Bitcoin (BTC) rebounded sharply on Friday following Federal Reserve Chair Jerome Powell’s subdued speech in Jackson Hole, where it surged from around $111,700 to $117,300 after Powell boosted risk appetite.

However, this recovery was short-lived and Bitcoin’s upward momentum quickly faded over the weekend, dropping to below $110,000.

While altcoins also accompanied the decline in Bitcoin, Ethereum (ETH) fell by 6% to $4,430 in the last 24 hours, and Solana (SOL) fell by 8% to $188.

At this point, while Bitcoin fell to its lowest level in the last seven weeks, it was stated that many factors were effective in this decline.

BTC Markets crypto analyst Rachael Lucas noted that the correction was driven by a mix of profit-taking, technical resistance, and changing interest rate expectations.

LLucas said the positive sentiment surrounding Powell’s speech faded as investors reassessed the likelihood and timing of a September rate cut, triggering the decline.

US President Donald Trump’s announcement that he had fired Fed Chair Lisa Cook also contributed to this negative atmosphere. Analysts said this further fueled concerns and uncertainty about the central bank’s political independence.

“Bitcoin briefly touched $117,000 on Friday before reverting to a lower high that suggested waning momentum.

Selling pressure intensified after a large investor sold 24,000 BTC, triggering a massive wave of liquidations.

Even if Bitcoin Rises, It Will Be Limited!

Presto Research analyst Rick Maeda explained the levels to watch out for for Bitcoin and said that even if there is a rise, it will be limited.

“Key levels currently sit at 105,000 as a June breakout zone and 100,000 as both a psychological line and a strong options move.

A clear break below the 100,000 level brings with it the risk of forced deleveraging, while the upside potential will remain limited to around 118,000-120,000 until macro conditions become clearer.

Liquidations are Increasing!

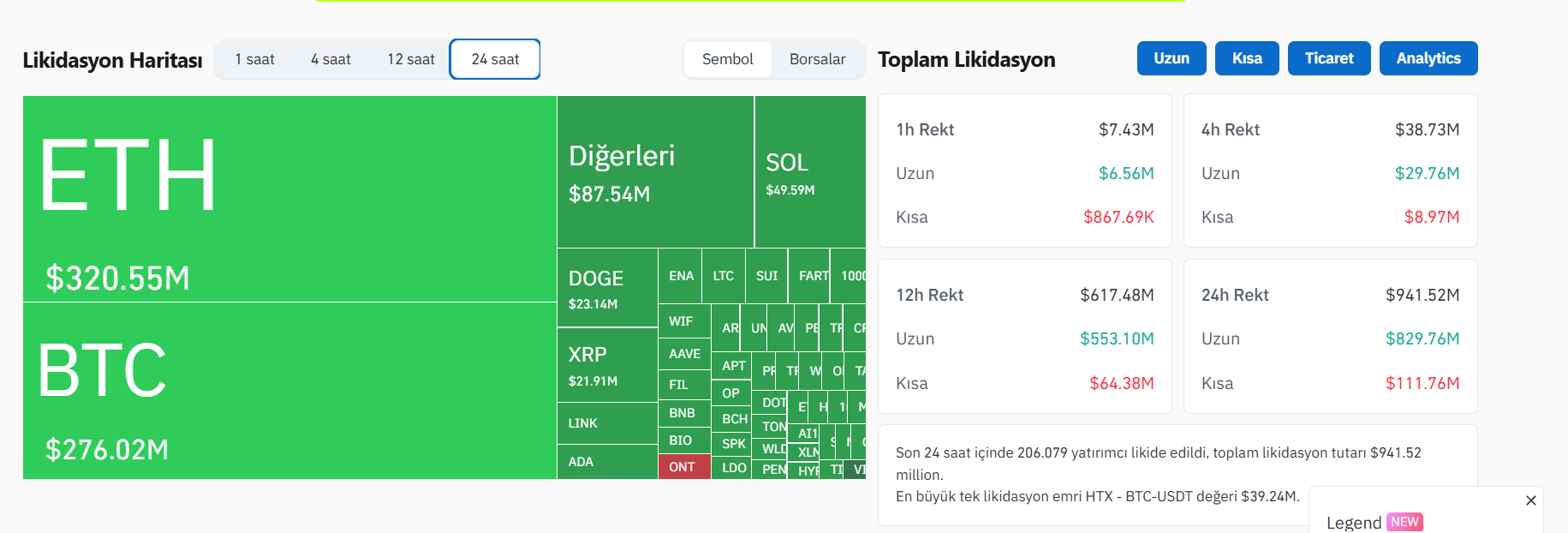

The decline in Bitcoin and altcoins has also thrown investors hoping for a rally into the red. According to Coinglass data, total market liquidations in the last 24 hours reached $941.65 million.

Of this, $829.8 million consisted of long positions and $111.8 million consisted of short positions.

The largest liquidation occurred in Bitcoin with $320 million, followed by Ethereum with $276 million and Dogecoin (DOGE) with $23 million.

While 206,069 investors liquidated in the last 24 hours, the largest liquidation occurred in the BTC/USDT trading pair on the HTX exchange, worth $39.24 million.

*This is not investment advice.

Source: https://en.bitcoinsistemi.com/powell-speaks-positive-but-bitcoin-still-falls-analysts-list-reasons-for-the-decline-and-explain-their-expectations-even-if-bitcoin-rises/