- Inflation data drives bearish sentiment with large Bitcoin sell-offs.

- Bitcoin and Ethereum key supports at $100K, $4K.

- Surprise in job data could alter market volatility.

Vincent Liu, CIO of Kronos Research, highlights intensified bearish sentiment in cryptocurrency markets due to inflation data and Bitcoin whale sell-offs as of September 1st, according to BlockBeats News.

The fragility of liquidity in Bitcoin and Ethereum suggests potential volatility, with critical support levels at risk, impacting market dynamics and investor strategies.

Inflation Impact and Bitcoin’s $100K Support Threat

Inflation data and large-scale

have led to increased bearish sentiment in the cryptocurrency market. Vincent Liu, CIO of Kronos Research, identified leveraged liquidations as a key concern, with Bitcoin’s psychological support level at $100,000. If breached, further liquidity tightening may occur.

Ethereum’s support at $4,000 raises similar concerns, as the crypto faces potential

and liquidity tightening. This highlights the fragility of current market conditions, under pressure from inflation data and weakened risk appetite.

Community reaction is mixed. Liu notes that strong non-farm payroll data could lead to sharp market volatility. A strong report may pressure cryptocurrencies by reducing risk appetite, while weaker data might increase demand.

Institutional Rotations and Historical Pricing Volatility

Did you know? Bitcoin’s previous critical support levels were notably tested during significant market events in May 2021 and November 2022, often involving massive liquidations leading to cascading effects on Ethereum and other assets.

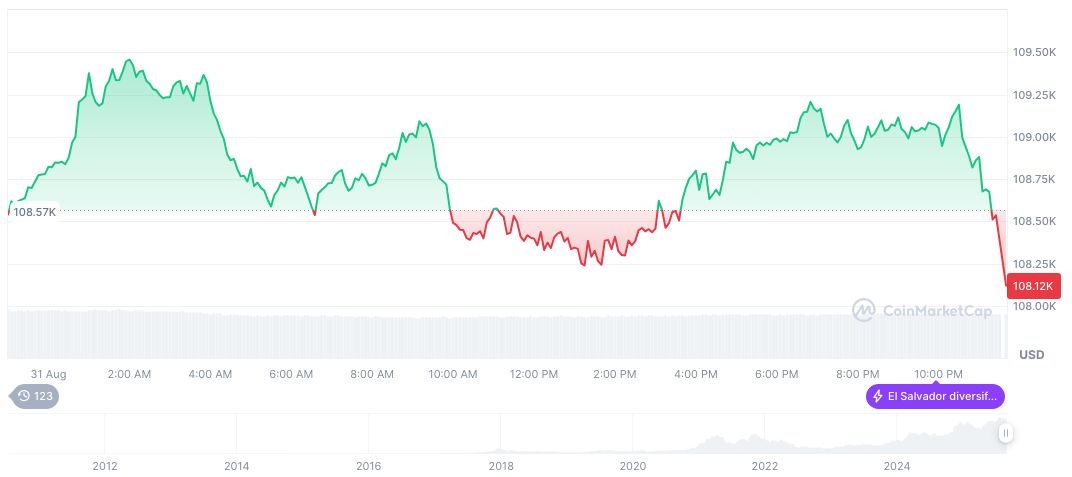

Bitcoin’s current price stands at $108,001.49 with a market cap of $2.15 trillion and dominance of 57.43%, according to CoinMarketCap. Despite a 0.60% decline in 24 hours, it shows a 90-day positive change of 2.58%. Recent volume recorded at $51.77 billion.

Coincu researchers suggest ongoing institutional rotations from Bitcoin to Ethereum may reverse sharply if sentiment deteriorates. Historical patterns of liquidity reduction during bearish cycles, alongside regulatory uncertainties, warrant attention as potential triggers for market re-evaluation.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/crypto-market-bearish-inflation-impact/