- Circle, Mastercard, and Finastra collaborate to expand USDC in payments.

- Mastercard enables EEMEA merchants to settle in USDC.

- Finastra processes $5 trillion daily with USDC integration.

Circle announced a partnership with Mastercard and Finastra on August 28 to integrate stablecoin settlement, including USDC, into mainstream finance across EEMEA regions.

The collaboration notably advances stablecoin adoption, potentially reshaping global payment systems by enabling USDC transactions through major networks and platforms, boosting its use for international settlements.

Circle and Mastercard Facilitate USDC Settlements in EEMEA

The collaboration between Circle, Mastercard, and Finastra marks a significant move towards integrating stablecoins into mainstream finance. Through this partnership, USDC and EURC will be available for payment settlements in Eastern Europe, the Middle East, and Africa (EEMEA). Scheduled rollouts include partnerships with Arab Financial Services and Eazy Financial Services, making USDC settlement a viable option in these regions.

Finastra’s integration of USDC into its Global PAYplus platform is expected to facilitate international transactions for banks worldwide, even when instructions remain in fiat currencies. Mastercard has also confirmed participation, allowing regional merchants to settle using stablecoins through its framework. These actions symbolize a forward shift in how financial infrastructures might adapt to include blockchain technologies.

Market responses have been positive, though there are varied reactions from analysts. Industry leaders like Chris Walters of Finastra emphasize the innovation potential, stating,

“This collaboration is about giving banks the tools they need to innovate in cross-border payments without having to build a standalone payment processing infrastructure. By connecting Finastra’s payment hub to Circle’s stablecoin infrastructure, we can help our clients access innovative settlement options.”

Jeremy Allaire from Circle highlights, “We’re enabling financial institutions to test innovative payment models with solid, scalable infrastructure.”

First EEMEA Stablecoin Service Signals Financial Evolution

Did you know? This move by Mastercard and Finastra marks the first stablecoin service in EEMEA. Historically, such developments are precursors to larger shifts in global financial practices, similar to prior Visa-Circle collaborations which showed gradual gains over time.

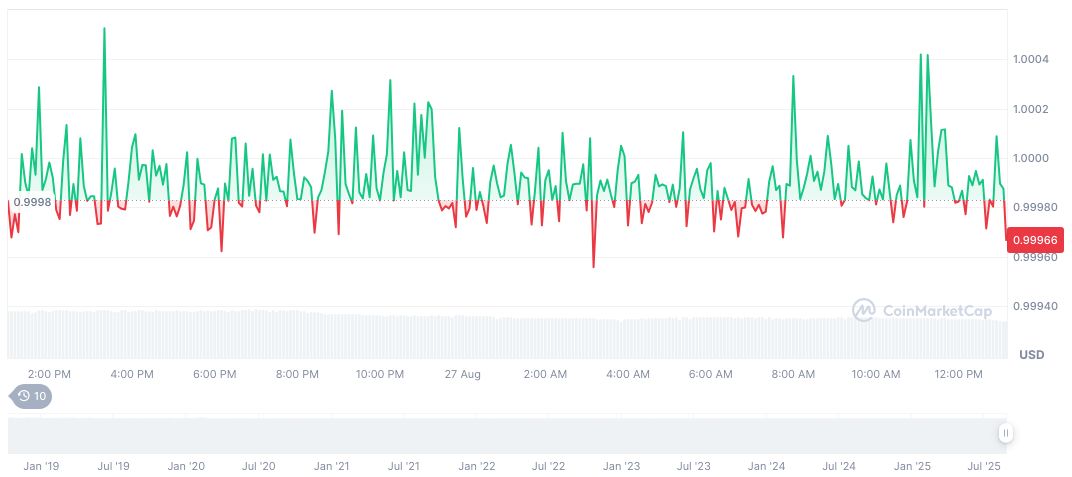

Circle’s USDC holds a stable price point at $1.00, with a market cap of $69.34 billion, signifying its steady role in the digital currency space. According to CoinMarketCap, the 24-hour trading volume for USDC was $18.92 billion, with a minor increase of 0.02% recently noted, indicating stable demand amid market changes.

Insights from the Coincu research team suggest this collaboration will likely enhance USDC’s position in the cross-border payment sector. The integration with Finastra’s massive daily transaction volume hints at future technological strands, with strengthened regulatory positioning potentially encouraging broader adoption of stablecoins in both private and public financial sectors.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/news/circle-mastercard-stablecoin-settlement/