- U.S. expected job creation falls; market anticipates Fed rate cut.

- 75,000 additional jobs forecasted; unemployment may rise to 4.3%.

- Potential labor market weakness influences rate cut expectations.

The U.S. will release the August Non-Farm Payroll report this Friday, with forecasts indicating modest job creation of 75,000 and the unemployment rate rising to 4.3%.

This report could influence Federal Reserve rate decisions, impacting financial markets and cryptocurrency assets like Bitcoin and Ethereum, which react to macroeconomic signals.

U.S. Job Data Could Spur Federal Reserve Action

Economists forecast the August Non-Farm Payroll report to reveal lower-than-expected job growth, adding approximately 75,000 jobs. This increase, alongside a possible rise in the unemployment rate to 4.3%, suggests a softening in the labor market. The report, slated for release this Friday, will be a key focus for the Federal Reserve and financial markets.

If job data confirms predictions, the Fed may consider interest rate cuts, addressing potential economic downturn signals. A slight increase in unemployment may help justify rate cuts without immediate recession fears, reflecting market expectations.

“For the financial markets, the best-case scenario is for the upcoming employment report to show moderate job growth and a slight increase in the unemployment rate. This would indicate that the economy is not in a recession but also show enough labor market softness to justify the Fed’s rate cut.” — Bill Adams, Chief Economist, U.S. Bank

Bitcoin Reaction to Labor Market Trends

Did you know? A consistent slowdown in job creation, similar to 2025 figures, previously led to significant Federal Reserve rate adjustments, stabilizing both economic concerns and financial asset fluctuations.

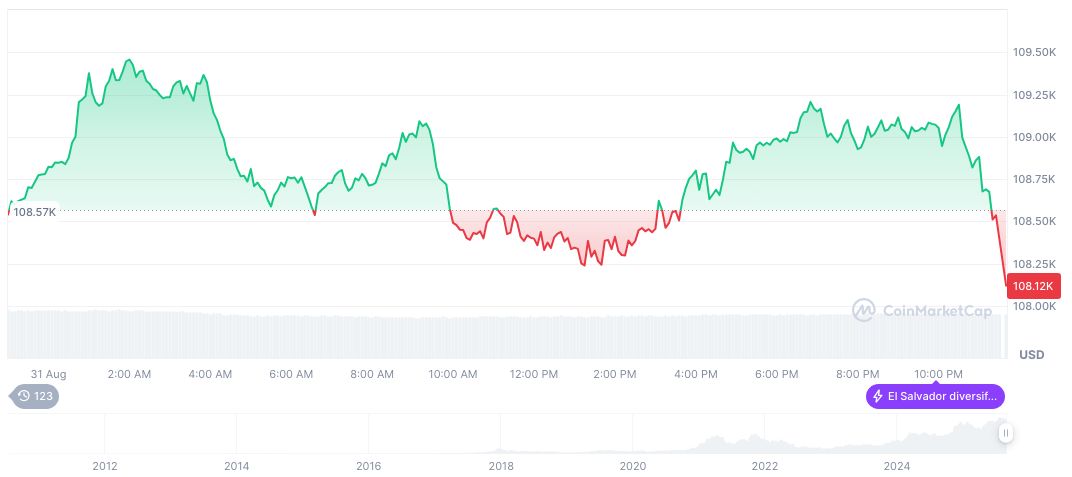

Bitcoin (BTC) trades at $107,632.34 with a market cap of $2.14 trillion and dominance at 57.34%. The last 24-hour trading volume reached $51.43 billion, down 1.01%. Trends show BTC declining 4.13% in 7-days, yet up 2.08% over 90-days, according to data from CoinMarketCap.

Coincu research team suggests the employment report may shape Federal Reserve actions. Lowering interest rates could further snowball affecting liquidity and market sentiment, influencing investor behavior. Strengthening or weakening of policies will impact both traditional and digital assets based on economic conditions.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/us-jobs-market-fed-policy/