- Institutional investors’ Bitcoin ETF holdings grew to $33.6 billion in Q2 2025.

- Brevan Howard and Harvard Management Company lead new allocations.

- Institutional activity suggests growing Bitcoin acceptance in traditional finance.

In Q2 2025, institutional investors, led by Brevan Howard Capital Management and Harvard Management Company, increased Bitcoin ETF holdings to $33.6 billion, marking significant market expansion.

The surge in institutional Bitcoin ETF investments signifies growing traditional finance adoption and potential shifts in asset allocation, impacting market dynamics as institutional integration accelerates.

Institutional Bitcoin ETF Holdings Reach $33.6 Billion in Q2

Institutional investors increased their exposure to Bitcoin through ETFs, totaling $33.6 billion in Q2 2025. Brevan Howard leads the charge with a $2.3 billion investment, while Harvard Management Company entered with a significant $117 million stake. “It appears that there are no specific quotes available from leadership at Brevan Howard Capital Management or Harvard Management Company regarding their recent Bitcoin ETF allocations, as no public statements were identified up to August 26, 2025”

Investment advisors now hold $17.4 billion in Bitcoin ETF positions, nearly double that of hedge funds at $9 billion. The majority of institutional activity concentrates on Bitcoin, marking an important shift in institutional investment strategies.

Crypto market reactions have been marked by a positive reception, although no major public statements from involved companies’ leaders were made. Experts note that the surge in institutional investment reflects Bitcoin’s increasing legitimacy.

Bitcoin Price Trends and Institutional Impact Analysis

Did you know? The surge in Bitcoin ETF investments by institutional investors during Q2 2025 is reminiscent of the inflows witnessed in the earlier adoption phase by companies like MicroStrategy and Tesla, signaling increased trust among traditional asset managers.

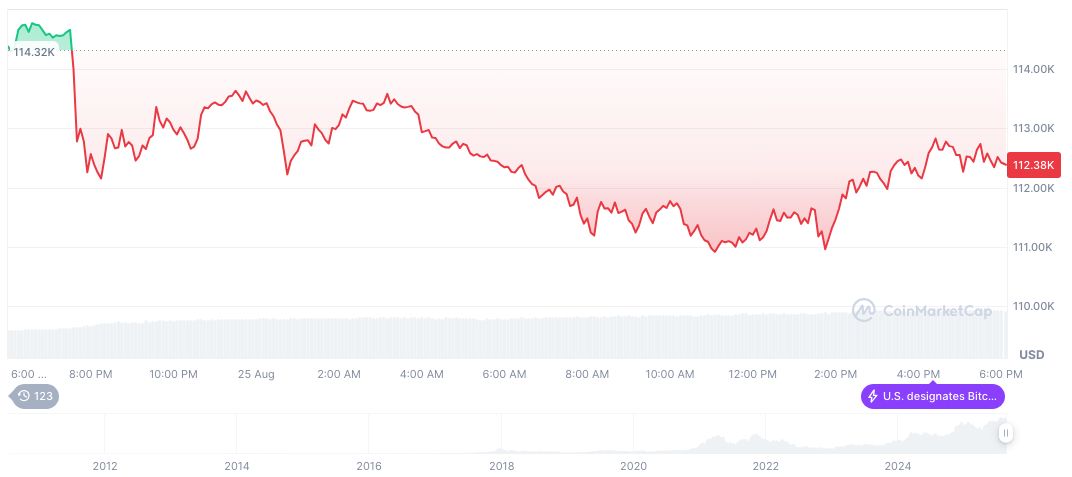

The current price of Bitcoin stands at $110,141.61, with a market cap of $2.19 trillion, according to CoinMarketCap. Despite a 1.38% decrease over 24 hours, the 60-day trend shows a positive 2.77% change. Bitcoin’s circulating supply is 19,911,731, nearing its maximum of 21 million.

Coincu research team insights suggest that institutional backing could lead to sustained upward trends in Bitcoin’s value. Regulatory clarity bolstered by SEC filings shows increasing institutional trust in Bitcoin investments through ETFs.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Source: https://coincu.com/bitcoin/institutional-bitcoin-etf-holdings-q2-2025/