- Strive Funds to acquire $700 million of Bitcoin, marking a strategic shift.

- Institutional interest in cryptocurrency grows with Strive’s decision.

- Expected impact on Bitcoin market dynamics and liquidity.

Strive Funds plans to purchase over $700 million worth of Bitcoin after its public listing, CEO Matt Cole announced, aiming to establish a significant institutional presence in digital assets.

This strategic move highlights growing institutional interest in Bitcoin, potentially influencing market dynamics and setting Strive Funds as a key player in Bitcoin treasury management.

Strive’s Bold Bitcoin Strategy and Financial Implications

Matt Cole, CEO of Strive Funds, announced the firm’s intention to bolster their Bitcoin holdings with a purchase exceeding $700 million as the company proceeds with its public listing. Cole, who once managed $70 billion at CalPERS, emphasizes Bitcoin as a strategic asset, influenced by Federal Reserve operations.

The strategy involves a $750 million private investment in public equity allowing for increased Bitcoin purchases, possibly expanding to $1.5 billion through warrants. This massive influx highlights the ongoing impact of institutional investment on the cryptocurrency market’s liquidity and value.

Reactions in the financial community underscore a growing interest in Bitcoin among traditional investment firms. Cole’s engagement in forums such as the “Bitcoin for Corporations Symposium” demonstrates proactive alignment with the industry’s evolving landscape.

Bitcoin’s Market Status Amid Institutional Investments

Did you know? Bitcoin was created in 2009, and its first recorded price was $0.00076, making its current value a staggering increase.

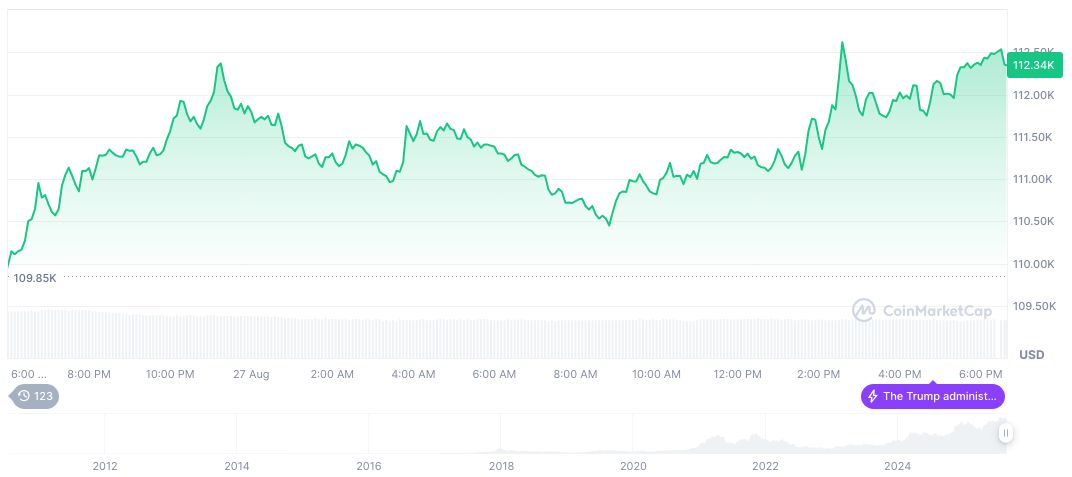

According to CoinMarketCap, Bitcoin’s current price stands at $113,307.98, with a market cap of $2.26 trillion. Recent shifts include a 2.57% increase over 24 hours, despite a 4.76% dip across 30 days. Bitcoin remains the dominant cryptocurrency, holding 57.48% market dominance.

The Coincu research team notes institutional investment strategies like Strive’s can hasten Bitcoin’s mainstream adoption and possibly prompt regulatory adjustments to accommodate rising corporate interest. The persistent price resilience, despite fluctuations, signals potential for long-term stability supported by institutional participation.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/bitcoin/strive-funds-bitcoin-purchase/