- Michael Saylor’s Strategy Inc. aims for S&P 500 inclusion.

- Company reports $14 billion unrealized gains.

- Potential institutional inflows from index-based funds.

Strategy Inc., led by Michael Saylor, is poised to join the S&P 500 index after reporting $14 billion in operating income and successful Bitcoin-based strategies.

This potential inclusion highlights Bitcoin’s growing institutional acceptance, potentially driving significant capital inflows and market interest, reinforcing Strategy Inc.’s pivotal role in cryptocurrency integration.

Strategy Inc.’s $14 Billion Gain Spurs S&P 500 Inclusion Bid

Strategy Inc., formerly MicroStrategy, reported $14 billion in unrealized gains last quarter due to its pivot to a Bitcoin reserve model, potentially qualifying it for S&P 500 index inclusion. Michael Saylor, a prominent Bitcoin advocate, leads the company’s strategic shift. Based on historical index entrants, passive inflows of over $2 billion from institutional investors and ETFs are anticipated upon inclusion. These potential investments may significantly bolster the company’s financial and market positions.

Market reactions remain muted, pending an official announcement by the index committee. Analysts speculate on the potential broad institutional adoption of Bitcoin due to Strategy Inc.’s high-profile participation. Stephen Biggar from KBW noted, “Strategy will adopt the latest FASB accounting standards in the first quarter of 2025, which may make it eligible for inclusion in the S&P 500 index, as one of the important inclusion criteria for the index is that the net profit for the most recent quarter and the cumulative net profit for the past four quarters must be positive.”

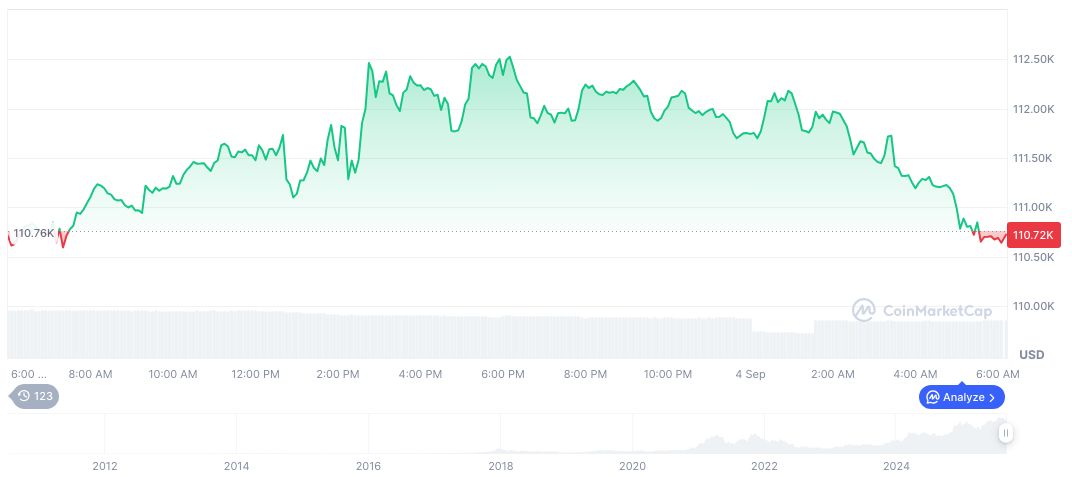

Bitcoin (BTC) is experiencing a slight downtrend, priced at $109,465.94, with a market cap of $2.18 trillion and a 24-hour trading volume down by 13.79% to $56.08 billion. Price movements include a 2.44% drop in 24 hours, while the 90-day change shows a 4.49% increase, per CoinMarketCap.

Bitcoin Trends Amid Strategy Inc. and Market Anticipations

Did you know? The anticipated inclusion of Strategy Inc. in the S&P 500 echoes Tesla’s 2020 entry, which sparked notable institutional buying and market shifts, offering comparative insights into expected market dynamics upon official confirmation.

Experts from Coincu suggest regulatory and market shifts could follow Strategy Inc.’s potential index inclusion, possibly encouraging broader institutional cryptocurrency engagement. Historical trends indicate such developments might also reinforce market stability, although regulatory responses remain a variable factor.

Experts from Coincu suggest regulatory and market shifts could follow Strategy Inc.’s potential index inclusion, possibly encouraging broader institutional cryptocurrency engagement. Historical trends indicate such developments might also reinforce market stability, although regulatory responses remain a variable factor.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/strategy-inc-sp500-inclusion/