- US August employment data attracts market focus.

- Crypto markets anticipate potential volatility.

- BTC and ETH could experience significant reactions.

The U.S. August ADP Nonfarm Employment and Initial Jobless Claims will be released on September 4, attracting significant attention due to potential impacts on Federal Reserve rate policy.

Market reactions could influence crypto prices, with potential volatility for BTC and ETH as interest rate expectations shift, highlighting interdependencies between macroeconomic data and digital assets.

US Employment Data’s Impact on Crypto Trading

The anticipated release of US employment figures has garnered intense interest from both central bank officials and market participants. Numerous economic analysts await these figures to grasp potential shifts in Federal Reserve rate policy discussions. Jerome Powell’s recent statements at the Jackson Hole symposium highlighted the relevance of this data, emphasizing the challenges the economy might face.

Economist José Torres expressed optimism about the potential stabilization of the labor market. Should job growth meet or surpass expectations, confidence in market stability could increase. Conversely, financial institutions and the global investment community are preparing for shifts in economic sentiment should the data disappoint.

Raoul Pal, CEO of Real Vision, noted that disappointing employment data might trigger rallies in Bitcoin and Ethereum. This sentiment echoes among other industry experts who believe significant deviations from expectations could reshape market risk evaluations and impact crypto assets: “The employment data matters more than ever for risk assets. Any disappointment could trigger a broad rally in crypto, especially ETH and BTC, as dovish rate cut expectations reprice the entire risk curve.”

Crypto Market Faces Potential Volatility Post-Labor Data

Did you know? Crypto assets like Bitcoin frequently experience short-term volatility following major US employment data releases, affecting trading volumes and market sentiments.

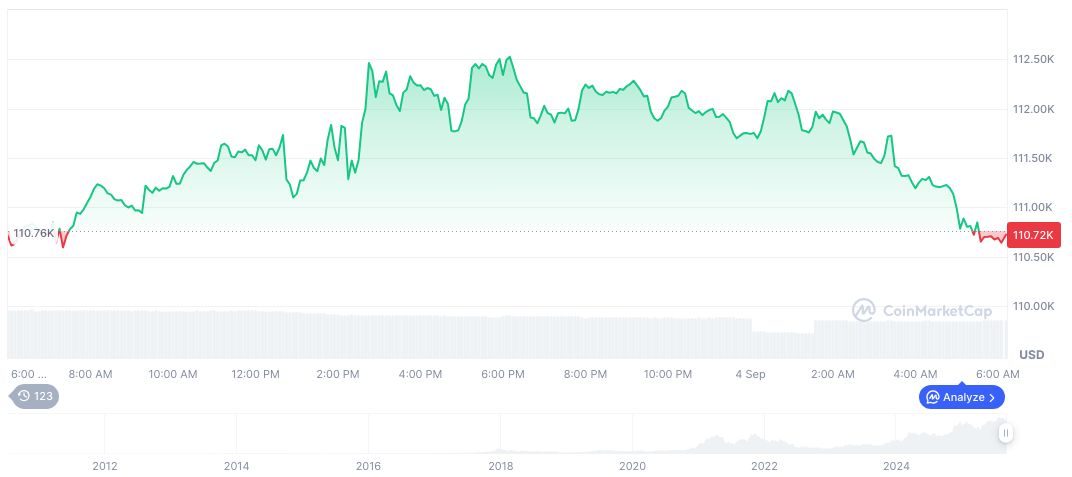

According to CoinMarketCap, Bitcoin (BTC) is trading at $110,493.98, with a market capitalization of $2.20 trillion and a dominance of 57.71%. Over the last 24 hours, trading volume declined 18.65%, with BTC posting a 0.12% dip. Long-term changes show a varied pattern: a 2.15% rise over 60 days and a 6.99% increase over 90 days.

Insights from Coincu’s research suggest that significant shifts in US employment data might expedite potential Federal Reserve interest rate decisions. Historical trends indicate that Bitcoin and Ethereum are among the most sensitive assets to US macroeconomic data, significantly affecting crypto market sentiment.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/us-august-employment-crypto-impact/