- U.S. President Trump states inflation is very low, contrasting Fed figures.

- Conflicting statements prompt market volatility.

- Crypto market sees over 1 billion liquidation post-statement.

U.S. President Donald Trump’s recent statement that inflation has nearly vanished contrasts sharply with Federal Reserve data showing July 2025’s core inflation at 2.7%, surpassing target levels.

The contradictory statement has fueled significant volatility in the crypto market, particularly affecting Bitcoin (BTC) and Ethereum (ETH), leading to considerable liquidations.

Trump’s “No Inflation” Claim Versus Fed’s 2.7% Report

President Trump’s claim of “almost no inflation” has stirred reactions, given that official data from the Federal Reserve indicates a 2.7% core inflation rate. This discrepancy creates uncertainty among investors, particularly those in cryptocurrency markets. Bitcoin and Ethereum saw market turbulence due to the conflicting reports on inflation, leading to heavy liquidations.

Financial markets remain sensitive to such statements, with analysts highlighting inconsistencies between Trump’s comments and economic data. Institutional investors noted shifts in investment strategies following the executive order concerning 401(k) accounts, potentially increasing funds in cryptocurrency assets. Adam Cochran commented on the implications of economic policies, stating, “Tariffs are levied on US consumers… Trump’s proposal could potentially increase the cost of goods and services.” Cinneamhain Ventures.

Inflation signals continue to influence investor decisions, with the Federal Reserve holding a cautionary stance towards economic forecasts. Chair Jerome Powell emphasized ongoing inflation concerns impacting policy decisions, while Matthew Sigel shared insights on market trends.

Crypto Market Volatility and Historical Context

Did you know? Previous claims of low inflation by U.S. presidents have historically led to significant market volatility.

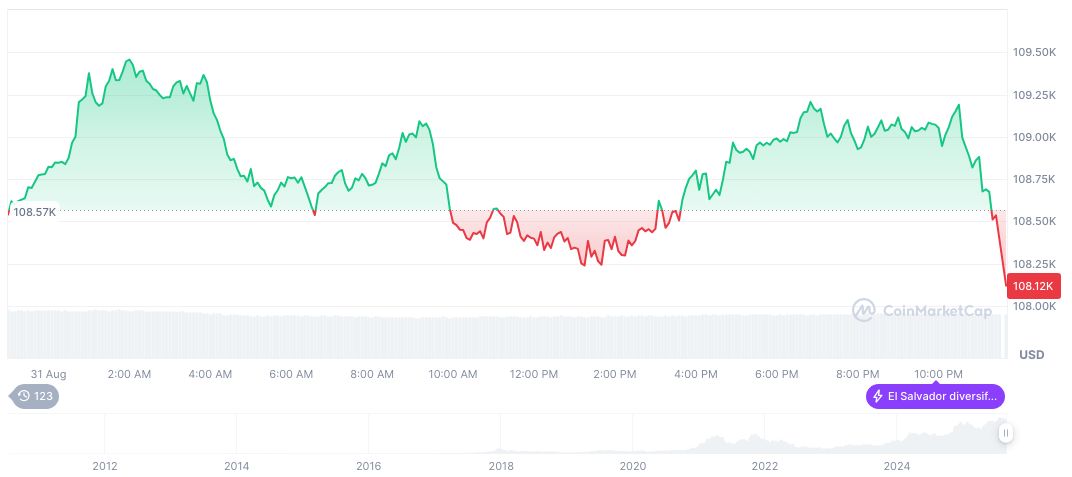

President Trump’s comments come amid a historical 2.7% inflation rate. Previous such claims by U.S. presidents have consistently led to market volatility, impacting cryptocurrencies significantly. As of September 1, 2025, Bitcoin trades at $108,186.43, with a market cap of formatNumber(2154470940483.79, 2). Its market dominance stands at 57.33%, with recent price movements reflecting a 4.09% decrease over the past week. A 1.13% drop occurred in the past 24 hours, indicating ongoing volatility. Data sourced from CoinMarketCap.

The Coincu research team points to historical trends suggesting that policy uncertainties could further affect regulatory frameworks. Potential technological advancements may drive future market growth, although inflation remains a crucial factor influencing Global market dynamics.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/trump-inflation-claims-federal-reserve/