- KindlyMD files for $5 billion stock issuance; funds to support Bitcoin strategy.

- Proceeds to aid acquisitions, working capital, and project investments.

- Market reactions and institutional participation anticipated.

Publicly traded KindlyMD, Inc. has filed an S-3 registration with the SEC to launch a stock issuance program valued at up to $5 billion, targeting Bitcoin strategy integration.

The filing emphasizes a prominent move in fintech, highlighting Bitcoin’s potential influence on traditional financial markets and KindlyMD’s strategic alignment with digital assets.

KindlyMD’s $5 Billion Stock Move: A Bitcoin Focus

KindlyMD has submitted plans to the SEC to raise up to $5 billion through a stock issuance program. The funds will be allocated towards a Bitcoin financial strategy, along with other business enhancements such as working capital and acquisitions. YA II PN, LTD., an identified investor, suggests potential institutional involvement.

The company’s focus on a Bitcoin financial strategy indicates a strategic move towards aligning its financial operations with cryptocurrency. This decision may lead to new investment opportunities and partnerships, influencing its market positioning.

“KindlyMD, Inc., issued an S-3 Registration Statement for proposed $5 billion equity raise to pursue a Bitcoin treasury program.”

Bitcoin Price and Market Implications Amid KindlyMD’s Plans

Did you know? Initiatives like KindlyMD’s echo past corporate Bitcoin investments, reminiscent of Tesla’s early 2021 crypto activities, highlighting ongoing interest in digital assets among corporations.

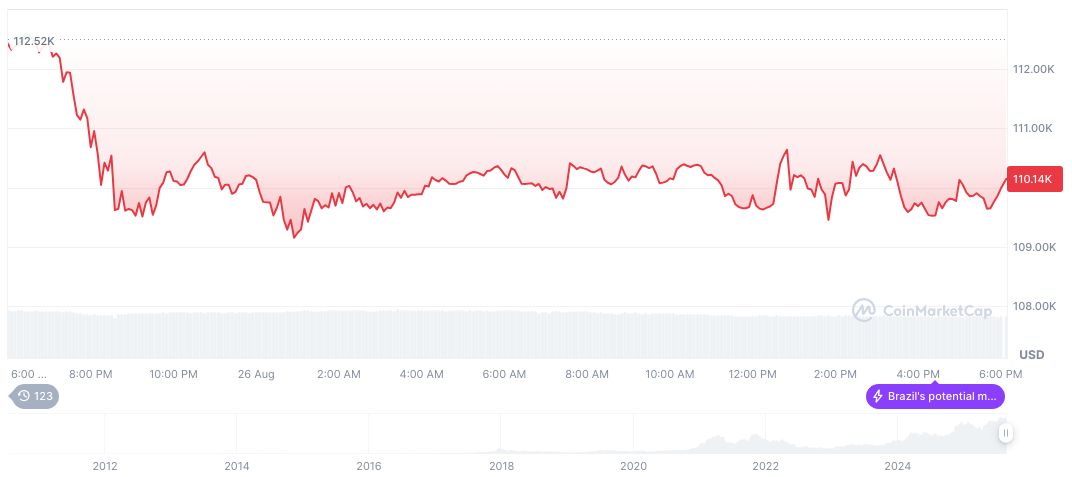

The latest CoinMarketCap data shows Bitcoin (BTC) priced at $111,292.42, with a market cap of $2.22 trillion. Its market dominance is 57.50%, and its 24-hour trading volume is $64.42 billion, marking a 26.94% decrease. The asset’s recent movements have seen a 1.40% increase over 24 hours but a 6.62% drop across 30 days. Circulating supply is 19.91 million, with data last updated at 01:34 UTC on August 27, 2025.

Experts from the Coincu research team suggest that KindlyMD’s embrace of Bitcoin could set a precedent in corporate financial strategies, potentially leading to further adoption and regulatory evaluations. The focus on Bitcoin may signal confidence in long-term value, influencing both market sentiment and corporate financial strategies.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/bitcoin/kindlymd-5-billion-stock-issuance/