- Bitcoin whale deposits 968 BTC into Hyperliquid for ETH trade.

- Monumental whale move impacts BTC and ETH markets.

- Significant volatility shift observed post whale transaction.

A Bitcoin OG whale has deposited 968 BTC worth $106 million into Hyperliquid, selling Bitcoin to purchase Ethereum on August 26th, according to Lookonchain monitoring data.

This sizeable transaction highlights potential strategic shifts in cryptocurrency markets, potentially affecting Bitcoin’s price stability and Ethereum’s market dynamics.

Massive $106 Million Bitcoin Trade Shakes Crypto Markets

The whale, identified via Lookonchain analysis, moved 968 BTC worth $106 million into Hyperliquid. Their activity includes selling Bitcoin to acquire Ethereum, reflecting substantial trading interest. Community discussions speculate a strategic shift in favor of Ethereum, with analysis focusing on institutional and high-net-worth individuals’ interest in Ethereum staking rewards.

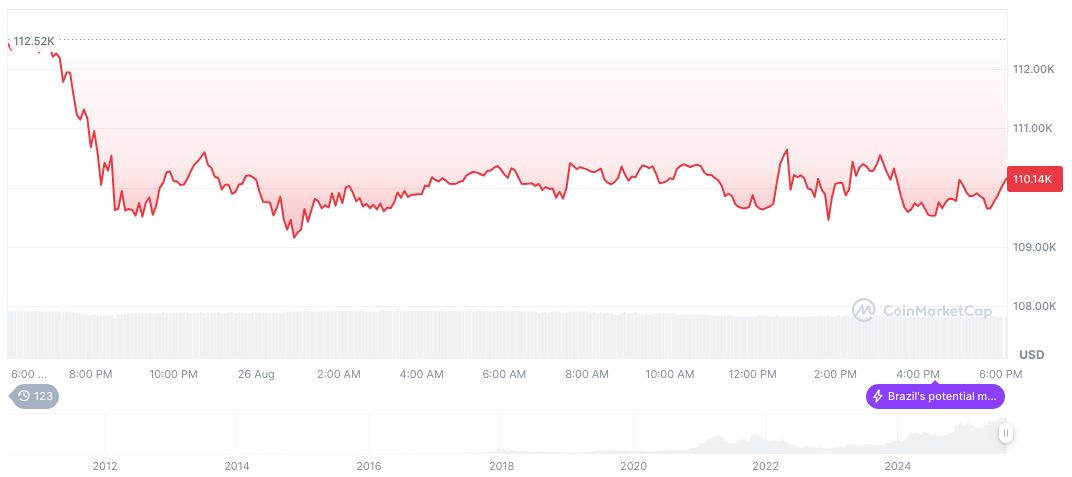

As of August 26, 2025, Bitcoin (BTC) is priced at $111,752.50 with a market cap of formatNumber(2225210899717.16, 2). BTC retains 57.46% dominance. Trading volume in the past 24 hours decreased by 18.63%. Data source: CoinMarketCap. The Coincu research team highlights potential shifts due to increased ETH stake purchase activity, potentially affecting DeFi liquidity and staking yields.

The Bitcoin OG who received 100,784 BTC ($642 million then, now $11.4 billion) seven years ago is frantically dumping BTC for ETH. In the past five days, they’ve deposited ~22,769 BTC ($2.59 billion) to Hyperliquid for sale, then bought 472,920 ETH ($2.22 billion) spot and opened a 135,265 ETH ($577 million) long.

— Lookonchain, On-chain Analytics Account, X/Twitter.

Historical Insights and Stake Implications for Ethereum

Did you know? Similar large-scale BTC sales have historically led to brief price shocks but often initiated altcoin seasonal gains.

Market data indicates the ongoing shifts in BTC and ETH dynamics as traders respond to the whale’s movements.

Analysts suggest that this move could be a precursor to larger institutional investments in Ethereum, reflecting a broader trend in the cryptocurrency market.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/markets/bitcoin-whale-trades-btc-for-eth/