- BTC and ETH show increased implied volatility and defensive trading mindset.

- Spike in put option volumes indicates market caution.

- MicroStrategy stocks lead decline in crypto equities.

On September 4, macro researcher Adam from Greeks.live reported a continuing downtrend in the cryptocurrency market, driven by rising implied volatility for BTC and ETH and increased put option trading.

This situation underscores the market’s defensive stance and anticipation of further volatility, exacerbated by declines in U.S. crypto stocks like MicroStrategy during historically weak September capital flows.

Rising Volatility in BTC and ETH Amid Market Decline

Market analysts have identified a sharp rise in the implied volatility (IV) for Bitcoin and Ethereum, driven by a decrease in U.S. crypto-related equities, particularly MicroStrategy. A significant increase in the trading volume of put options reflects a defensive stance investors are adopting amid market uncertainty.

Market changes are underway, as indicated by the increased short-term IV for BTC reaching 40% and ETH hitting 70%. Institutional and trader risk aversion is highlighted by the spike in put options volume, which accounts for 30% of the total daily trading volume.

“The market is clearly in a downtrend, with BTC’s short-to-medium-term IV rising to 40% and ETH’s short-term IV rising to 70%. The increase in short-term IV represents the market’s anticipation of higher volatility this week…” – Adam, Macro Researcher, Greeks.live

Historical Trends and Expert Predictions on Market Recovery

Did you know? Bitcoin’s current turmoil parallels previous September downtrends, a month traditionally associated with weak capital inflows and heightened market defensiveness.

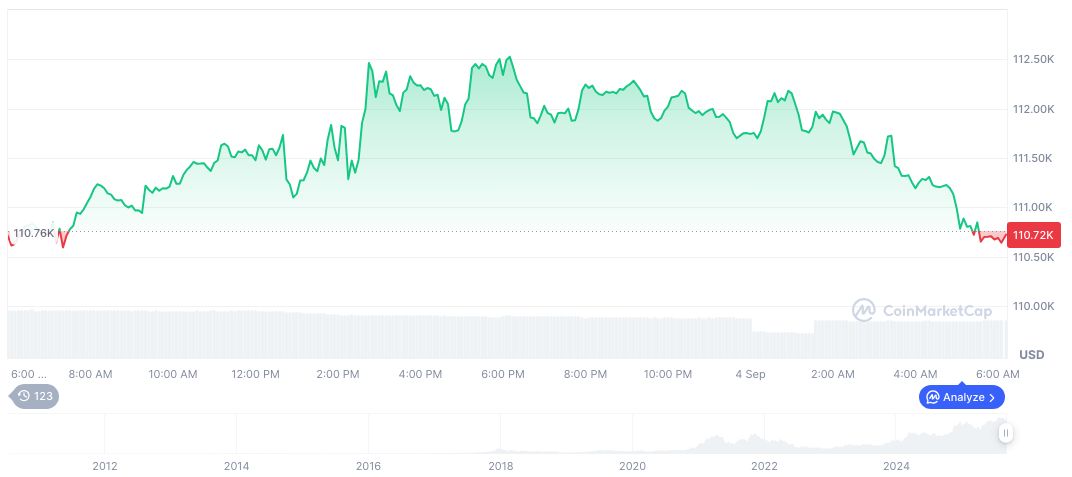

Bitcoin (BTC) is trading at $110,337.25, with a market cap of $2.20 trillion and dominance of 57.93%. As per CoinMarketCap, the price has decreased by 1.62% over the past 24 hours. The 24-hour trading volume is $57.69 billion, a decline of 7.10%. Additional price trends show a 1.46% fall over the past week but a 5.70% increase over 90 days, as recorded on September 4, 2025.

Coincu analysts indicate that the current volatility surge could pressure regulatory bodies to re-evaluate existing frameworks. The event could also impact strategies of institutional investors, who may pivot towards alternative hedging mechanisms if volatility persists. This response highlights the interconnected nature of financial policies and market behaviors during downturns.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/crypto-market-volatility-equity-decline/