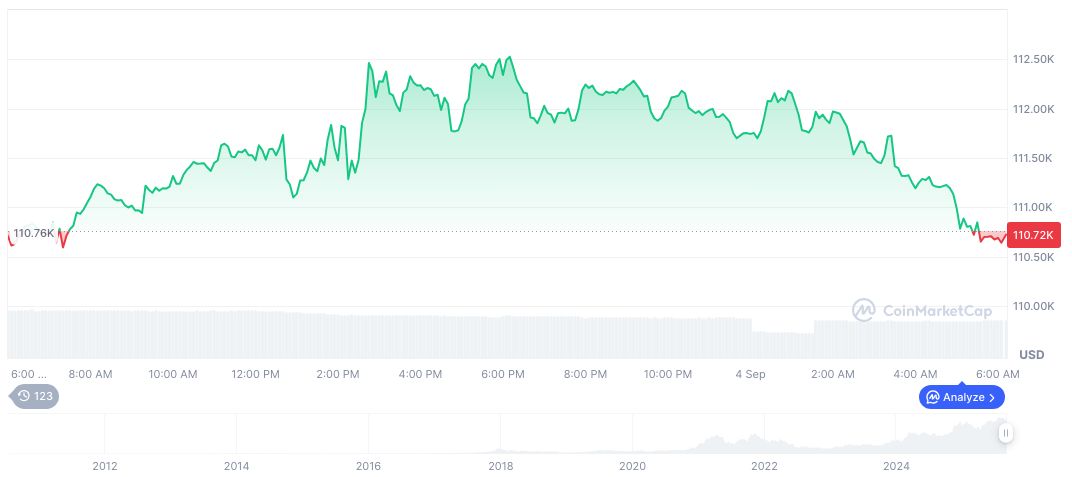

Bitcoin (BTC) trades at $110,569.70, with a market cap of $2.20 trillion and a dominance of 57.91%, according to CoinMarketCap. Recent data shows a 1.39% price drop in 24-hours and 5.96% increase over 90 days. The trading volume decreased 4.82% in 24 hours, indicating moderate shifts.

Coincu analysts suggest that Fed policies targeting inflation and interest adjustments can significantly affect cryptocurrency valuations. Historic trends indicate resilience in crypto markets during liquidity influxes, supporting Bitcoin’s status as an inflation hedge. Additionally, potential regulatory shifts remain closely monitored for further analysis.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/fed-williams-rate-decline-forecast/