- Federal Reserve may cut rates to 3%, potentially underestimated by the market.

- Potential increased liquidity could affect interest rate-sensitive sectors, including cryptocurrencies.

- Institutional interest in Bitcoin as a hedge against Fed policy volatility.

Mark Cabana, Head of US Rates Strategy at Bank of America, predicts the Federal Reserve may cut interest rates to at least 3%, impacting financial markets.

This potential rate cut could drive institutional investments in Bitcoin and Ethereum, influencing the broader cryptocurrency market’s liquidity and volatility perceptions.

Fed Rate Cuts of 3% and Crypto Market Liquidity

Key Developments, Impact, and Reactions

Mark Cabana predicted potential interest rate reductions by the Federal Reserve to at least 3%, which he believes the market underestimates. Speaking on Bloomberg Surveillance TV, he emphasized that such rate cuts might not be fully accounted for by economic models, possibly leading to broader implications.

Market shifts stemming from rate cuts could expand liquidity, influencing borrowing costs and risk appetite. Cryptocurrencies, especially Bitcoin and Ethereum, may find renewed interest. As potential hedges against US policy-driven volatility, these assets could attract greater institutional investment.

The Federal Reserve could cut interest rates to at least 3%. The market is underestimating the range of outcomes below 3% that the Fed could take us to. – Mark Cabana, Head of US Rates Strategy, Bank of America

Reactions have varied across financial sectors. While no immediate governmental statements affirm these predictions, the crypto market is attentive. Some institutional investors, particularly in the DeFi space, may prepare for probable shifts in liquidity dynamics, thus increasing their positioning in cryptos.

BTC Price and Institutional Strategies Amid Dovish Policies

Did you know? The last significant rate cut cycle in 2019 saw increased BTC and ETH activity, illustrating potential growth patterns for crypto under similar monetary easing.

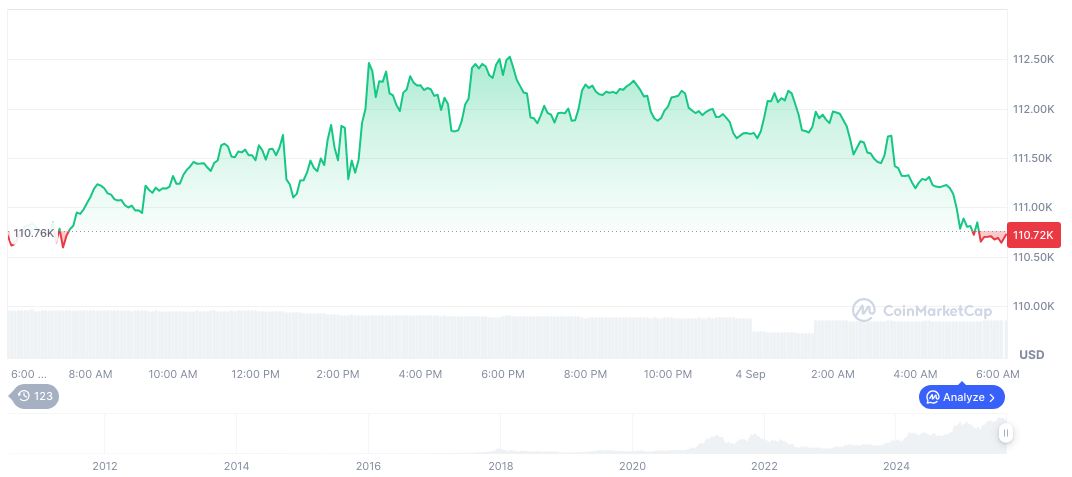

Bitcoin (BTC) currently maintains a price of $110,500.18, according to CoinMarketCap. With a market capitalization of formatNumber(2200651039139.93, 2), its market dominance is at 57.74%. Trading volume across the last 24 hours dropped by -21.93%, though BTC sees continued resilience with a 90-day uptick of 7.12%.

Research from the Coincu team emphasizes potential financial outcomes should this rate cut occur. The anticipation of increased liquidity and risk-on shifts could bolster BTC and ETH valuations, while regulatory concerns remain minimal amid such dovish shifts. This potential pivot signals possible bullish behavior in crypto markets.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/fed-rate-cut-crypto-impact-3/